Meet Sarah, a young professional who’s been saving diligently. After hearing that “real estate is a safe investment,” she’s ready to take the plunge and buy a property. The idea of earning passive income and building wealth is enticing, but as she explores what it takes to become a real estate investor, she realizes it’s more involved than expected.

Sarah imagines finding the perfect property, securing financing, and using rental income to help pay down a mortgage, eventually becoming the proud owner of an investment property. But as she dives deeper, Sarah begins to wonder: “Is there a simpler way to invest in real estate?”

That’s when she stumbles across REITs—Real Estate Investment Trusts. Intrigued, Sarah wishes for a straightforward guide, and luckily, this article covers it all: what REITs are, how they compare to other investments, and the potential benefits and risks. Let’s unravel the world of REITs!

Qualifications of a REIT

The idea of a REIT (Real Estate Investment Trust) was born in 1960 with a simple but powerful purpose: to allow companies to pool funds from many investors to purchase and manage real estate portfolios. Think of it like a mutual fund—but instead of stocks or bonds, the investments are in commercial real estate. Here’s where it gets exciting for investors: a large part of REITs are publicly traded, so you can buy and sell shares just like you would with stocks, making them far more flexible than traditional real estate investments.

Now, a big draw of REITs is their tax advantage. By distributing dividends to shareholders, they can reduce their taxable income and often pay little to no corporate tax. But not every organization can just decide to become a REIT. There’s a set of criteria that a company must meet to earn this status. Here’s a quick look at some of the key requirements REITs must fulfill:

Must be a taxable corporation

Must be managed by a board of directors or trustees

Must invest at least 75% of assets in real estate, cash, or U.S. Treasuries

Must earn at least 75% of gross income from real estate-related sources like rent or interest on mortgages

Must pay out at least 90% of taxable income to shareholders as dividends

Must have at least 100 shareholders after the first year

Must ensure that no more than 50% of shares are held by five or fewer individuals

In short, REITs are built around three key purposes:

Investment in income-generating real estate – REITs are required to invest in properties that pay rent.

Dividend-focused returns – They’re a compelling choice for dividend investors since they must pay out most of their taxable income.

Diverse ownership – They’re structured to spread ownership among a large group of investors, avoiding concentration with just a few major shareholders.

Now that we’ve got a solid understanding of what REITs are and what they do, let’s dive into the different types of REITs out there and how they’ve performed over recent years.

Types of REITs and Performance

When it comes to REITs, there’s more variety than you might expect—both in how they operate and in their accessibility for everyday investors. Operationally, REITs generally fall into one of two main types: equity REITs and mortgage REITs. Equity REITs are the traditional type, investing directly in real estate and generating income primarily from rent. Mortgage REITs, on the other hand, finance real estate purchases by acting as mortgage lenders, earning income from the interest on loans. Although there’s also a hybrid model that combines both approaches, equity REITs remain the most common.

For retail investors, access to REITs can come through different channels. Publicly traded REITs are available on stock exchanges, making them easy to buy and sell but also more susceptible to market volatility. Non-traded public REITs aren’t on the stock market, but they can still be purchased through brokers or financial advisors. Then there are private REITs, typically reserved for institutional investors, which offer less liquidity and are out of reach for most individual investors.

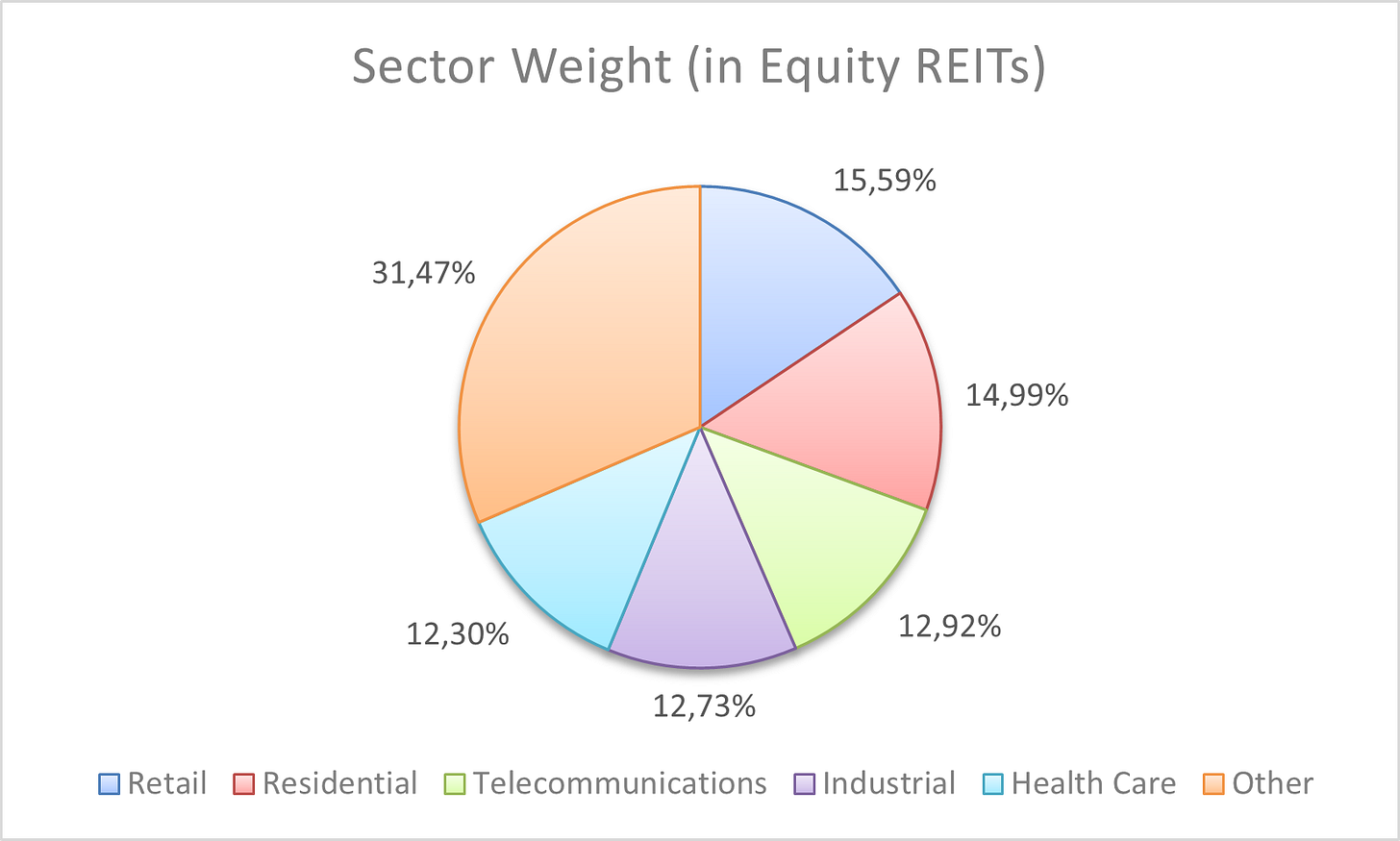

In the end, while REITs come in various structures, they all focus on real estate. The exciting part is that each REIT chooses specific sectors within the real estate world, meaning you, as an investor, can align your investment with sectors that resonate with you or meet your financial goals. For instance, you might find REITs dedicated to retail spaces like shopping centers, residential buildings like apartment complexes, or even telecommunications infrastructure like cell towers and fiber cables. Industrial REITs, which often own warehouses and distribution centers, have become increasingly important in the e-commerce era, helping to meet the high demand for rapid delivery. There are also health care REITs that invest in senior living facilities, hospitals, and medical offices. The piechart below offers an overview of the relative weight of these sectors in the REIT space:

Here’s the performance on REITs lately: they’ve shown some mixed but promising results, especially in a few standout sectors. REITs offer something unique—stability in sectors like health care and retail, along with high returns in areas tied to industrial demand.

Industrial REITs took the lead in 2023 with a 19.15% return, driven by the essential need for warehouses in e-commerce, though returns have cooled in 2024 as the sector stabilizes. Health Care REITs brought steady, recession-resistant growth, delivering a solid 13.94% last year and keeping strong at 7.77% so far in 2024. Meanwhile, Retail REITs adapted to changing consumer habits, with grocery-anchored centers helping to secure a 10.57% return in 2023, and they’re continuing steady performance this year.

Compared to VNQ, which tracks the general REIT market, these top performers have been driving better-than-average returns. And against the S&P 500? REITs, particularly in these robust sectors, bring attractive dividends and sector-specific growth, even if the broader market may offer stronger growth potential when conditions are ideal. However, historically speaking, they still lack performance against the S&P 500.

It’s clear that REITs offer a variety of possibilities and a variety of risk-return structures. So, what are now the actual benefits and risks of REITs?

Benefits and Challenges

Let’s start with some of the challenges that come with investing in REITs and how these compare to other assets. For one, REITs generally have lower growth rates. Since they rely heavily on rental income—over 75% by rule—their growth tends to match that of rental income, which rarely sees double-digit increases. This reliance on rent means capital gains for REITs are often lower than those for individual stocks, with REITs offering more value as a steady income source than a fast-growing investment.

Another major factor is interest rate risk. REITs, like much of the real estate world, depend on debt for financing. Rising interest rates make this debt more expensive, lowering the REIT’s overall value. I’ve experienced this firsthand—it’s a real risk that hits hard. While this can also impact highly leveraged stocks, it’s particularly relevant to REITs, where sector-specific sensitivity to interest rates is pronounced. There’s also the matter of management. REITs are actively managed funds, meaning you pay fees for professional oversight. You’re also handing over control; the manager decides what properties to buy, so if you’re someone who likes to call the shots, this lack of influence can feel limiting.

Finally, let’s talk about fraud risk, especially in private REITs. Public REITs are closely monitored by the SEC, but private REITs operate with less oversight, creating an environment where scams can occur. Some operators pose as legitimate REITs without meeting regulatory requirements, hoping to attract investors into fraudulent schemes. So, it’s essential to ensure any REIT you’re considering meets the necessary standards and regulatory oversight.

REITs certainly aren’t all risk—they bring some unique advantages that can really enhance a portfolio. For starters, they offer a highly liquid alternative to owning physical real estate. This liquidity means transaction fees are much lower than buying property outright, which is a major perk. Plus, there’s no hassle of property upkeep; you get rental income benefits without the burdens of maintenance costs or high transaction fees.

Another big plus is the fixed-income structure. While REITs aren’t likely to skyrocket in price, they offer a consistent cash flow through dividends. This steady income can add a reliable stream to your portfolio, blending nicely with more growth-oriented investments. For some, this balance of capital appreciation and income is ideal. For readers that are interested in how dividends can or cannot improve your portfolio, we give our view on dividends in this article.

Finally, there’s the valuable diversification REITs bring. Real estate as an asset class behaves differently from stocks, with a generally low correlation, which can help reduce overall portfolio risk. Real estate is also historically less volatile, making REITs a safer option with steadier returns, even if those returns are more modest. All in all, REITs can be a great way to gain real estate exposure without the heavy lifting.

Final Remarks

REITs certainly bring something different to the table compared to other assets or physical real estate, but like all investments, they have their limitations. It ultimately comes down to a personal choice—balancing the steady dividend income and lower risk that some find valuable against the slower capital gains that others might find limiting. As always, make sure to do your own research, weighing the pros and cons based on your own goals.

Thanks for reading, I’d like to leave you with the following motivating words:

“When one door closes, buy another one and open it yourself.”

References

Barwick, J. (2024, July 11). Mid-Year Report: Diversity of global real estate returns offers investment Opportunities. Nareit.

https://www.reit.com/news/blog/market-commentary/2024-midyear-reit-global-returns

https://www.globalpropertyresearch.com/gpr-250-index

https://www.reit.com/data-research/reit-market-data

Please note: This article includes a disclaimer regarding investment advice.