A few weeks ago, we decided to dive into analyzing Edenred. If you've been following our journey, you might remember our deep dive into stock screeners to unearth hidden gems. Well, after sifting through the European market, we stumbled upon Edenred—a name that's quite familiar here in Belgium, where we are based.

Interestingly, Edenred performed above average on most of our criteria, and despite not being the flashiest or most glamorous company out there, it piqued our interest. So, in this article, we're excited to walk you through what we see as the potential value and risks associated with Edenred.

Please keep in mind that this is purely our opinion and absolutely not financial advice.

Edenred, a company with roots going back to 1954, has become a global leader in specific-purpose payment solutions. Originally part of the Accor Group, Edenred gained independence in 2010 through a demerger that allowed it to fully focus on its core business. Now, the company operates across diverse sectors like employee benefits, fleet and mobility management, corporate payments, and public social programs. In 2023, Edenred had processed €41 billion in business volume, reflecting its growing influence in a world increasingly driven by digital solutions. But enough of the history, let’s take a look at the current story of Edenred!

A Recipe for Success

Edenred’s financial history shows a clear trajectory of growth. Dividing its performance into pre- and post-COVID-19 periods highlights the company’s resilience and ability to accelerate revenue and EBIT growth despite global disruptions. From 2014 onwards, key financial metrics such as revenue and net profit displayed a steady upward trend, with the only notable dip occurring in 2020 due to the pandemic. However, Edenred bounced back quickly, resuming its positive growth trajectory.

During the post-pandemic period, Edenred saw revenue grow by an average of 12.4% annually, with EBIT increasing by 15.1%—though net profit growth slightly lagged behind. Despite this, the company has shown an impressive ability to adapt and capitalize on emerging opportunities in the digitized payment ecosystem.

The Three Ingredients of Edenred’s Success

Edenred’s success is built on three different ingredients: Benefits and Engagement, Mobility, and Complementary Solutions.

Benefits and Engagement

This segment represents 65% of Edenred’s operating revenue, equivalent to €821 million in the first half of 2024. Edenred’s employee benefits solutions include meal vouchers, transport benefits, and healthcare and childcare support. These services are tax-efficient for both employers and employees, enhancing purchasing power while delivering substantial tax savings. In essence, users can buy more essentials with cheap-to-provide cash. This model, which links businesses, employees, and merchants, is the backbone of Edenred’s value proposition. It forms a powerful network, with each participant contributing to the ecosystem, reinforcing Edenred’s market dominance. In my opinion, this is one of the strongest types of value propositions a company can offer. It’s a perfect example of a win-win-win situation where everyone benefits—each party gets a share of the pie, which coincidentally, could even be paid for with Edenred’s meal vouchers.

Mobility Solutions

Contributing 24% of Edenred’s revenue, or €311 million, mobility solutions support fleet operators and vehicle owners through cards designed for mobility-related expenses, such as fuel or tolls. With programs like "Beyond Fuel Cards," Edenred extends its offering to include road-related services such as freight payments and VAT refunds, ensuring value for clients while keeping operational costs low. By incorporating EV-related services, such as charging cards, this segment becomes more and more future-proof. One of the strategies to ensure this future-proofness is acquisitions specifically for EV-related services. The latest one in this direction is the acquisition of Spirii, a Danish company. As these acquisitions play such a major role in the future success of Edenred, my co-author and I will dedicate a full article on acquisitions as a strategy with Edenred as a business case. I’m not saying you should subscribe, but you don't want to miss this either…

Complementary Solutions

This segment, which includes Corporate Payment Services and Incentive & Rewards programs, brought in 11% of Edenred’s revenue in early 2024. These services streamline business processes, such as accounts payable and employee recognition programs, while also managing public social programs. A concrete example of this is the acquisition of CSI (Corporate Spending Innovations – not Crime Scene Investigation). CSI provides payment solutions that allows companies to automate the procure-to-pay process, making the lives of countless accountants much easier. This diverse range of offerings allows Edenred to tap into new markets and provide tailored solutions that cater to both businesses and government entities. Here again, acquisitions play an important role towards being future-proof – did I already mention there will be a very interesting article on that soon?

Sustainable Competitive Advantage: Edenred’s Secret Sauce

I can imagine you thinking, “This all sounds good, but it doesn’t necessarily mean Edenred is a great company.” That’s a fair point. Don’t worry, though—the best part is just ahead. Like with a fine steak, the sauce is what makes or breaks the experience. In the next section, I’ll reveal the five key ingredients that, when blended just right, create the perfect Edenred sauce.

The Business Model

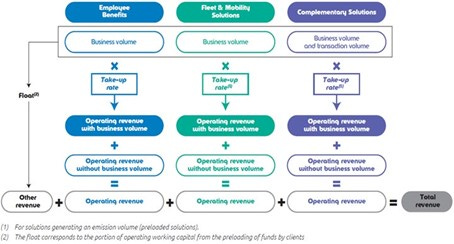

Edenred’s primary source of revenue comes from transaction fees paid by employers and merchants. This fee structure provides reliable, recurring income while maintaining a scalable platform that continues to grow. The picture below makes the business model somewhat more visual. The “take-up rate” is the operating revenue divided by the issue volume – very technical, I know. In essence, this is the amount of fees paid for every $100 that is processed. So, intuitively, you can feel that the higher this take-up rate is, the more fees Edenred receives. This take-up rate increased in 2023, partly due to the higher acquisition of SMEs as clients. Smaller clients pay relatively more on the money they issue and are therefore more interesting clients for Edenred. Attracting these SMEs is one of the pillars for the future, as (1) they bring in more money and (2) this market is largely untapped.

Additionally, Edenred earns float income—interest on prepaid funds held until they are redeemed—further boosting profitability. This means that Edenred has not one, not two, but three different streams of income on almost every product they sell. Talk about a win-win-win situation!

The combination of Edenred’s business model and the market it operates in has created several strong moats. We’ve identified 3.5 distinct moats—yes, one of them is half a moat—which we’ll explore in the following section.

Economies of Scale

As Edenred’s business expands, it benefits from economies of scale. Its established platform requires minimal incremental costs to fit revenue growth. This means that as revenue rises, operating expenses increase at a slower rate, allowing Edenred to improve its margins. This scalable model drives the company’s long-term profitability. Again, the picture tells more than a thousand words. The numbers are not of importance. What is, though, is that the EBIT margin increases as the revenue grows. Finding a moat doesn’t always have to be hard…

Network Effects

One of Edenred’s strongest moats is the network effect. As more employees use Edenred’s payment solutions, more merchants and employers join the system. This positive feedback loop strengthens the company’s market share, making it harder for competitors to enter the market. The more participants in Edenred’s ecosystem, the more value is generated for all stakeholders. With 60M+ users, 2M merchants and 1M clients, the least we can say is that Edenred has built such as network. This is a very strong moat, which can be even increased over time as the network grows.

Regulatory Protection

Edenred operates within a regulatory framework that benefits all parties involved. Employers save on taxes by offering Edenred’s solutions, employees enjoy tax-free benefits, and merchants see increased sales through the specialized payment systems. This regulatory alignment makes Edenred’s services highly attractive, creating a moat that is difficult for competitors to replicate. This moat is what really separates Edenred from other payment companies. The B&E division, which generates the most revenue, is also largely based on this moat. However, it has to be said, Edenred is trying to diversify its revenue streams by integrating lots of other services into their platforms (I refer you back to section 1 for the explanation on this).

Moderate Switching Costs

While not as robust as its other moats, Edenred benefits from moderate switching costs. Contracts with employers and merchants make it less convenient for them to move to a competitor, helping the company retain its customers over time. Most clients close 2 – 3 year contracts with Edenred and these are also tacitly renewed if the customer does not explicitly cancel the contract. Edenred does not disclose numbers on customer churn - or I did not search enough – but once clients chose a provider for these services, chances of switching are rather low. To be honest, there is only half a switching cost moat (here it is). Edenred has, however, long-term relationships with its clients and that is something invaluable to a company.

Looking Ahead: Risks and Opportunities

Despite its strong position, Edenred faces several risks that could impact its future performance. Changes in regulatory laws could diminish the appeal of its core services, while shifting into non-regulated income streams, such as greener mobility solutions, may expose the company to increased competition. Additionally, Edenred’s float income is highly dependent on interest rates, creating potential earnings volatility tied to external macroeconomic factors.

Nevertheless, Edenred has demonstrated an impressive ability to navigate challenges, expand its offerings, and adapt to changing market conditions. With its solid foundation in employee benefits and a strategic focus on mobility and complementary solutions, Edenred is well-positioned to continue its growth journey, offering a robust and competitive future powered by its specialized payment solutions.

Finally, we wanted to thank Patches AKF. Their analysis on Edenred was a true source of inspiration for us!

Please note: This article includes a disclaimer regarding investment advice.