Welcome to the grand finale of our series on qualitative stock research! If you've been following along, you already know we've covered a lot. In Part I, we dug into MOAT's and what makes a management team shine. Then, in Part II, we explored how companies weather economic storms, innovate to stay ahead or protect themselves from innovation, and flex their pricing power.

Now, it's time to tackle the big, scary, and unavoidable topic—risks. In this final chapter, we'll uncover how to spot red flags in a company and break down the different types of risks investors should keep an eye on. After all, understanding risks is like packing an umbrella—better safe than sorry when the forecast looks cloudy!

Beta Uncovered: Why Volatility Isn’t the Whole Story

We’ve looked at risks before in a previous article, where we found that volatility and risk aren’t the same thing. Relying solely on a stock’s beta to gauge risk can be misleading. A stock might appear calm and steady most of the time but that doesn’t tell the whole story. It could still turn highly volatile during tough economic periods. And let’s not forget, volatility cuts both ways. A stock with low volatility might lag behind in booming markets, only to become erratic and unpredictable when conditions get worse.

That said, beta can still be a useful indicator of risk when used properly. However, we want to highlight that beta should never be followed blindly. Instead, it’s important to dig deeper and complement it with a broader analysis of the company’s fundamentals and risk factors. Now, we’ll now dive into how you can perform that broader analysis and highlight the key elements to watch out for when assessing risks.

Big-Picture Threats

Before we dive into the finer details, let’s zoom out and take a look at the big-picture threats—those macro-economic and policy risks that can ripple through markets and shake up even the most stable companies. From political instability and regulatory overhauls to trade wars and sweeping economic policies, these forces can make or break growth prospects. Keeping an eye on these trends isn’t just smart—it’s essential for staying ahead of the curve.

Regulatory Risks & Geopolitical Uncertainty

In recent years, governments have become increasingly involved in so-called “free markets”, amplifying regulatory risks.

For example, here in Belgium, where we live, they’ve been trying to build a new stadium for the national football team for years. But thanks to layers of red tape, endless bureaucracy, and the EU’s love for overregulation, the project has been stuck in limbo. Honestly, at this point, we might see humans land on Mars before we see that stadium finished. It’s a perfect example of how regulations, while sometimes necessary, can also stifle progress and create headaches for businesses trying to operate within these frameworks.

These examples really drive home the need to understand the rules and regulations a company faces in the regions where it operates and makes money. But it’s not all bad news—sometimes governments can be surprisingly helpful, offering subsidies or favorable legislation that align with their policy goals. That’s why it’s so important to dig into the regulatory landscape and figure out whether it’s more of a tailwind or a headwind for the business you’re analyzing.

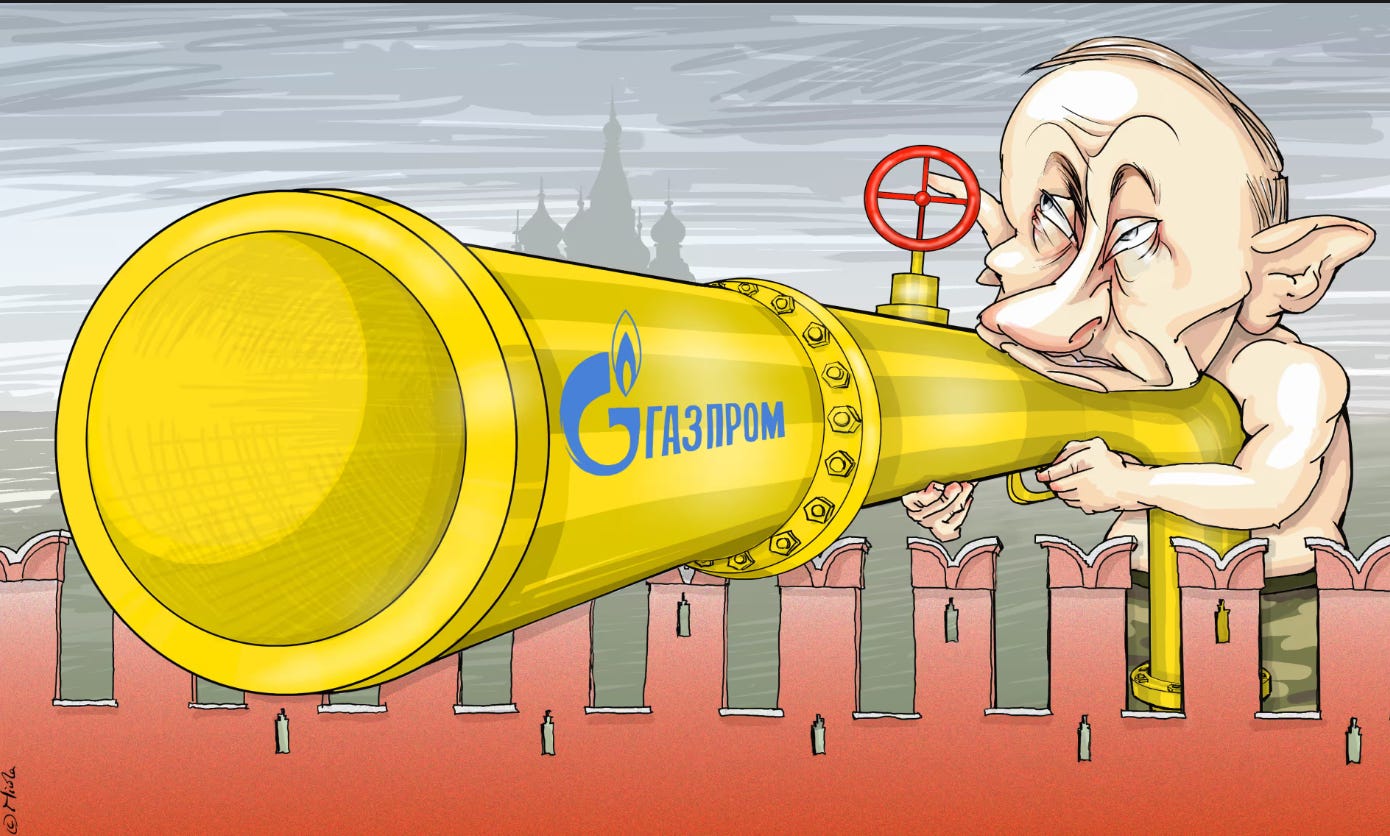

Governments can also influence businesses in other ways. Just ask energy-intensive companies in Europe. They have been hit hard by the "special military operation"—Putin’s peculiar term for war—in Ukraine. Geopolitical instability can significantly impact a business, even if the conflict doesn’t occur directly in the country where the company operates.

This is where macroeconomic knowledge becomes particularly useful. To navigate geopolitical uncertainty, investors should evaluate a company’s exposure to high-risk regions and assess its dependency on unstable governments or controversial figures like Putin.

Now let’s move on to another big external risk—competition. We’ve already covered economic downturns back in Part II, so we won’t revisit that here. Instead, let’s focus on one of the toughest challenges companies face—keeping up with competitors and staying ahead of the pack.

Competition: The Battle Within the Industry

Understanding the sector as a whole is essential when analyzing a company. A lack of knowledge about competitors can lead to overestimating a company’s strength and underestimating the risk of being overtaken by competitors. Competitors might introduce better products or services, operate more cost-efficiently, employ advanced technologies, or execute superior marketing strategies.

Aggressive competition can also lead to pricing pressures, eroding margins, or even causing a loss of market share.

It’s therefore crucial to gain as much knowledge as possible about the sector in which the company operates. Industry reports from consultancy firms like McKinsey, which often share these reports for free, can be valuable resources. Additionally, take a close look at the products and key financial metrics of competitors to get a clearer picture of the competitive landscape. Evaluating a company’s ability to defend its market position and innovate is key to understanding its long-term viability.

The Hidden Dangers Inside the Business

We’ve now tackled the big external risks. Now it’s time to turn inward and look at the risks that can bubble up from inside a company. Internal risks might not grab headlines, but they can hit just as hard.

In this section, we’ll dig into a few critical areas—how reliant a company is on key customers and suppliers, whether it has the right talent in place, and how vulnerable it is to reputational damage.

And while we’ve already covered management risks in Part I and innovation risks in Part II, it’s worth keeping those in mind as part of the bigger picture. Even though we won’t rehash them here, they’re still major pieces of the qualitative risk puzzle.

Too Few Partners, Too Many Problems

It’s never ideal for a company to be overly dependent on a small number of customers. If one of these key clients leaves, it can be challenging to replace them with another client of the same scale, leading to a sharp decline in results. Large customers are also often aware of their importance, which gives them leverage to negotiate better terms, potentially squeezing the company’s margins.

The same principle applies to suppliers—relying too heavily on a single supplier can give them significant leverage, allowing them to dictate terms and potentially impact profitability. However, supplier dependency brings an additional layer of risk. If a critical supplier suddenly fails or is unable to deliver, it can cause severe disruptions to the supply chain.

A real-world example of this occurred near the Volvo factory in my area. The factory faced temporary shutdowns due to supply chain disruptions caused by Houthi rebel attacks in the Red Sea. The interruption in the flow of parts forced them to halt production multiple times—a costly setback. Situations like this highlight the importance of evaluating a company’s supply chain resilience, diversification strategies, and contingency plans during your research.

When analyzing these risks:

Review the company’s annual report to identify key customers and suppliers.

Assess their financial health and determine whether the company relies heavily on a small number of partners.

Pay attention to the geographical origin of revenue streams and supplier locations to spot potential exposure to unstable regions.

Evaluate contract terms—long-term agreements can offer stability, while short-term contracts may signal higher risk.

Compare this data with competitors to determine whether the company’s dependencies are more or less vulnerable than others in the industry.

In the following section, we’ll investigate the importance of employees. We’ll also explore the risks tied to reputation, because as the saying goes, trust takes years to build and seconds to destroy. From workplace culture to public scandals, we’ll uncover how these factors can have a lasting impact on performance.

Employees: The Human Core of a Business

A company, much like many aspects of modern life, is ultimately a fictional construct we collectively agree to believe in—similar to national borders, which are imaginary lines that exist only in our minds, even a country is technically fictional. What truly makes a company real are the people who work there. It’s the employees that bring life, ideas, and results to the organization.

You could argue that employees are the most important asset a company has—and in many cases, that’s absolutely true. Talented teams drive innovation, build customer relationships, and execute the strategies that keep businesses afloat and thriving.

However, the reliance on people also introduces risks. Key personnel leaving, skills shortages, or toxic workplace cultures can disrupt operations and lower performance. Therefore, evaluating the quality, stability, and morale of a company’s workforce should always be a key part of your research.

To assess these risks:

Check the company’s employee turnover rate and retention statistics to gauge workforce stability and satisfaction.

Use platforms like Glassdoor, which offer anonymous employee reviews, to gain insights into company culture, management quality, and workplace morale.

Look for patterns in feedback that might reveal internal issues like poor leadership, toxic culture, or lack of growth opportunities.

Compare these findings with competitors to see how the company stacks up in terms of employee satisfaction and workplace quality.

Reputation Risks: Trust is Hard to Build and Easy to Lose

A company’s reputation can be one of its most valuable assets—but also one of its most fragile. Negative press, scandals, lawsuits, or ethical breaches can quickly erode trust with customers, partners, and investors, leading to long-term damage.

To assess reputation risks:

Stay updated with news reports and public announcements about the company.

Monitor lawsuits, regulatory investigations, and social media sentiment to identify early warning signs.

Review customer feedback, online reviews, and ratings to gauge public perception.

Compare insights with competitors to determine whether the company stands out positively or negatively.

Conclusion

In this article, we’ve explored the many qualitative risks investors should consider when analyzing a company—from macroeconomic and geopolitical uncertainties to internal vulnerabilities like customer and supplier dependencies, workforce stability, and reputational risks.

Next Wednesday, we’ll put these lessons into practice by analyzing a real company, showing how to apply this framework step-by-step. We’ll walk through the qualitative aspects we’ve discussed—from management and competitive positioning to supply chain vulnerabilities and macroeconomic risks—bringing all the concepts together in a practical, real-world example.

Then, on Friday, we’ll switch gears and dive into quantitative analysis using the same company. We’ll break down financial statements, incorporating the lessons from Cas about how to effectively analyze the balance sheet and the income and cashflow statements. Along the way, we’ll share practical tips to help you analyze profitability, liquidity, and leverage ratios.

The goal is to take the theoretical knowledge covered in the past three parts on qualitive research and the two parts on financial statements and apply it in practice.

By working through real-world examples, you'll gain hands-on experience in analyzing both qualitative and quantitative aspects of a company, helping you turn insights into actionable strategies.

Hope to see you next week!

Please note: This article includes a disclaimer regarding investment advice.

These articles might interest you as well:

Mastering the Art of Quality Investment Research

In one of our earliest articles, we talked about using stock screeners to find good companies that are fairly priced. These tools use financial data to sort through lots of stocks and point out promising options. While stock screeners are a great place to start, they don’t tell you everything you need to know about whether a company is a smart investmen…

Mastering the art of Quality Investment Research II

Last Sunday, we introduced several concepts that we at DualEdge Invest focus on when conducting Qualitative research on a company. We explored MOATS in depth and discussed how to evaluate a company’s management. This Sunday, we are building upon that foundation. Today, we will discuss a few key qualities that a company should ideally possess. If these q…

Excellent write-up!