Last week we sprayed perfume. This week we sniff for rot.

Last week, we introduced you to Givaudan — the Swiss titan behind that strawberry yogurt you love, the scent of your favorite shampoo, and, let’s be honest, at least three overpriced niche perfumes you’ve sniffed once and never bought.

It was a post full of flowers and moonlight.

The goal?

Get you excited about what might be a top-tier investment... and, let’s not kid ourselves, subtly nudge you into reading the next parts too. Shameless marketing? Absolutely. But hey, we’re nothing if not honest about it.

This week, though, the rose-tinted goggles come off. Because you still deserve the truth.

No more soft-focus optimism. We’re diving deep. Real deep. As in: peel-back-the-layers-and-look-at-the-undergrowth deep. Yes, we’ll still talk about strengths. But we’re also digging into the risks, red flags, and strategic blind spots — the stuff even Givaudan’s own PR team probably tries to downplay.

Brace yourself. This might sting a little.

🧠 Part I: Strengths – The Fragrance of Dominance

There’s a reason Givaudan smells like victory.

It starts with scale. In the secretive world of Flavours & Fragrances — a market that most consumers never think about yet touch every single day — Givaudan is the kingpin. With ~20% global share, the Swiss giant is the biggest nose in the room. Its reach? 166 sites across 52 countries. Its product portfolio? Over 12,400 ingredients combined into countless custom formulations.

But scale alone doesn’t cut it. Givaudan wins because it’s embedded. In the labs of Nestlé. In the fragrance briefs of Estée Lauder. Its creatives — perfumers, flavourists, biochemists — co-develop products alongside clients, often starting at the blank page. That co-creation model makes the relationship sticky. Breakups are rare.

And behind all this? A machine-like commitment to R&D. The company reinvests ~7–8% of revenues each year into innovation — that's over half a billion Swiss francs annually. With 65+ creative and research centres, Givaudan doesn’t just follow trends, it often starts them.

With R&D spending at 7.6% of sales in 2024, it leads the pack:

Innovation isn’t everything — but in a business where taste and scent drive loyalty, it’s a critical growth lever. Givaudan’s above-average investment, combined with its industry-best co-creation model, helps explain why it's still setting the pace.

Financially, the results speak. Stable 5–7% organic growth historically, resilient margins (23.8% EBITDA in 2024), and consistent shareholder returns (~11% annual since IPO). Its cash flows are strong, dividends dependable, and debt levels trending down.

Add to that its ESG credentials — AAA-rated by MSCI, A/A by CDP, and 100% renewable electricity use as of 2024 — and you’ve got a business that not only smells good, but looks good on paper too.

And yet... this isn’t the full package.

😬 Part II: Weaknesses – What Even the Best Perfume Can’t Mask

Givaudan may lead the fragrance world, but even the most iconic scents have base notes you don’t want to linger on.

Let’s start with the obvious one: cost pressure. The business is exposed to thousands of raw materials — from vanillin and citrus oils to exotic botanicals and petrochemicals. When input prices spike (as they did in 2022), margins get squeezed fast. Yes, Givaudan has pricing power. But contracts need renegotiation, and clients don’t always play along immediately. That’s why free cash flow halved in 2022, even as sales grew.

Then there’s currency exposure. Operating globally but reporting in Swiss francs is a double-edged fondue knife. In 2023, a stronger CHF masked solid underlying growth with a headline revenue decline. The FX drag isn’t a one-off: it’s structural. If you invest in Givaudan, you’re betting — in part — against the strength of its own currency.

The trouble? The Swiss franc isn’t just momentarily strong — it’s structurally strong. For two decades, CHF has appreciated against both the euro and the dollar. It’s what happens when your central bank is boring (in a good way), your politics are neutral, and your economy is relentlessly stable. The result? For a global exporter like Givaudan, currency drag isn’t a quarterly nuisance — it’s a permanent tax.

Next up: debt. The company has CHF 4 billion in net debt — manageable, yes, but not trivial. Most of it was racked up through acquisitions. And while Givaudan integrates well (so far), one badly timed or overpriced deal could easily push leverage above the comfort zone again. With interest rates no longer free, that’s a real cost.

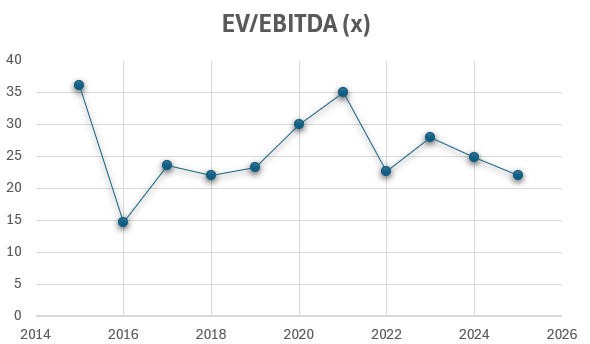

Then there's valuation. Givaudan rarely trades cheap. Investors consistently pay up for its quality, which means the margin of safety is thin. A wobble in margins, a misstep in innovation, or a shift in sentiment — and the stock could derate fast. Premium pricing demands premium execution. Every quarter.

And perhaps the most underappreciated risk? Talent. Givaudan’s secret sauce isn’t just its molecules — it’s the artists who mix them. Master perfumers and flavourists are in short supply, and retaining them is critical. A few key exits, or a slowdown in the internal talent pipeline, could dilute the company’s creative edge over time.

Finally, there’s the unsexy reality of scale. Yes, it protects. But it can also slow you down. When a new biotech startup releases a radically efficient way to replicate citrus scents, Givaudan can’t pivot overnight. The company is agile — for a CHF 7 billion machine — but it’s still a machine.

None of these weaknesses are fatal. But they are real. And unlike top notes, they don’t fade after the first whiff.

🌱 Part III: Opportunities – The Future Smells Good

You don’t dominate an industry for 250 years by standing still. Givaudan’s growth isn’t just a continuation of the past — it’s an active bet on where consumer taste (and scent) is heading.

Let’s start with the megatrends. Wellness, plant-based food, clean beauty, sensory experience. Givaudan is leaning into all of them. Its move beyond traditional flavours and fragrances into functional nutrition and biotech-based beauty ingredients opens up high-growth, high-margin verticals. Think: natural caffeine alternatives, neuro-enhancing extracts, biotech anti-aging serums. Stuff that sounds like it came from a Goop lab — but actually works.

The acquisition of b.Kolor in 2024 is emblematic. With that, Givaudan didn’t just expand into makeup and skincare — it added a full-stack innovation lab for next-gen beauty formulations. It’s no longer just a supplier; it’s a partner in product strategy.

Then there’s geography. In 2024, revenue in emerging markets grew +19.5% organically — triple the growth rate of developed markets. In places like China, India, Brazil, and the Middle East, Givaudan is building local creative centres and co-developing with regional brands. These aren’t just satellite offices — they’re future growth engines.

And don’t overlook the long tail of clients. While global FMCGs still matter, Givaudan has quietly been shifting focus toward mid-sized, fast-growing regional players. These smaller brands are hungrier for innovation, more agile in product cycles, and less price-sensitive when the added value is clear. In 2024, they drove the strongest volume growth in the portfolio.

Let’s not forget sustainability — which, if executed well, isn’t just risk mitigation but a commercial edge. Givaudan’s leadership in traceable sourcing, low-waste production, and climate-positive goals increasingly wins business in a world where consumers (and regulators) demand green credentials. And as ingredient transparency becomes a selling point, being the supplier that helps brands tell that story is a competitive moat.

Lastly: tech and IP. From AI-assisted creation tools to partnerships in carbon fermentation and ingredient encapsulation, Givaudan is betting that innovation isn’t just what’s in the bottle — it’s how it gets there. And that’s a defensible edge.

Givaudan isn’t just keeping up. In many areas, it’s ahead. Which is exactly what you want from a market leader... and what just might justify that premium multiple.

⚠️ Part IV: Threats – Not Every Scent Lingers

Even the finest fragrances fade. And for all its strengths, Givaudan isn’t immune to the slow evaporation of edge — or the occasional gust of trouble.

First: macro pain. Yes, people still brush their teeth in a recession. But they don’t always splurge on niche perfume or try a new plant-based yogurt when times are tight. Givaudan has exposure to both the essential and the experimental — and while that blend is a strength, it also means parts of the business are cyclical. The 2022 inflation spike hit margins hard. And while Givaudan bounced back, the scars are there: cost volatility remains a fact of life.

Currency risk? Always there. The Swiss franc is a safe haven — great for Swiss citizens, annoying for Swiss multinationals. Givaudan’s CHF reporting can obscure otherwise strong underlying growth. Investors need to read between the (currency-adjusted) lines.

Second: competitive creep. For decades, Givaudan has led the industry. But the moat is not bottomless. DSM-Firmenich’s merger, Symrise’s nutrition push, IFF’s footprint — the big boys are all sharpening their blades. Meanwhile, startups in synthetic biology are trying to replicate aromas using fermentation and AI. No, they won’t dethrone Givaudan tomorrow. But they might nibble at niche segments. Or push margins in commoditized categories.

Third: regulation. New EU rules on allergens, REACH revisions, traceability requirements for deforestation-free sourcing — Givaudan operates in a world where an unexpected ingredient ban can send R&D scrambling and supply chains into panic. Compliance costs are rising. And while Givaudan stays ahead, it can’t predict every twist.

Fourth: M&A missteps. So far, Givaudan’s acquisition track record is solid. But one overpriced or misaligned deal — especially in unfamiliar territory like makeup — could hurt margins or dilute focus. With CHF 4bn in net debt, another big acquisition could also reignite leverage concerns.

Fifth: tail risks. A plant explosion. A major quality recall. A cyberattack leaking proprietary formulas. These are unlikely, but they exist. The fatal accident at the Louisville site in 2024 was a sobering reminder: operational risks are real. And reputation is hard-earned, easily lost.

Finally: customer power. While no single client dominates revenue, the top 10 still matter. If a giant like Nestlé or P&G decides to switch suppliers or bring flavour development in-house, the impact would be noticeable. Givaudan tries to embed deeply via co-creation — but even sticky relationships can come unstuck.

In short: Givaudan’s not fragile. But it’s not invincible either. It’s built like a castle — tall walls, strong moat. Still, a siege or an internal fire can do damage.

🧾 Closing Remarks

Givaudan is what happens when chemistry meets craftsmanship — and then scales globally. It’s a business that smells deceptively soft and luxurious, but is built on hard numbers: strong margins, solid cash flows, consistent dividend growth, and a strategic machine that just keeps expanding its reach.

It’s rare to find a company that combines defensive resilience with genuine innovation. Givaudan does both. It supplies the world’s FMCG giants with critical (if invisible) ingredients. It’s embedded in long-term customer pipelines. And it’s not afraid to reinvent itself — biotech skincare, integrated food solutions, or carbon-negative fermentation — without losing sight of what made it great in the first place.

But none of that makes it bulletproof. Raw material shocks, currency swings, regulatory changes, or one bad M&A decision could quickly hit results. And then there's the valuation: this is not your typical bargain-bin Swiss stock. Quality comes at a price.

So if you're considering Givaudan as a cornerstone position — or even imagining a “100% of my wealth” thought experiment — here's our take.

🔍 Our Bottom Line

Givaudan is a world-class operator in an underappreciated niche, with powerful moats and real reinvention chops. But owning it requires trust — not just in the company, but in your own ability to stomach the occasional whiff of risk.

If the fragrance of innovation and consistency is what you seek, Givaudan might just be your scent. Just don’t spray too much in one spot.

🧭 Key Watchpoints

Margins vs. inflation: Can they protect the 24% EBITDA when input costs rise again?

Innovation pipeline: Still winning briefs at big clients, or starting to smell stale?

Acquisition discipline: No beauty overpays, please.

Debt & cash flows: Especially in a rising rate world.

Valuation multiple: Still justified if growth slows?

🧭 Next Up: What’s It Worth?

So far, we’ve explored Givaudan’s business model, strengths, risks — and yes, a few potential blind spots.

But none of that matters if you don’t ask the one question that counts:

What is Givaudan worth as an investment?

In our next article, we roll up our sleeves and dig into the numbers. We’ll build a full valuation model, unpack Givaudan’s margin structure, scenario-test its growth assumptions, and — for the valuation nerds among you — look at how its free cash flow profile justifies (or doesn’t) that premium multiple.

This will be a premium-only deep dive. If you’re serious about investing, this is where it gets real.

👇 Want in? Become a paid subscriber below.

We promise it smells like value.

💬 Agree? Disagree? Smell something we missed? Drop a comment — we actually read them all.