As we dive into 2025, it’s time for another deep dive into the business world. Don’t worry—we promise not to churn out yet another “Top 20 Stocks to Buy in 2025” list (at least not this year… but hey, who knows what we’ll do if we’re desperate for clicks and shares next time). Instead, today’s focus is on a company that hits close to home—literally. Meet Melexis, a Belgian gem headquartered in Ieper, a city steeped in World War I history (yes, we’re flexing our historical knowledge too). Whether Melexis is gearing up for battle in the competitive semiconductor arena is something we’ll unpack shortly.

But first, let’s lay down some groundwork. Founded in 1988 and taking the public stage in May 2002, Melexis has delivered an impressive 591% return since its IPO—that’s 9.18% annualized—beating out the S&P 500’s 437% (7.94% annualized). That’s a nice track record for a company proudly positioning itself as 'a global supplier of microelectronic semiconductor solutions.' So, what makes Melexis stand out—or not—in this fiercely competitive market? Let’s find out!

Core Business & Moat

Core Business

Melexis operates at the forefront of semiconductor innovation, focusing primarily on the intricate design of chips. The journey from concept to a finished chip involves a meticulous and multi-stage process that ensures high performance and reliability.

The process starts with Chip and Package Design, where engineers create the blueprint for the chip and its casing.

Next is Wafer Fabrication, where silicon wafers, made from sand, are layered and patterned to build the chip's structure.

In Wafer Probing, electrical tests check which chips are functional before moving forward.

The Assembly phase cuts the wafer into individual chips, encapsulating them for protection.

Finally, the Final Test simulates real-world conditions—testing durability under high voltages and extreme environments to ensure reliability.

While this process may appear long and complex, it underscores the precision and care required to deliver cutting-edge technology. Here is where Melexis carves its niche—as a 'fabless' semiconductor designer. Unlike traditional manufacturers, Melexis focuses solely on design, assembly, and testing, leaving the fabrication stage to specialized partners.

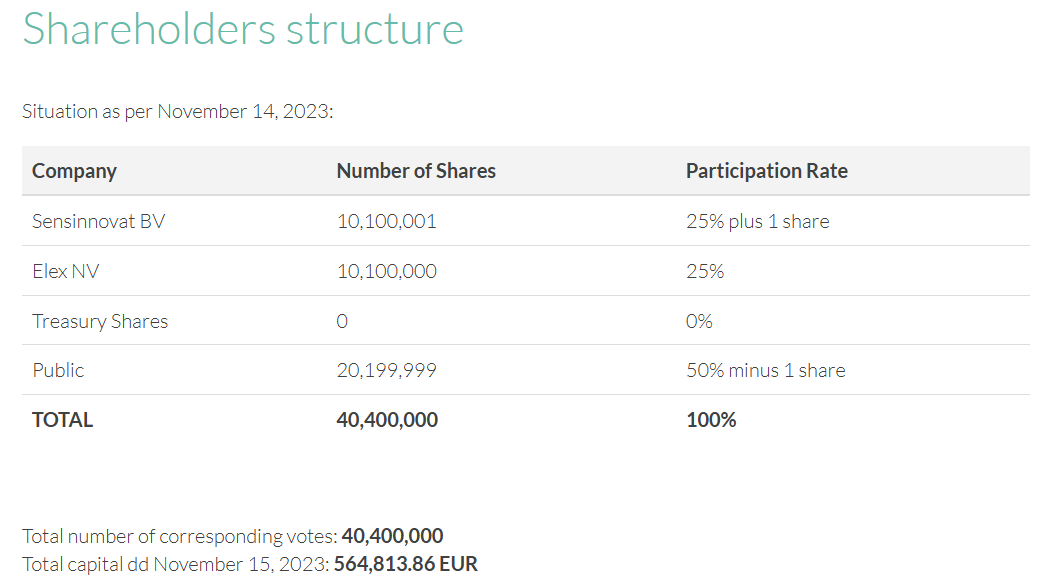

This approach allows Melexis to leverage its close ties with X-Fab, a Belgian public company specializing in wafer manufacturing. The synergy between these two companies creates a tightly integrated supply chain. Notably, key shareholders Rudi De Winter (Sensinnovat NV) - also CEO of X-Fab - and the Duchatelet family (Elex NV), maintain significant stakes in both firms, reinforcing this partnership. Both shareholders hold around 25% of both X-Fab and Melexis. For Melexis, the shareholder structure looks like this:

Moat

This vertical alignment potentially grants Melexis a competitive edge—or moat—by streamlining production costs and improving margins. Additionally, lower production costs free up more cash for reinvestment into research and development (R&D), enabling Melexis to focus on innovation and enhance future growth. These factors warrant close scrutiny as we evaluate Melexis’ financial performance and long-term sustainability in a next article.

Transitioning from process efficiency to market potential, the next section explores the addressable markets for Melexis. Understanding where and how these chips are deployed provides insight into the scalability and future growth prospects of the company.

Positioning for Long-Term Growth

Automotive

When it comes to the automotive world, Melexis isn’t just keeping up—it’s leading the charge in designing analog chips. In 2023, a whopping 90% of Melexis’ revenue came from the automotive sector. These aren’t just any chips; they’re analog chips designed to connect the physical world to the digital one. Imagine this—when you press the brake pedal, a sensor detects the pressure and sends a digital signal to the car’s central system to start slowing down. That’s the magic of analog chips! As Melexis puts it, “a car is becoming a smartphone on wheels,” and software is the secret ingredient powering this transformation.

To stay ahead, Melexis is zeroing in on three major trends reshaping the automotive industry:

1. Electrification

The electric vehicle (EV) revolution is already here, and it’s picking up speed. Companies like Melexis need to stay nimble to not only keep up but lead the pack. Melexis targets three key areas:

EV Powertrain: Converting electrical energy into motion requires more chips than ever, and the demand is only growing.

Thermal Management: For EVs to maximize driving range, battery temperature must stay between 20–40°C. Chips play a vital role in managing this balance.

Battery Monitoring: EV batteries need constant oversight—tracking pressure, temperature, and current to ensure safety and efficiency. And guess what? That’s exactly what Melexis specializes in.

2. Premiumization

Who doesn’t love a sleek, high-tech car? In the whole premiumization trend, Melexis focuses on lightning—both for aesthetics and safety. Melexis expects the lightning chip market to skyrocket, with a 23.4% annual growth rate over the next five years. To put it in perspective, the average car will go from using 10 "premiumization" chips to a staggering 150. That’s a 15-fold jump!

3. ADAS (Advanced Driver-Assistance Systems)

Driver-assistance technologies, like E-braking and E-steering, are at the core of the shift toward autonomous driving. These systems require seamless communication and monitoring to operate effectively. As self-driving technology becomes more mainstream, Melexis is well-positioned to ride this wave. Revenue from this segment is projected to grow at a 10% annual rate over the next five years—but we’ll analyze these claims further when we evaluate the management team.

Beyond-Automotive

While 90% of revenue comes from automotive, Melexis isn’t putting all its eggs in one basket. The other 10% comes from “Beyond-Automotive” ventures, covering:

Sustainable World

Alternative Mobility

Robotics

Digital Health

These sectors align perfectly with Melexis’ strengths, leveraging technology to address two major trends: sustainability and an aging population.

Sustainability: The shift to greener energy is unavoidable, and chips are critical for converting natural forces—like sunlight and wind—into usable electricity. The Sustainable World and Alternative Mobility sectors focus on enabling this transformation.

Aging Population: In Europe and beyond, people are living longer, and birth rates are declining. This creates both challenges and opportunities. From health-monitoring wearables like smartwatches to robots that handle repetitive tasks, Melexis is tapping into this demand. These trends aren’t going away—they’re only going to grow.

Market Prospects

The future of EVs is hardly a secret anymore—it’s the next big thing. The best part? Melexis’ chips fit into any vehicle type, whether it runs on electricity, hydrogen, or even alternative fuels. But EV batteries, which need plenty of analog chips, are particularly suited to Melexis’ strengths.

As shown in Graph I, EV adoption is set to explode, potentially quadrupling within the next decade—a growth rate of 17.5% per year. Even emerging markets are jumping on the EV bandwagon as prices drop due to increased competition.

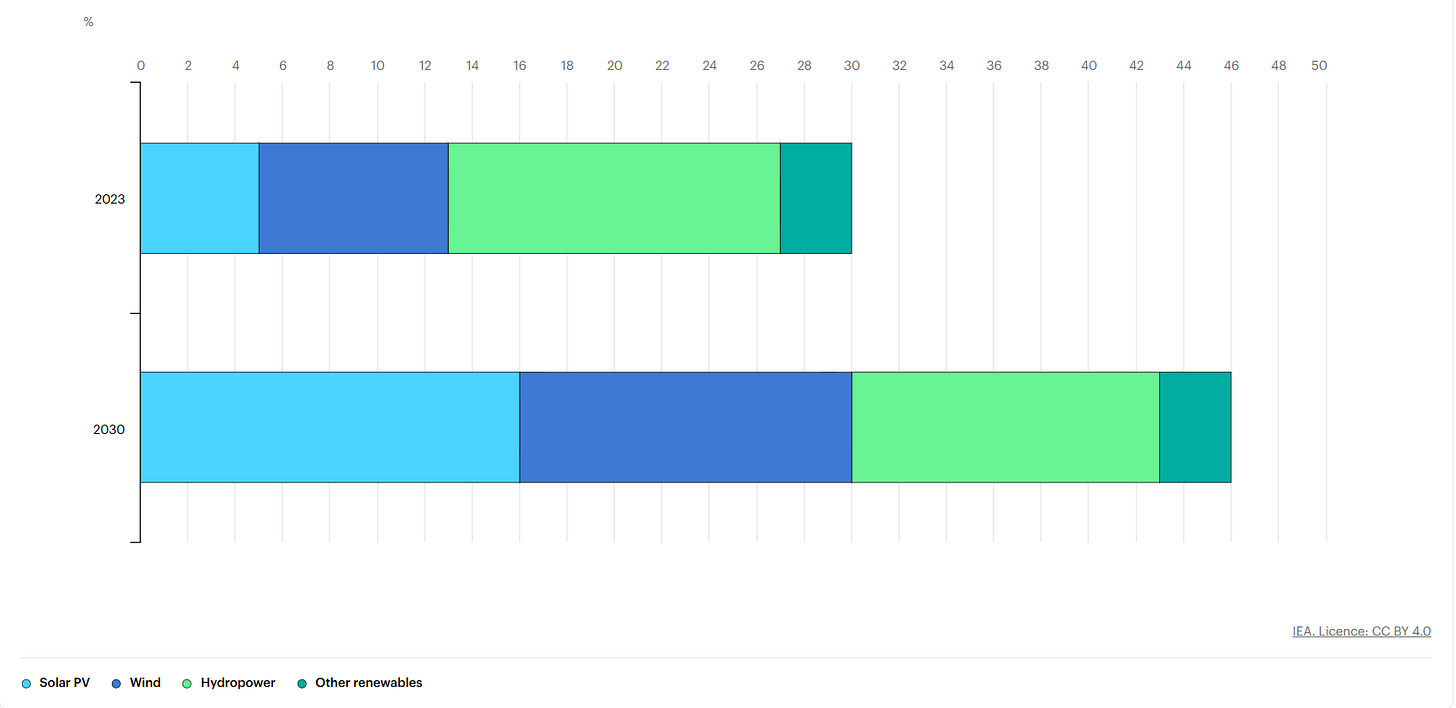

Sustainability and renewable energy are also hot topics. By 2030, roughly 45% of energy production is expected to come from sustainable sources (see Graph II). That’s impressive, especially considering global energy consumption is rising rapidly. But renewable energy systems are still inefficient, with only 20–40% efficiency in many cases. This leaves plenty of room for improvement—and opportunities for companies like Melexis.

Robotics and digital health, while less mature markets, are poised for exponential growth. With aging populations and labor shortages, these sectors are expected to grow by 15–20% annually over the next 5–8 years. However, the bulk of this growth might come later rather than sooner.

Melexis is laser-focused on trends that could reshape industries over the next decade. While some areas, like EVs, are already booming, others—like robotics and digital health—are still building momentum. Companies that make smart investments now will be the ones to thrive when these markets hit their tipping points. And based on what we’ve seen, Melexis is positioning itself to be one of those winners.

Next, we’ll dive into the competitive landscape and assess whether Melexis has what it takes to outshine its rivals.

Competition & Management

Competition

Let’s talk about competition—because let’s face it, Melexis isn’t exactly playing in a league of amateurs. In Belgium, Melexis stands out, but when we broaden our view to the analog semiconductor industry, the field gets crowded quickly. Especially in the automotive sector, the big players are hard to ignore. Infineon, STMicroelectronics, and NXP Semiconductors dominate Europe, raking in €8.4B, €7.8B, and €7.5B, respectively, in 2023. Compared to Melexis’ €900M, it’s clear they’re fighting giants—nearly ten times their size.

Across the Atlantic, Texas Instruments and Analog Devices hold strong positions too, pulling in €6B and €3B from the automotive sector—still several times more than Melexis. But here’s the twist: these industry titans are stretched across multiple sectors, from industrial applications to consumer electronics. Their R&D budgets are massive, but so are their commitments, meaning resources are divided across numerous fronts.

This is where Melexis could carve out an advantage. By being a niche player, entirely focused on automotive applications, they avoid the distraction of competing across multiple industries. Plus, their “fabless” model—designing but not manufacturing chips—allows them to double down on innovation without the burden of heavy infrastructure costs. It’s not to say they’re on track to dethrone the big names anytime soon, but this laser-focused approach leaves the door open for breakthroughs. If they continue to refine their designs and innovate, who knows? They might just snag a more substantial piece of the market pie.

In terms of entry barriers, the semiconductor business is capital-intensive and fraught with risks, and the dominant players have spent decades cementing their positions. Texas Instruments, for example, is celebrating its 95th birthday this year. With such deeply rooted relationships between automotive manufacturers and their suppliers, the transition to EVs is unlikely to upend the landscape. Instead, it’s more likely to amplify investment needs rather than shake up existing partnerships. Breaking into this club would require Herculean effort—so much so that it begs the question: is it even worth trying?

Management

And now, let’s shift gears and talk about the crew steering the ship. We’ve covered the competitive waters and potential threats, but what about the leadership navigating Melexis through it all? Warren Buffet once said, “An idiot with a plan can beat a genius without a plan.” So, let’s see if Melexis’ leadership has a plan—and more importantly—whether they’ve been delivering on it.

Rather than drowning you in résumés and alma maters, let’s take a more practical approach. The big question is: can management actually hit their own targets? This table already shows some promising results:

Looking at the last five years, it seems they’re improving. Since Marc Biron took over as CEO, forecasts have become more accurate. In fact, over the past three years, their predictions were either spot-on or underestimated, which suggests they know their business well and aren’t over-promising.

But, Biron is still relatively new, and time will tell whether this trend continues. That means keeping a close eye on upcoming reports to see if they maintain this performance.

Now, let’s address another key factor—skin in the game. Popularized by Nassim Taleb, this concept looks at whether leaders have personal stakes in the companies they run. It’s simple: the more personal investment they have, the more aligned their interests are with long-term investors. In Melexis’ case, management doesn’t hold a significant (>5%) stake. Instead, about 50% of shares are held by private investors, which is generally a positive sign since these stakeholders tend to focus on sustainable growth.

Wrapping It Up

Alright, let’s bring it all together. Today, we unpacked the story of Melexis—a Belgian player in the high-stakes semiconductor game. With its fabless and semi-vertically integrated business model, Melexis leans heavily into innovation, aligning itself with trends that are shaping the future (even if they’re not keeping you up at night just yet). We also took a peek at the management team, and under the new CEO, things seem to be heading in the right direction with forecasts looking more reliable. So far, so good.

But let’s not kid ourselves—this isn’t the whole story. I intentionally kept things straightforward today, leaving out the risks that come with investing in a company like Melexis. After all, if it were all sunshine and rainbows, I’d probably be lounging on a yacht instead of writing this!

So what’s next? On Friday, we’ll dive into the potential risks—short and sweet but absolutely worth your time. Then, on Sunday, we’ll put today’s narrative to the test by crunching the numbers to see if it holds up. And finally, sometime next week, we’ll tackle valuation, piecing together assumptions from the story and validating them with hard data.

Stay tuned—there’s plenty more to uncover, and you won’t want to miss it!

thanks for this one. looks interesting.