Yesterday, we hinted. Today, we deliver.

After announcing we’re rolling out a paid version of DualEdge — with deeper dives, more tools, and exactly zero fluff — we figured: let’s start by showing, not telling.

So here it is: our full report on Aris Water Solutions.

Aris is a small-cap water midstream company operating in the heart of the Permian Basin. It handles the dirtiest problem in oil production: millions of barrels of toxic wastewater. With recycling tech, regulatory tailwinds, and contracts with the biggest names in oil, Aris claims to be both an environmental fix and a scalable infrastructure bet. We went deep to see if that’s true — or just slick packaging.

If this is your first time here — yes, this is what we mean when we say deep dives.

If you’ve been around — you know the drill. But here’s what’s new:

We’re offering a 60% discount for those who pledge early to the paid version. Why? Because the best investors spot optionality before it's priced in. Same applies to subscriptions.

You can now pledge in two ways:

$8/month (vs $20/month after launch)

$80/year (vs $200/year after launch)

👉 Click here to go to our Substack profile, and go pledge your support!

We’ll be dropping more full reports like this in the coming weeks. If you find value here, that’s your signal.

Now, back to the Permian Basin.

🧭 Table of Contents

Part I: Introduction

Setting the stage in the Permian Basin — and why Aris is trying to turn water from a problem into a profit stream.Part II: External Influences

How macro trends, seismic activity, policy shifts, and oil prices shape Aris’s opportunity (and risk) set.Part III: Financials

Balance sheet, income statement, and cash flow analysis — what the numbers reveal about Aris’s true health.Part IV: Valuation

Growth scenarios, reinvestment logic, and our implied IRR framework. No fairy dust — just sober expectation management.Final Take: What We Really Think

Where we stand, what we’re watching, and whether Aris earns a place on our long-term radar.

Part I: Introduction

In the oilfields of the Permian Basin, water is both a lifeline and a looming headache — and no company knows this better than Aris Water Solutions. As oil producers ramp up drilling, they also unleash a flood of wastewater that must be managed, treated, and, increasingly, recycled.

This analysis takes you on a deep dive into Aris’s business model, growth strategy, and financial health. We’ll explore not just the opportunities — rising demand, smart acquisitions, and regulatory tailwinds — but also the risks and uncertainties lurking beneath the surface. From geology and commodity prices to regulatory shifts and reinvestment challenges, we aim to give you the full picture so you can decide whether this small-cap water midstream player deserves a place on your investing radar.

So grab your coffee(s): we’re about to explore whether Aris is a quietly compelling long-term bet or a capital-intensive gamble best left to the pros.

Setting the Stage: The Permian Basin

To understand Aris Water Solutions, we first need to look at the Permian Basin, the only region that Aris currently operates in. The Permian is one of the world's most prolific oil-producing regions. Located in West Texas and Southeast New Mexico, this "super basin"—a geological depression where sediment, organic material, and hydrocarbons have accumulated over millions of years—accounts for about 41% of total U.S. crude oil production and 15% of natural gas output in 2022, and it only has risen since then. If it were a country, it would rank among the world's largest oil producers.

Despite decades of extraction, the Permian isn’t running dry anytime soon. Thanks to technologies like hydraulic fracturing (fracking) and horizontal drilling, even previously inaccessible reserves are now being tapped. In 2023, the region still held an estimated 20 billion barrels of proven oil reserves—around 40% of all U.S. reserves.

The Water Challenge

Oil production in the Permian isn’t just about oil—it’s also about water. And a lot of it.

Fracking a single well requires 14–16 million gallons of water—roughly the amount needed to fill 25 Olympic-sized swimming pools. The reason fracking is so water-intensive is that it involves injecting a high-pressure mix of water, sand, and chemicals deep underground to fracture rock formations and release trapped oil and gas.

For every barrel of oil pumped, 3–4 barrels of contaminated "produced water" come up with it. This wastewater is a toxic cocktail of salt, heavy metals, and hydrocarbons that can be several times saltier than seawater—making disposal and treatment a major challenge.

The region produces nearly 19 million barrels of wastewater per day—that’s enough to fill more than 1,200 Olympic-sized swimming pools daily. Managing this massive water influx is one of the biggest logistical and environmental hurdles in the Permian.

Managing this water is a huge challenge. The Permian is an arid region with limited fresh water, and groundwater sources are depleting fast. It has very few natural water sources and an annual average precipitation of only ~13 inches (~330 mm)—far below the national average. Meanwhile, companies have historically disposed of wastewater by injecting it deep underground—but that’s been triggering earthquakes, prompting regulators to crack down.

The problem has been growing rapidly. The number of earthquakes with a magnitude of 3.0 or higher has more than quadrupled in some key oil-producing areas like Midland, Odessa, and Lea County, New Mexico, between 2018 and 2023. In response, regulators in Texas and New Mexico have started imposing severe restrictions on wastewater injection, forcing operators to either reduce volumes, shut down disposal wells, or find alternative solutions.

The result? Rising costs, stricter regulations, and increasing pressure to find sustainable solutions. And that is where Aris comes into play.

Enter Aris Water Solutions

Aris Water Solutions is a leading player in the water midstream sector, specializing in managing water resources for oil and gas producers. Originally founded in 2015 as Solaris Water Midstream by William “Bill” Zartler, the company built an extensive water pipeline and infrastructure network in the Permian Basin.

In October 2021, the company rebranded as Aris Water Solutions and went public on the New York Stock Exchange (NYSE: ARIS), raising approximately $214 million in its IPO. This move provided capital for further expansion and allowed early investors to partially exit.

Aris is led by industry veterans with deep expertise in energy and water management. Founder Bill Zartler, who has over 30 years of experience in private equity and energy infrastructure, serves as Executive Chairman. Before founding Aris, he was the Founder and Managing Partner at Denham Capital Management, a global energy and commodities private equity firm, where he led investments in the midstream and oilfield services sectors. He later founded Solaris Oilfield Infrastructure, a company focused on providing mobile proppant management systems for hydraulic fracturing.

CEO Amanda M. Brock, who joined Aris in 2017, brings extensive international experience in water treatment, sustainability, and energy infrastructure. She previously served as CEO of Water Standard, a water treatment technology company. Under her leadership, Aris has formed key partnerships with major oil companies to advance sustainable water solutions in the Permian Basin, solidifying its role as a critical player in water management for the energy sector.

How Do They Operate?

Aris operates a full-cycle water management system, ensuring that oil and gas companies can handle, recycle, and reuse wastewater more efficiently. The process begins with the collection of produced water, which is the byproduct of oil extraction; It is gathered from both existing and newly completed wells through an extensive pipeline network. With around 35 customers, primarily oil and gas producers, Aris manages this water throughout the well’s lifecycle. In return for this service, the company charges a water handling fee for collecting, treating, and disposing of the produced water.

Rather than solely relying on deep-well injection for disposal, which has been linked to environmental concerns such as induced seismicity, Aris recently prioritized wastewater recycling. By treating and repurposing this water, they create a sustainable solution that significantly reduces the industry’s dependence on fresh groundwater. The recycled water is then resold for use in new fracking operations, helping to close the loop on water consumption in the Permian Basin.

Aris generates revenue through multiple streams. The primary source comes from produced water handling, which involves the gathering, treatment, and disposal of wastewater throughout the life of a well. Additionally, the company profits from selling both recycled water and groundwater for well completions, offering a practical alternative to traditional freshwater sources. Looking ahead, Aris is also exploring opportunities in beneficial reuse and mineral extraction. By unlocking additional value from wastewater, they aim to tap into new revenue streams while simultaneously reducing waste.

Now, let’s take a closer look at how Aris Water Solutions aims to position itself for the future. The company defines itself as a growth-oriented environmental infrastructure company, which makes it particularly interesting to examine its growth trajectory.

The Path Going Forward

One of Aris’ primary strategies is organic expansion, which involves continuous investments in infrastructure. Each year, the company commits substantial capital to the development of new pipelines, pump stations, evaporation facilities, and recycling plants. A prime example of this is the recent $45 million acquisition of the 45,000-acre McNeill Ranch, located on the Texas-New Mexico border. Strategically located in the rapidly expanding Northern Delaware Basin, this ranch allows Aris to develop new injection wells and infrastructure to handle future water flows.

Aris also strengthens its position through mergers and acquisitions (M&A). In 2022, the company acquired Delaware Energy Services, which immediately expanded its disposal and recycling facilities while adding new customers in its core region. This acquisition solidified Aris’ presence in the Northern Delaware Basin and brought in a skilled local team.

Beyond acquiring companies, Aris has also invested in intellectual property (IP) to enhance its technological capabilities. In 2022, Aris acquired advanced water treatment technologies from Water Standard, including key intellectual property for sophisticated purification processes. This move directly supports Aris’ expansion into water recycling. Keen-eyed readers may also note that Water Standard was the previous employer of CEO Amanda Brock—a clear sign that she is leveraging her network and expertise to drive Aris forward.

The company’s heavy investments indicate a strong commitment to its future, but the key question is: Will these investments pay off?

From a market demand perspective, the outlook is promising. The Permian Basin remains the most productive oil region in the U.S., and forecasts indicate that thousands of new wells will be drilled in the coming years. Increased oil production leads to an exponential rise in produced water, driving demand for Aris’ services.

Additionally, regulatory pressures favor Aris' business model. Both Texas and New Mexico are pushing for limitations on deep-well injection due to seismic activity concerns, while simultaneously encouraging water recycling initiatives. New Mexico is even exploring the possibility of allowing treated produced water to be repurposed for industrial and agricultural use—an ongoing political discussion that could create a game-changing market for Aris. If regulations shift in favor of partially treated produced water being legally used for irrigation or industry, Aris would hold a first-mover advantage due to its existing pilot programs and technology.

On top of that, Aris has recently begun research into extracting valuable minerals from produced water. If successful, this could open up an entirely new revenue stream, further reinforcing its long-term growth potential.

Part II: External Influences

Back to Basics

I quickly realized that ignoring macroeconomic factors this time around just wasn’t possible. That’s why we're exploring external influences—not just oil prices and inflation, but also regulation and geology, which can either boost or derail Aris’s business.

Interest rates have a pretty limited impact on Aris’s business. According to management's latest 10-K filing, a 1% rise in interest rates would add just $0.4 million in extra financing costs. Considering Aris has around $25 million in profit in 2024, this isn’t exactly something to lose sleep over.

Inflation, however, could significantly impact Aris, especially considering potential tariffs proposed by Trump. Aris works with fixed-term contracts for water treatment and recycling (more on that in upcoming parts). While these contracts are inflation-protected, there's a cap. Meaning, if inflation exceeds this cap, Aris can't fully pass along increased costs to its customers. So, if you're thinking about investing in Aris, keep an eye glued to monthly inflation reports.

Alright, now that we've covered the basics, let's dive into the juicy stuff. After all, 99% of businesses feel the pinch from inflation and interest rates—it's the following factors that really matter specifically for Aris.

Beneath the Surface

The next thing I want to recap is the region where Aris operates: the Permian Basin. Aris relies heavily on this area, as virtually all their revenue originates here. So it makes sense to give this region a closer look.

If you've read the previous part of this analysis, you're already aware that the Permian Basin has some massive strengths from which Aris greatly benefits. Foremost among these strengths are the vast reserves of oil and gas underground, ensuring long-term growth prospects for Aris. Oil and gas production in this region, as illustrated in Figure III below, has been steadily increasing over the years. While production was initially thought to have peaked in the early 1970s, new extraction technologies like hydraulic fracturing (fracking) and horizontal drilling have dramatically boosted production, reshaping both the industry and Aris's potential for future growth.

There are no signs of slowing down, given the Permian Basin’s immense reserves. Just the Wolfcamp and Bone Spring formations alone boast estimated proven, technically recoverable reserves of 50 billion barrels of crude oil and nearly 300 trillion cubic feet of natural gas. To put that into perspective, since 1920, the region has produced around 30 billion barrels of oil and 75 trillion cubic feet of natural gas—less in 100 years than what remains today. Factor in ongoing innovations that can make even more oil and gas fields economically viable, and Aris’s future in this region looks exceptionally secure.

The Permian Basin also holds another significant advantage compared to other oil-producing regions in the U.S. As hydraulic fracturing technology advanced, water management needs skyrocketed—from 6.3 million barrels per day in 2017 to 18.9 million barrels per day in 2023. To illustrate this challenge clearly, consider Appalachia, where water production only increased from 0.17 to 0.33 million barrels per day over the same period (Figure IV). This striking difference highlights the immense water management challenge faced by the Permian Basin—a challenge that Aris is uniquely positioned and eager to address.

Yet, there are also risks associated with the Permian Basin that investors should keep in mind. For instance, there's a notable shortage of available workforce in the region. In Q4 2024, the average unemployment rate was only 2.9%, indicating a tight labor market. This makes it challenging for businesses, including Aris, to recruit and retain skilled employees.

Climate change also significantly impacts this region, primarily due to the substantial methane emissions resulting from flaring—a process where excess natural gas is burned off during extraction. This practice not only worsens air quality but also contributes to light pollution. Additionally, seismic activity poses another critical concern.

A common industry practice is injecting produced water back into underground formations. Unfortunately, this process significantly increases seismic activity by raising underground pressure, leading to earthquakes. You can imagine local authorities aren't thrilled about this, seamlessly bringing us to our next external factor: regulation.

Drill Baby Drill

Regulation is a crucial factor for Aris, and it will remain so in the future. Initially, I was somewhat apprehensive when I first began researching the company. Coming from Western Europe, I'm accustomed to regulation having a rather poor reputation—often seen as complicating business operations, especially concerning sustainability.

Take the EU’s Corporate Sustainability Reporting Directive, for example, where companies must report on thousands of metrics, often appearing disproportionately burdensome relative to the benefits.

However, my fears about regulation in the Permian Basin quickly proved unwarranted. Sure, Aris faces challenges like seismic activities that occasionally force them to limit or abandon wells. Yet, these very earthquakes have pushed the focus increasingly towards recycling produced water. Over recent years, Aris has heavily invested in recycling produced water, enabling reuse in fracking and potentially other applications in the future. Regulatory trends are increasingly supporting these initiatives, primarily driven by necessity.

Historically, Texas and especially New Mexico—home to the Permian Basin—had limited restrictions on freshwater extraction, resulting in severely depleted aquifers. This situation has forced state governments to become increasingly receptive to utilizing filtered produced water, even for agriculture. Although still evolving, the regulatory landscape in states like New Mexico is progressively favoring filtered produced water for broader uses, including agriculture.

Furthermore, strategic partnerships between Aris and its largest customers highlight this shift. They're collaboratively exploring cost-effective, scalable solutions for treating produced water, making it viable for reuse in sectors like non-consumptive agriculture and alternative energy.

On another note, recent policy developments, especially under the previous Trump administration, temporarily eased regulatory barriers, granting additional permits for new rigs. This has lowered short-term risks, enhancing Aris's prospects for meeting growth expectations. Whether this policy is beneficial in the long term is debatable, but that’s a discussion for another time—we're not a political newsletter, after all.

Still, it's essential to remain cautious. While short-term regulatory easing supports Aris's growth outlook, long-term implications remain uncertain. Additionally, regulatory easing under Trump primarily aimed to lower energy prices, which isn't necessarily favorable for oil and gas producers.

Lower Prices, Lower Production?

This brings us to today's final external factor: oil and gas prices, thanks in part to recent actions by Trump. The theory goes like this: when oil prices drop, producers cut back their production to limit supply, aiming to stabilize or drive prices back up. This strategy helps balance supply and demand, safeguards profitability, and secures long-term investments. Additionally, collaboration within cartels like OPEC plays a crucial role in collectively agreeing to reduce output, preventing excessively sharp price declines. Lower oil prices also render less accessible and costlier oil reserves economically unviable to exploit, prompting producers to wait for prices to rise before tapping these reserves.

Now, I've always been skeptical of textbook theories—real life rarely follows the script perfectly. So, I decided to put this theory to the test. And for once, I was right.

Don't believe me? Just check out the two figures below.

Figure V illustrates oil prices, while Figure VI shows oil production in the Permian Basin over the same period. As you likely already noticed in Figure III, production continues to rise steadily, except for a brief dip during the COVID-19 pandemic. What we do observe, however, is a faster growth in production during periods of rising prices, which makes sense intuitively. Therefore, declining prices slow down potential revenue growth but don't necessarily reduce revenues outright.

The number of active rigs is more directly affected, though. I'm not suggesting there's a perfect one-to-one correlation, but it's clear that rig activity decreases alongside falling prices. This aligns with the economic reality that some rigs become financially unviable at significantly lower prices. Since Aris’s revenues are directly tied to production volumes, lower oil and gas prices inevitably have some impact—albeit limited—on Aris’s profitability.

Part III: Financials

Now, let’s get into it—starting with the balance sheet. This is where we separate the hype from reality, where we find out if Aris is a financial powerhouse or just really good at marketing itself. We’ll be looking at assets, liabilities, and equity to determine the company’s financial stability, debt levels, and overall health. Think of it as a financial check-up—because no matter how great a company sounds, if the numbers don’t add up, the story falls apart. So, let’s break it down.

The Financial Health Check

ASSETS

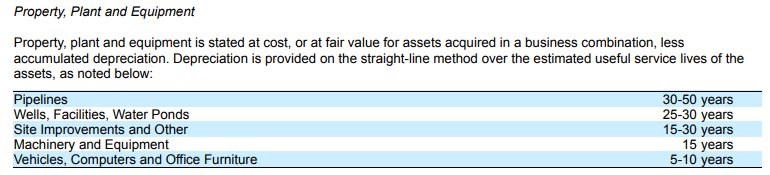

If you’ve been following our qualitative analyses, nothing here should come as a shock. Aris operates in a capital-intensive industry, and that reality is crystal clear when you look at the balance sheet for fiscal years 2023 and 2024. A quick glance at the assets section tells you that Property, Plant & Equipment (PPE) dominates, making up a solid 71% of total assets. Not exactly pocket change.

Expanding pipelines, treatment facilities, and disposal wells requires hefty capital investments, and you can see that reflected here. But here’s where things get really interesting—PPE isn’t just holding steady; it’s growing. That means Aris isn’t just maintaining what it has (which would be covered by maintenance CAPEX). Instead, it’s investing in expansion, signaling plans to scale operations.

For those unfamiliar, maintenance CAPEX is the capital needed just to keep current assets running smoothly—think of it like servicing your car to keep it roadworthy. Growth CAPEX, on the other hand, is all about expansion—buying a second car to double your mileage. A common rule of thumb is that maintenance CAPEX roughly matches depreciation. So when PPE is increasing, like we see here, it’s a clear sign that Aris is putting money into long-term growth.

And speaking of long-term, most of these investments aren’t short-lived, as you can see above. Pipelines, disposal wells, and machinery come with extended depreciation periods, meaning Aris will likely reap the benefits for years. This directly ties into Return on Invested Capital (ROIC), which, if all goes well, should trend upward over time. Of course, that’s not a given—you’ll want to keep an eye on this metric year after year if you’re considering Aris as a long-term investment.

We’ll dive deeper into the cash flow statements soon to see exactly where this money is coming from and where it’s going. But for now, let’s just say Aris is playing the long game—and if they execute well, it could pay off big time.

The second and only other significant category in Aris’s assets is intangible assets. These are non-physical assets that generate value for a company—think brand names, patents, goodwill, copyrights, and software. Unlike tangible assets like machinery or buildings, intangibles are often harder to value and sell, but they play a crucial role in profitability and competitive advantage.

For Aris, these intangible assets primarily consist of existing contracts acquired through past acquisitions. As we’ve discussed in previous articles, the water services sector typically operates on long-term contracts. When Aris acquires another company, it also takes on these contract obligations (and the associated revenue streams). That’s why you see them classified as assets—they generate future income, much like pipelines and other PPE (Property, Plant & Equipment).

A Quick Word on Accounts Receivable

Another item worth mentioning on the balance sheet is accounts receivable, but let’s keep it brief. Given its relatively small size compared to total assets, we don’t need to spend much time analyzing collection periods or credit risk. However, if you read our SWOT analysis last Sunday, you’ll remember that customer concentration is one of the biggest risks for Aris. This is where accounts receivable helps paint a clearer picture.

Take a look at how dependent Aris is on its largest customers:

50% of revenue comes from ConocoPhillips and Chevron alone.

Mewbourne, the third-largest customer, still represents an estimated 8-9% of total revenue.

That’s a heavy reliance on just a few players. And when your top two customers account for half your revenue, any disruption—contract renegotiations, volume reductions, or payment delays—could hit hard. But before you start sweating over this, here’s some good news:

ConocoPhillips is a major shareholder of Aris, owning a significant 22% stake in the company.

This changes the risk profile quite a bit. When your largest customer also has a vested interest in your success, the chances of them suddenly pulling the plug on business diminish significantly. Of course, it doesn’t eliminate the risk entirely—but it does provide a layer of stability that many other companies with high customer concentration don’t have.

LIABILITIES

Alright, now that we’ve covered the assets, it’s time to flip the script and look at their counterpart: liabilities. Here, we’re going to focus on the debts and obligations Aris carries—and, more importantly, what they mean for the company’s financial health. For those too lazy to scroll back up, here are the most significant categories we’ll be breaking down:

Long-Term Debt

Tax Receivable Agreement Liability

Accrued and Other Liabilities

Long-Term Debt: The Big One

By far the most crucial of these three is long-term debt, which Aris uses to finance its investments. But here’s something interesting: unlike many companies, Aris doesn’t rely on traditional bank loans. Instead, the bulk of their debt—$400 million—comes from bonds set to mature in 2026.

Well, that was the plan—until March 11, when Aris announced via press release that they’re issuing new bonds worth $500 million with a maturity date in 2030. The proceeds from this issuance will primarily go toward paying off the existing $400 million early, and while they haven’t explicitly stated what they’ll do with the remaining funds, my bet is on further investments.

The key takeaway? Aris has successfully rolled over its debt. Essentially, they don’t need to repay the principal as long as they can keep refinancing at reasonable terms. Of course, they do have to ensure they can continue covering interest payments—so let’s put that to the test with the Interest Coverage Ratio (ICR).

With $36.233 million in interest expenses and $106.753 million in operating income, Aris lands at an ICR of 2.94. That means they can cover their interest payments nearly three times over with their operating profits. Not spectacular, but definitely not bad either—especially when you compare it to previous years:

2023 ICR: 2.55

2022 ICR: 1.18

See the trend? Their EBIT is growing much faster than their interest costs, meaning the situation is steadily improving. Cash flow growth is strong, so the risk of missing coupon payments looks pretty low—for now. However, this is something that needs to be closely monitored, especially if we see a slowdown in drilling activity in the Permian Basin. A drop in production could put pressure on Aris’s revenue streams, which in turn could affect their ability to comfortably cover interest payments.

Let’s quickly break down the other two notable liability categories: Tax Receivable Agreement (TRA) Liability and Accrued and Other Liabilities. These aren’t major threats to Aris’s stability, but they’re still worth explaining—especially since not everyone is familiar with them.

Accrued Operating Expenses

This is essentially a catch-all category for costs and obligations that have been incurred but not yet paid. For Aris, these typically include:

Maintenance and repairs for water infrastructure

Chemical and filtration costs

Contractual obligations to contractors and suppliers

…

In short, these are the everyday costs of doing business—they fluctuate, but they’re not unexpected.

Tax Receivable Agreement (TRA): What It Means for Investors

A Tax Receivable Agreement (TRA) is a contract between a company and its pre-IPO shareholders. In Aris’s case, this means that if the company benefits from certain tax advantages (like depreciation-related step-ups or restructuring-related deductions), 85% of those savings go to the original owners, while Aris keeps only 15%.

For new investors, this has two key implications:

Reduced tax benefits: If you’re a shareholder today, you won’t see the full tax savings in Aris’s financials, since most of those benefits are going to the original owners.

A fixed long-term obligation: This isn’t a debt in the traditional sense, but it does mean that part of Aris’s future cash flow is already spoken for. However, there’s a crucial catch—if there’s a sudden change in ownership, Aris would be required to pay out this liability to the previous owners in full. That could take a massive bite out of their cash flow, creating significant financial strain.

The Income Statements

Let’s continue with the income statement. This is where we find out how much revenue Aris is pulling in—and more importantly, how much of that actually sticks around as profit at the end of the day.

Revenue is split into two categories that should sound familiar if you’ve been following our qualitative breakdowns: Water Handling (the collection and treatment of produced water) and Water Solutions (recycling that produced water for reuse). There’s a small "Other Revenues" category too, but it’s too minor to spend time on.

Here’s what stands out at first sight: Aris still generates the bulk of its revenue from Water Handling. And it’s this division that’s doing the heavy lifting when it comes to revenue growth. So, while Aris has branded itself as a future-forward water recycler, that narrative doesn’t fully translate into the numbers—yet.

Or at least, that’s how it looks at first sight. But if you dig a little deeper into the revenue breakdown, you’ll notice that the stagnation in Water Solutions revenue is actually tied to a decline in fresh water sales. Meanwhile, the volume of recycled water increased by 16% in 2024. Just goes to show—always read the footnotes in the annual report. This also shows that we were not wrong in our SWOT analysis — that water scarcity is truly an issue, something that not only benefits Aris but, as the current figures now show, also causes difficulties for the company.

That said, Water Solutions now accounts for just under 20% of total revenue, so it’s far from negligible. It’s not leading the charge, but it’s definitely an income stream to watch, especially since Aris keeps pushing new investments in this division, but more on that later.

But Water Solutions isn’t the only alternative revenue stream in play here. Dig a little deeper into the footnotes (yes, you really need to do this), and you’ll spot something interesting: Aris classifies revenue from "skim oil" under the Water Handling segment.

Quick explainer for those unfamiliar: skim oil is the residual oil that gets separated from produced water during treatment. Instead of letting it go to waste, Aris captures and sells it—essentially squeezing a few extra bucks out of each barrel.

And those bucks are adding up. In 2022, Aris brought in $25 million from skim oil. By 2024, that number had jumped to $42 million. That’s a 68% increase in just two years.

So while it’s not the core business, it’s a fast-growing side hustle that could scale alongside Aris’s overall water handling volumes. Definitely something to keep an eye on if you’re looking for upside beyond the main segments.

Let’s zoom in on Aris’s growth over the past few years. Since the company only recently went public, the data is still a bit limited—so no wild Excel wizardry or ten-year trend lines here. But hey, a little visual storytelling never hurts. We’ll kick things off with absolute growth in revenues, gross income, operating income, and net income, as shown in Graph I.

At first glance, things look pretty solid. All four metrics show a steady upward trend over the three-year period. But here’s where it gets interesting: the real story isn’t just in the raw growth, it’s in the margins.

For a growth company, one of the key questions is whether it's becoming more efficient as it scales. That’s where economies of scale come into play. It’s not just about selling more—it’s about doing it better, and at lower relative cost. When that happens, you get a beautiful flywheel effect: revenue grows, and margins improve, which means cash flow doesn’t just grow—it compounds.

So you can imagine my reaction when I pulled up Graph II and saw that Aris’s margins are trending up. That’s exactly what you want to see.

Now, let’s pump the brakes for a second. Three years isn’t exactly a lifetime in financial analysis, and one unexpected shock—economic, operational, or otherwise—could flip the narrative on its head. So let’s not get carried away.

Still, based on what we do see? Aris seems to be on the right track. That doesn’t mean we’ll see this kind of growth forever, and it definitely doesn’t mean you should assume a copy-paste repeat performance in the years to come. But for now? They’re executing—and doing it efficiently. And that’s worth paying attention to.

Now let’s turn to the Cash Flow Statements. Once again, we’re not just looking at the biggest cash inflows and outflows—we’re also zooming in on anything unusual or revealing. Because sometimes, it’s the little line items that tell the biggest stories.

The Cash Flow Statements

Broadly speaking, Aris seems to be doing quite well when it comes to generating healthy operating cash flows. We already saw signs of this in the income statement, and the cash flow statement only confirms it. With $178 million in Operating Cash Flow (OCF) on $435 million in revenue, Aris converts a solid 41% of its top-line in cash they can use to invest or pay off their debt. For a capital-intensive business like this one, that’s more than respectable.

This strong cash generation gives Aris the flexibility to reinvest in its business. Of course, part of that goes to maintenance CAPEX—just keeping the lights on and the pipelines flowing—but there’s clearly room for growth investments too.

But enough with the obvious. Let’s dig into some of the more unusual items we spotted.

First up: Stock-Based Compensation (SBC). If you were paying close attention to the income statement, you might’ve noticed that the weighted average shares outstanding have been creeping up. That’s often a sign of SBC in action—and sure enough, we see it show up clearly in the cash flow statement. In 2024, SBC expenses jumped by 50%.

Quick explainer if you’re new to this: Stock-Based Compensation is when companies pay employees or executives in shares rather than cash. It doesn’t hit the income statement as a cash cost, but it does dilute existing shareholders by increasing the share count. So while it’s technically a "non-cash expense," it has a very real impact on your ownership slice. That’s why investors tend to raise an eyebrow when SBC climbs too quickly.

Now, to be fair, earnings have grown faster than SBC—so EPS is still heading in the right direction. But a 50% spike? Yeah, we don’t want to see that become a habit. It’s also something we’ll have to factor into our valuation model, given the rising share count.

Next up: costs related to abandoned wells and projects. This one ties directly into our earlier analysis of external risks. As we discussed, seismic activity in the Permian Basin has led to tighter regulations on produced water injection. And in some cases, Aris has had to abandon wells entirely—an expensive, unfortunate necessity. These aren’t everyday costs, but they’re highly specific to the nature of Aris’s operations, and worth flagging.

Finally, let’s talk about the investments Aris is making—not just to maintain their empire, but to expand it. We’ll break those down in more detail in the next section.

The vast majority of the cash Aris generates from its operations flows right back into the business through investments. A full 81% of operating cash flow is reinvested. Now, part of that is simply the nature of a capital-intensive business—water infrastructure doesn’t build itself. But when investment nearly doubles depreciation, you’re not just maintaining the status quo. You’re pushing for growth.

That tells us something important: Aris isn’t just treading water—they’re swimming full speed ahead. This isn’t a company milking existing assets for cash flow. It’s one that’s betting big on the future, and backing that bet with real dollars.

Aris’s investment strategy over the past few years reveals a clear two-pronged approach: one that balances intangible innovation with tangible operational expansion.

On one side, we see a strong push into intellectual property and specialized technologies. In 2025, Aris acquired Crosstek Membrane Technology to accelerate its entry into the industrial and wastewater treatment markets. And this wasn’t a one-off move—back in 2022, they also acquired patented water treatment technologies from Water Standard Management. If you remember our SWOT analysis, this fits perfectly with one of the identified opportunities: expanding beyond oil and gas into broader water markets. It’s a signal that Aris isn’t just playing defense—they’re diversifying and leaning into more sustainable, future-focused water solutions.

On the flip side, Aris is still pouring capital into physical infrastructure—because all the IP in the world won’t help if you can’t actually handle more water. A standout example: in November 2024, Aris acquired 45,000 acres across New Mexico and Texas for $46.1 million. This land will support long-term disposal and treatment capacity. And it’s not their first rodeo—just look at their 2022 acquisition of Delaware Energy, which was all about water processing infrastructure. These kinds of material investments reinforce Aris’s long-term commitment to operational strength in its core regions.

Bottom line? Aris is hedging smart. They’re betting on tech to open up new markets and on infrastructure to reinforce their current dominance. That dual strategy strengthens their hand in both the traditional oilfield services world and the emerging clean water economy. Not a bad place to be.

Part IV: Valuation

My Story of Aris

I’m breaking this into three parts:

Part I: My take on Aris’ future growth—mainly revenue and FCFF.

Part II: How that growth ties into ROIC and reinvestment rate.

Part III: Efficiency—can Aris maintain (or improve) its margins, or are we heading toward the economic equilibrium Cas always rants about?

Let’s start with the top line. I see a few solid, tangible growth drivers for Aris. First up: rising volumes. If you read Part II of this series, you’ll remember the chart showing steady growth in oil and gas production in the Permian Basin—even with falling oil prices.

On top of that, Aris has long-term contracts (average length: 8 years) with its biggest customers. These aren’t just vague handshake deals—they include minimum volume commitments. That gives us visibility, stability, and a bit of a safety net even in tougher market conditions.

Management expects volumes to grow by ~10% in 2025. That’s not eye-popping, but it’s steady—and given their track record, I’m inclined to believe them (though I’ll stay cautious in my bear cases).

Then there’s recycled water. Aris projects 460–520k barrels per day in 2025, about 15% higher than 2024. Longer term, I think regulation will push this even further—water scarcity is real, and recycled water could even be used outside of oil and gas.

But let’s not sugarcoat it: not everything’s rosy. Freshwater revenue is under pressure due to scarcity, which likely caps upside more than it causes actual revenue decline. And skim oil? That’s probably heading down if oil prices normalize after a strong 2024.

As for longer-term upside (think >10 years), I’ve left that out of my model—for now. Stuff like extracting minerals from produced water is still early-stage and unproven. If it becomes viable? Great. But I’d rather not bake hope into my numbers.

I’m not factoring in the energy transition too heavily just yet. Over the next 4 years, I think we’re relatively safe on that front—though let’s be honest, with Trump anything’s possible. Beyond that, I don’t see a dramatic drop-off in fossil fuels. If anything, I expect renewables to absorb most of the additional energy demand (AI, data centers, etc.), while fossil fuel use declines slowly and steadily. Just my opinion—not gospel.

Now, growth doesn’t happen in a vacuum. It takes investment. So let’s pivot to reinvestment rate and ROIC.

Aris went hard on CapEx in 2023—$155M invested. That’s tapering off: ~$100M in 2024, and guidance for 2025 is $85–$105M. That should cover ongoing projects and maintenance, but it signals a pause on major expansions. Management says they’re shifting toward shareholder value (think dividends, buybacks).

So I expect the reinvestment rate to fall. How far? Tough to say. Likely still above depreciation levels, since I do see decent growth runway left. But it’ll depend on how pilot projects evolve—and on macro conditions in oil and gas.

ROIC, on the other hand, should improve. Right now, it’s hovering around 8%, mainly due to heavy recent investments. With CapEx dropping and NOPAT rising, we should see upward momentum. If growth continues while the asset base stabilizes, that’ll drive better returns.

To achieve that higher ROIC, though, Aris needs to hold the line on margins. Can they? I think so. Most infrastructure is already in place, so incremental volume comes at low marginal cost. We’re seeing economies of scale kick in—cost of revenues rose just 1.16% in 2024, while revenue grew 11%.

Their contracts also help: fee-per-barrel pricing with indexation clauses means they’re partially hedged against inflation. Management has consistently referred to “strong maintained margins,” and the numbers back that up. That said, I’m not forecasting margin expansion from here—just stability. The big jump already happened.

Alright. We’ve covered the story. Now it’s time to turn that narrative into numbers.

Let’s value this thing.

Wich Returns Can You Expect?

Normally, our valuation process starts with a classic DCF. These days, we even use a Monte Carlo simulator to add some depth. (Quick explainer: Monte Carlo helps us simulate thousands of scenarios based on our assumptions. We used it in our [Melexis valuation]—feel free to check that out.)

But this time, we didn’t use it—and there’s one clear reason why: the reinvestment rate.

After spending a month digging into Aris, we feel like we’ve got a pretty solid understanding of the business. But not enough to confidently project reinvestment assumptions. And for a small company like this—market cap just under $900M—even a $50M swing in CapEx can massively skew the FCFF, and with it, the valuation—which, given the sharp drop in CapEx guidance we discussed earlier, feels like a very real possibility.

That’s especially true for a capital-intensive business with growth ambitions. Reinvestments matter—a lot. And in Aris’ case, we’re just not confident enough in the input range to justify a full DCF.

So, we pivoted.

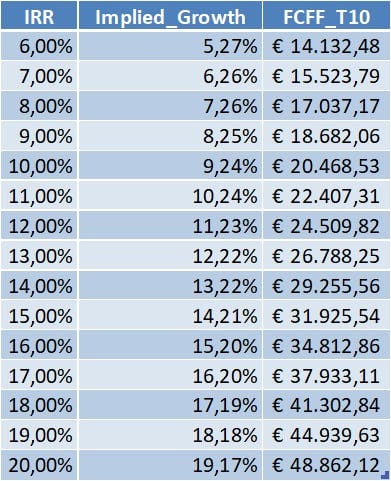

Rather than force false precision, we went with a different valuation method. But first—take a look at the table below:

This table shows how Aris Water Solutions’ valuation shifts depending on different assumptions for expected return (IRR) and implied free cash flow (FCFF) growth in year 10. By running IRRs from 6% to 20%, you get a sense of how much FCFF growth you’d need to hit those returns. For example, if you’re aiming for a 10% IRR, you’d need to believe in ~9.24% annual FCFF growth—translating to over €20,000 in cash flow by year 10.

This approach forces you to sanity-check the valuation: What kind of growth actually feels realistic? If you think 10% annual growth is doable, then a 10–11% return makes sense. But if you want a higher return, you’ll have to believe in significantly faster growth—which might not be all that likely. It’s a clean way to check whether your expected return aligns with your own conviction about the company’s potential.

Closing remarks: What Do we Think?

Ideally, this is the part where you decide for yourself what kind of FCFF growth feels realistic—without worrying too much about what we think. We've given you the objective data, we’ve done the math, and now it’s your turn. In fact, we strongly encourage you to approach the next few paragraphs with a healthy dose of skepticism. That’s the spirit of this series: think critically.

But for the five people who still care what we think—here’s our take.

We see a business with a few solid years of growth ahead. Based on everything we’ve looked at, we think revenue growth of around 8% annually over the next decade is a fair assumption. Combine that with a declining reinvestment rate and improving ROIC, and we estimate FCFF growth could land closer to 10%.

That would translate to an expected IRR of ~11%. Not bad. Definitely within “juicy territory” for us.

But let’s pump the brakes for a second—because we’re not fully convinced that Aris deserves a spot in our portfolio. And here’s why.

First off, we have no idea what management is really planning—or how competent they are. Their post-IPO track record looks decent, but it’s short. Too short for us to feel confident. On top of that, this is a small-cap stock operating in a region (the Permian Basin) that’s thousands of kilometers away from our base in Belgium. Researching a company like this isn’t easy. There are few public interviews, and the investor presentations? Let’s just say they’re not exactly binge-worthy. Investing in Aris would require serious discipline.

For that reason, we’d need this to be an obvious buy—and right now, it just isn’t.

Then there’s the complexity. We’re still not sure if Aris is fully within our circle of competence. It bothers us that estimating reinvestment rates is this tricky—especially for a business where reinvestment is mission-critical. Calculating FCFF becomes a guessing game, and while our implied growth method helps, it doesn’t give us the full picture. Relying solely on it feels... incomplete.

The macro risks only add to the unease. Aris is highly sensitive to external forces like geology and oil/gas prices. It’s already taken financial hits from extreme weather—and let’s be real, that’s not going to get better. Forecasting commodity prices is basically gambling. Might as well enter the lottery.

That said—this doesn’t mean you shouldn’t buy. If the price were significantly lower, we might reconsider. Our goal here is simply to be transparent about the risks. You don’t have to agree with us, but hopefully, you now see both sides of the coin.

📢 We’d love to hear your opinion on Aris Water Solutions? Convinced or not? Leave a comment!

🔔 Enjoyed this Full Analysis? There’s more to come! Make sure to subscribe!

Great write-up. Aris just doesn't seem like an exceptional business I'd own. Why go for Aris when there are countless other higher-quality stocks?