If you’ve read our previous post on diversification, you know we promised to share a guide on how to effectively diversify a portfolio. A promise is a promise, so here it is.

Many investors diversify without a clear plan, simply because they assume that more diversification is always better. However, did you know that over-diversification can actually harm your returns?

Since diversification is such a broad and important topic in the world of investing, it wasn’t possible to cover everything in one post. Additional posts diving deeper into this topic will be published soon. Don’t miss out—make sure to subscribe!

One common myth about diversification is that spreading your investments guarantees success. But what does effective diversification actually look like in practice? A key pillar is diversifying across different asset classes. By allocating your investments across different types of assets—such as stocks, bonds, real estate, and commodities—you can better manage risks and maximize opportunities. Let’s dive into how you can do this effectively and we’ll also explore whether there are asset classes you might be better off skipping.

Crafting Your Investment Blueprint

As you know, there are several asset classes in which you can invest your wealth. Below is a brief overview of the asset classes we consider worthwhile:

Stocks (including ETFs and mutual funds)

Bonds

Real estate

Crypto

Gold

Cash

You may notice that some asset classes are missing from this list, and we have our reasons for that.

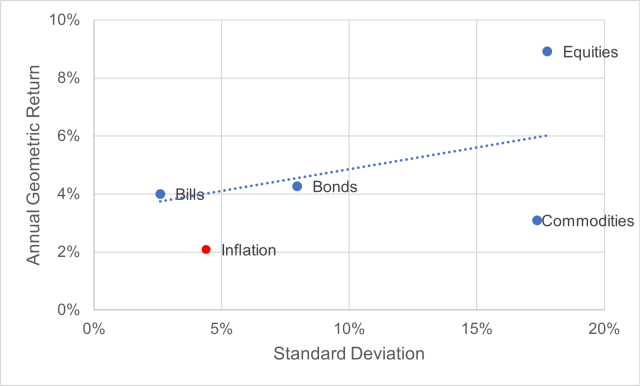

Commodities (excluding gold): Other commodities, such as oil, uranium, and agricultural products, are not included because we see little added value in holding them over the long term. Historically, this asset class has delivered the lowest returns while carrying significantly higher risk compared to, for example, bonds. If you’d like to learn more, check out the research from which we’ve drawn the chart below.

That said, we acknowledge that commodities can outperform in the short term, particularly during periods of high inflation. However, we don’t recommend including this asset class (except for gold, which we’ll discuss later) in your portfolio. Successfully investing in commodities requires expertise in multiple areas, such as economics, geopolitics and, believe us, many more topics, making it unsuitable for the average investor.

Private equity: Private equity is an alternative to stocks. We’ll discuss this topic in more detail in a future post, as there’s much to cover. For now, here are some reasons why we don’t recommend this asset class: high entry requirements, lack of transparency, high fees, and illiquidity. For example, minimum investments often start at €100,000, which makes private equity impractical for most investors. Additionally, without regular and detailed reporting, it’s difficult to stay informed about the performance and risks of these investments.(kan je dit wat aantrekkelijker schrijven aub, niet echt een aangenaam stuk om te lezen)

Collectibles: Collectibles include art, wine, and similar investments. We believe these assets can have a place in an investment portfolio, provided you have sufficient expertise. Collectibles offer diversification beyond traditional markets and can be a hedge against economic uncertainty. However, achieving consistent returns without deep knowledge of these markets is challenging. Moreover, these investments often require a substantial amount of capital, making them less accessible to the average investor.

The Ultimate Portfolio

Now that we've decided what to leave behind, it’s time for the good stuff. In this section, we’ll review each asset class and explain why it deserves a spot in your portfolio.

Why Every Portfolio Needs Equities

For those who noticed the image above, it’s clear that equities are the top performer over the long term. Research shows that stocks deliver the highest returns compared to other asset classes. Of course, higher rewards come with higher risks, but there’s a catch: the longer you hold equities, the less risky they become.

This phenomenon is known as time diversification. Studies confirm that investors who stick with equities over time experience reduced volatility and increased potential rewards. Think of it as the market rewarding your patience.

Most of these researchers do equate risk with volatility, and if you’ve read our post on Risk, you know we don’t completely agree. Still, even Warren Buffett emphasizes the importance of holding stocks long-term. As he famously said:

“The stock market is designed to transfer money from the active to the patient.”

Historically, equities have demonstrated a clear upward trend over periods of 10 to 20 years, despite occasional corrections or even dramatic crashes. By holding stocks over the long term, you reduce the impact of market fluctuations, effectively shielding yourself from the ups and downs of short-term volatility. This is exactly why equities should always have a place in your portfolio.

The longer you hold stocks, the less risky they become. Research shows that time diversification significantly lowers risk while increasing potential returns. Investors who stay the course and remain patient benefit not only from reduced volatility but also from the long-term growth of the economy.

In our next post, we’ll explore how to diversify within this asset class and maximize its potential. This will include strategies to balance growth with risk, ensuring your portfolio remains robust across market cycles. (Stay tuned for more insights in our upcoming posts!)

If equities are the foundation of long-term growth, real estate offers a tangible way to diversify your portfolio. While both are essential, real estate provides a completely different set of opportunities and challenges, making it a valuable addition.

Real Estate: Safe or a Blessing in Disguise?

Let’s keep this brief since we’ve recently gone into detail about real estate investments in a dedicated post. There, we discussed the benefits of REITs and in our next post, we examined the key factors influencing property prices. So make sure you are subscribed!

Real estate is a unique asset class, offering one significant advantage: leverage. For most individuals, it’s one of the few investments you can partially fund with debt, using a mortgage to amplify your returns. This ability to boost your return on equity (ROE) is what makes real estate attractive.

But let’s not overlook the risks. Leverage can work against you just as easily as it can work for you.

A mortgage is a long-term financial commitment, limiting your flexibility to save, invest in other opportunities, or manage unexpected expenses.

The total cost of ownership often exceeds the purchase price. Maintenance, property taxes, and transaction fees can significantly impact your profitability.

Finally, interest rates matter. The rate at which you borrow directly affects your overall returns.

The bottom line? Approach real estate with a clear plan and a full understanding of the risks. It’s an excellent asset for diversification, but not without its challenges.

While real estate can feel tangible and equity offers long-term growth, bonds provide something different: stability and predictability. Let’s explore how fixed-income investments can fit into your portfolio.

Bonds: The Reliable Choice for Stability

We’ve previously covered bonds in detail, so our loyal readers already know we’re big proponents of this asset class. But let’s recap why bonds are worth considering.

Bonds are often viewed as safer than equities, especially if you steer clear of high-risk “junk bonds.” They’re relatively simple to understand and evaluate, making them an appealing choice for conservative investors.

For those with short-term financial goals, such as saving for a house in 3–5 years, bonds are a practical solution. Unlike stocks, they’re less likely to face sudden value drops, making them a safer option for preserving capital.

Bonds also offer the added benefit of predictable cash flow. When a bond matures, you receive a lump sum, which can be reinvested or used to capitalize on new opportunities, such as undervalued stocks or real estate. This flexibility is invaluable for financial planning and maintaining liquidity.

If you’d like to explore which types of bonds might suit your needs, check out our dedicated guide.

If bonds are the steady rock in your portfolio, gold represents a timeless hedge against uncertainty. Let’s move from fixed income to this historic store of value.

Gold: Timeless but Optional

Gold has always been a divisive asset, and for good reason. Unlike stocks or bonds, it doesn’t generate cash flows. Its value comes from two key factors: scarcity and belief. Much like fiat currency, gold holds value because we collectively agree that it does. This shared belief, coupled with its finite supply, has kept gold’s value relatively stable over centuries.

For some investors, gold is an excellent addition to a portfolio, especially for those who struggle with the volatility of stocks. Its low or negative correlation with other assets makes it a useful tool for diversification.

That said, we consider gold an optional component. Over the long term, it tends to underperform equities, meaning you might sacrifice potential returns by holding too much of it. However, during periods of inflation or economic uncertainty, gold can provide short-term outperformance.

If you decide to include gold, think of it as a stabilizer, not a growth driver.

With gold setting the standard for a stable store of value, it’s no surprise that Bitcoin has earned the nickname “digital gold.” But does it live up to the comparison? Let’s explore.

Bitcoin: The Digital Gold Standard

Crypto remains one of the most debated and volatile asset classes. While we approach it with caution, Bitcoin deserves special mention. Its scarcity and the collective belief in its value echo many of gold’s characteristics.

Recent developments, such as Bitcoin ETFs and discussions about its potential adoption as a reserve currency, have reduced fears of catastrophic loss. That said, always do your research before investing, especially at current price levels.

For beginners, Bitcoin is a logical starting point. Other cryptocurrencies, while promising in their utility (e.g., smart contracts, fast transactions), carry higher risks due to uncertain adoption and governance.

From equities to crypto, one constant remains: the need for a financial safety net. Let’s talk about cash as the foundation of any portfolio.

Cash: Your Buffer in Uncertain Times

No matter how diversified your investments are, a cash reserve is essential. It ensures you can weather market downturns without selling at a loss and seize opportunities when they arise.

Whether it’s unexpected expenses, income loss, or market opportunities, cash offers flexibility and peace of mind. Think of it as the foundation that supports the rest of your portfolio.

With this, we wrap up the current discussion on the role of cash in a diversified portfolio. In the next section, we’ll discuss how we continue to explore this critical topic in more depth in the future.

What’s Next?

This guide was designed to provide more clarity on which asset classes deserve a place in your portfolio. However, we recognize that within certain asset classes, such as stocks, there is a need for further diversification. That’s why, in the future, you can expect additional comprehensive addendums that will explore these topics in greater detail.

We’re certain that we’ll delve deeper into diversification for stocks, but we’re still debating whether to do the same for crypto. While we both have a solid grasp of the basics of crypto and don’t limit ourselves to Bitcoin, we want to be cautious about putting this asset class in the spotlight due to our limited expertise and its inherently risky nature. Rest assured, we’ll keep you updated on this decision!

In the meantime, we already have new content lined up for you. Next, we’ll dive into the factors that influence real estate prices. See you on Wednesday!