An Analysis on Predicting GDP Growth

An Introduction To The World of Macroeconomics

In today’s article, we’ll revisit some of the basics of macroeconomics, but with a twist. Rather than stopping at the usual definitions, we’ll dive into a recent paper that explores the actual mechanisms behind them. Specifically, we’ll look at how the yield curve and GDP growth, two of the most cited concepts in economics, are connected in practice.

This paper was brought to our attention by

, whose articles consistently deliver sharp summaries of recent academic research with a practical lens for investors. A well-deserved shoutout here, and a link to his work is included at the end.The Basics

Let’s start with some macro basics before diving into the paper itself. The two key concepts at play here, both for this research and for macroeconomics in general, are Gross Domestic Product (GDP) and the Yield Curve. We’ve covered both before, but a short refresher never hurts.

GDP Growth

GDP is one of the most cited and often misused concepts in economics. At its core, it measures the output of a country, or how much was produced over a given period.

The common interpretation is straightforward: if GDP is growing, the economy must be doing well. Simple enough, but not quite. While GDP is a useful indicator, it reduces the complexity of an entire economy to a single number. It’s valuable, but it also has blind spots. If you want a deeper take, I’d recommend revisiting our earlier article where we break this down in more detail.

Still, GDP provides the foundation for this research. The central question is: what drives, or hinders, GDP growth? Economists have been wrestling with this for decades. Some factors are well-documented, others remain uncertain. The principle, however, is intuitive enough: reinforce what boosts growth and limit what suppresses it.

Easier said than done.

Take the second quarter of 2025 in the US. The revised, or “second,” numbers show real GDP growth (that’s growth adjusted for inflation) of nearly 4%. At first glance, that sounds fantastic.

But dig into the details and the picture shifts. The contributions to growth reveal a different story. The fine print notes: “[…] a decrease in imports results in a positive contribution to GDP.” Exactly. That’s where the growth comes from.

A sharp drop in imports, likely influenced by recent tariffs - a calculated guess from my side - added more than 4% to real GDP. Which means the other components? They pulled growth down. Investments, in particular, were a heavy drag, partly offset by modest consumer spending.

So yes, GDP grew. But as always, the headline number hides more than it reveals.

Yield Curve

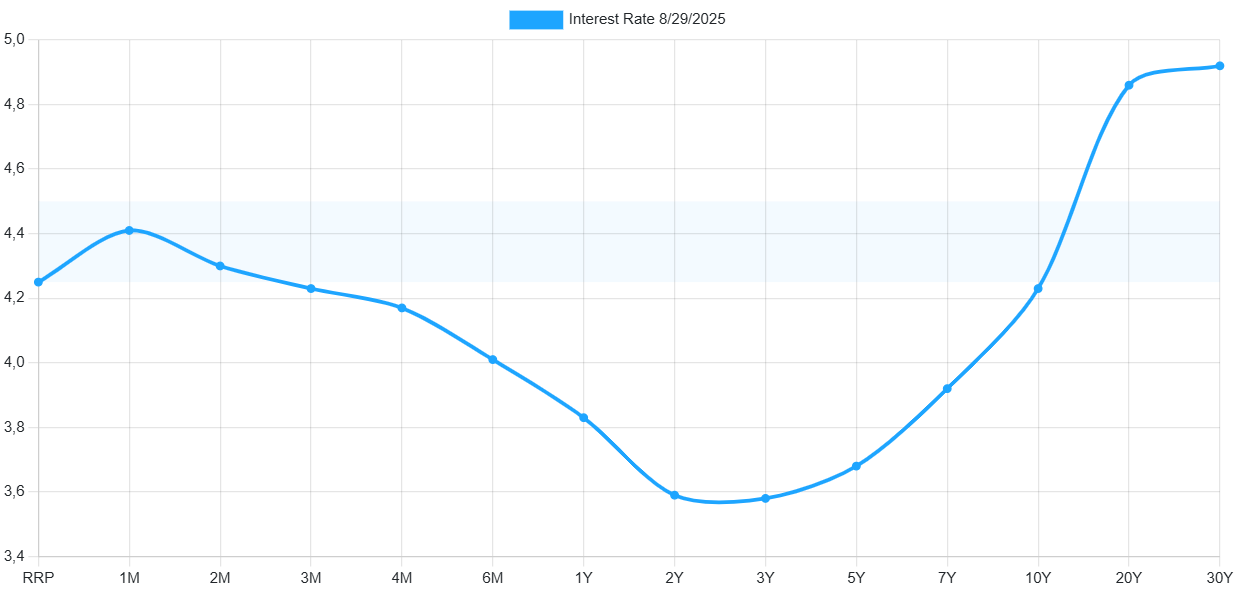

The yield curve is another cornerstone concept in macroeconomics. In essence, it reflects how markets perceive risk over different time horizons. As with GDP, I’ll keep this recap brief, and we also have a full article dedicated to the quirks and subtleties of yield curves if you want to dig deeper.

Short-term yields, anything under a year, are strongly shaped by central bank policy, in this case the Federal Reserve. Longer-term yields, on the other hand, represent the “aggregate expectation” of investors: how much risk or uncertainty they see in future inflation.

In a textbook world, the yield curve is convex, with rates steadily rising as maturities extend. The logic is straightforward. The further out you go, the more inflation matters, and the higher the reward investors demand to lock away their money for longer.

But today’s curve is… unusual. The middle section slopes downward, which tells us investors expect rates to fall. That is often a sign of looming recession, since central banks tend to cut to support a weakening economy. Yet at the long end, yields rise again, reflecting concerns that inflation will resurface over time and require tighter policy.

So rather than one clean signal, this curve shows a tug-of-war: markets are pricing in short-term weakness and long-term inflation risks at the same time.

The Role of Banks

Over the past years, researchers have shown that the yield curve can predict GDP growth. So, mystery solved? Do we already know everything there is to know? Was this whole article just a piece of clickbait?

Not quite. The relationship between the yield curve and growth is real, but it is far from the whole story.

First, the yield curve itself is not something policymakers can easily control. Anyone who has watched markets for a while knows how irrational investors can behave. Aggregated expectations are fickle, and certainly not something a central bank can steer directly.

The real question is not whether the yield curve predicts growth, but how. What is the actual mechanism linking a line on a graph to real economic activity? That is where this paper comes in with new insights.

Let’s bring banks back into the picture. We’ve written at length about them - a mini-series of five articles - and for good reason. In the first part of that series, we called banks “the heart of the economy,” since they channel funding from people who don’t need it right now to those who do. They take short-term deposits and turn them into long-term loans. The difference between those two interest rates is what a bank earns. Economists call this maturity transformation.

Here is why that matters. Banks’ behavior transmits investors’ expectations into actual economic growth through what the authors of the paper call the “expected profitability channel.” The logic is straightforward. When long-term rates rise, banks charge more for loans. When short-term rates rise, they may have to raise the interest they pay on deposits. If one bank does it, competitors follow, otherwise customers will move their money.

However, the focus should not be on interest rates in isolation, but on the spread between long-term and short-term rates. The wider this spread, the higher the profits banks can make. And what do firms do when a product becomes more profitable? They sell more of it.

Banks are no different. A bigger cushion of profitability makes them more willing to lend, even to borrowers who might have been considered slightly too risky before. This is the supply side at work: even if demand from companies is unchanged, banks relax their standards and extend more credit.

The result is more investment, which, as we’ve already seen, pushes GDP growth higher. In short: a wider spread leads to more loans, and more loans fuel more growth.

That is macroeconomics in action.

Closing Remarks

The purpose of this article was not simply to revisit definitions, but to show the economy in motion. We wanted to unpack how the relationship between two seemingly abstract ideas - the yield curve and GDP growth - actually translates into tangible actions like banks extending more loans and firms making more investments.

It might sound trivial in hindsight, yet this research is one of the few that manages to demonstrate the mechanism empirically, moving the discussion from theory to evidence.

Another word of thanks to

for highlighting the paper that sparked this piece. You’ll find links to both his article and the paper itself at the end.And of course, thanks to you for reading. Hopefully, we’ll see each other again next week!

References

Recent Academic Research by

:

Minoiu, C., Schneider, A., & Wei, M. (2023). Why Does the Yield Curve Predict GDP Growth? The Role of Banks. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4493101

📢 What’s your take on the yield curve’s link to growth? Drop a comment below!

🔔 Enjoyed this piece? Hit subscribe and don’t miss the next one!

Please note: This article includes a disclaimer regarding investment advice.

Our Recent Free Posts

The Mental Game of Superior Investing

Last week, in Part 1, we broke down the hard skills: financial fluency, dissecting business models, valuing companies, and managing risk. These are the technical tools every serious investor needs just to get in the game.

GDP: The Ultimate Lie?

“What we measure affects what we do; and if our measurements are flawed, decisions may be distorted”

How To Become a Better Investor

Everyone wants to be a better investor. Few want to admit how much actual work that takes. Most people just want better stock picks. We think you need a better process.

Great deep dive! Looking forward to future posts.