“I say you can always become a state. If you're a state, we won't have a deficit, we won't have to tariff you.”

- Donald Trump on tariffing Canada -

Take a moment and look around you. The chair you're sitting on, the phone in your hand, the clothes you're wearing—where do you think they were made? If you check the labels, you might be surprised. Perhaps your phone was assembled in China, your sneakers crafted in Vietnam, and your coffee beans harvested in Brazil.

Speaking of that coffee—go ahead and grab another sip, because what if, one day, it suddenly became significantly more expensive? Not because of bad weather or supply shortages, but because of a government policy. This is where tariffs come into play. By imposing taxes on imported goods, governments aim to protect domestic industries, encourage local production, and sometimes even influence international trade dynamics.

But are tariffs a smart economic tool, or do they do more harm than good? This article isn’t here to defend or criticize any political stance. Instead, we'll shed a nuanced light on the matter—exploring the foundations of tariffs, their intended purpose, and whether they truly make sense in an interconnected world like ours. So, grab another Brazilian coffee and let’s take a closer look.

The Sense of Tariffs

Imagine you’re an importer trying to bring in a batch of German cars or Chinese steel. Suddenly, the government slaps a hefty fee—let’s call it a tariff—on your shipment. That means your costs just went up, and importing these goods is no longer as attractive as it used to be. The goal? To make domestic alternatives look more appealing, encouraging consumers and businesses to buy local instead. In theory, this helps boost domestic production, create jobs in targeted industries, and even fill government coffers with fresh tariff revenue. Sounds like a win-win, right? Well, not so fast.

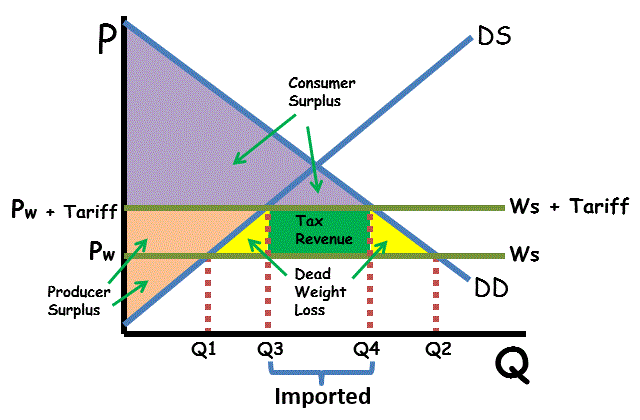

Take a look at this supply and demand graph under tariffs. Notice what happens: domestic production increases, foreign imports shrink, and prices rise. The government rakes in money from the higher import duties, but there’s also a downside—something economists call Deadweight Loss. This is the economic value that simply vanishes because higher prices and lower competition mean fewer goods are traded. Essentially, tariffs don’t just shift wealth around; they reduce overall efficiency in the economy.

For tariffs to make sense, they need to be imposed on industries that actually produce enough output to replace imports. Think of steel—if a country produces more steel than it consumes, tariffs might help strengthen the industry. But if domestic supply falls short, businesses relying on that steel will face rising costs, leading to price hikes, job losses, and, ironically, a weaker economy.

A perfect historical example? The Volkswagen tariff of the 1960s. Back then, the U.S. government slapped a hefty tariff on imported European cars, particularly targeting Volkswagen. Why? Because the American auto industry was already massive, and policymakers wanted to shield it from cheaper foreign competition. Since U.S. car manufacturers had the scale to meet domestic demand, the tariff made strategic sense—at least from a protectionist standpoint. But history is full of cases where tariffs backfired, hurting industries they were supposed to protect.

The Non-Sense of Tariffs

At first glance, tariffs might seem like a clever economic tool—protect local industries, boost jobs, and make foreign competitors think twice before undercutting domestic producers. But if you’ve been following along, you’ve already seen the flaws in this logic. From our earlier graph, two problems stand out immediately:

Prices go up—everywhere. Not just for imported goods, but for domestically produced ones too. With less competition, local producers can (and will) raise their prices. And guess who foots the bill? That’s right—the everyday consumer. Effectively, tariffs can become a wealth transfer from consumers to the government.

Deadweight loss—economic efficiency takes a hit. When trade slows and businesses have to adjust to higher costs, resources aren’t allocated efficiently, leading to a net loss for the economy.

But here’s the real kicker: tariffs used to make a lot more sense in a world where economies were more isolated. That world doesn’t exist anymore.

Globalization has changed everything. Faster communication, smoother logistics, and interdependent supply chains mean that a tariff on a single product often affects multiple industries. Products today aren’t simple commodities; they’re complex, multi-sourced creations. Slap a tariff on one component, and it ripples through entire sectors.

Labor costs aren’t as important as they used to be. In the past, tariffs helped protect industries by keeping domestic wages competitive. But in modern economies, wage differences are no longer the defining factor—automation, technology, and global specialization are.

Corporations have become experts at playing the game. Big companies don’t just accept tariffs—they work around them. A product that would’ve been imported whole is now shipped in parts, assembled domestically, and voilà—no tariff! Others repackage goods in tariff-free countries and reroute them to avoid extra costs. The biggest businesses barely feel the impact, while smaller ones (and consumers) bear the brunt of it.

And then there’s the most reckless idea of all: tariffs on everything. This approach is like a dentist using a power drill to fix a cavity—sure, the hole is gone, but so is most of your tooth. Instead of precision, it’s brute force, leaving behind more damage than the problem it was meant to solve. A targeted, strategic approach would be far more effective.

At the end of the day, tariffs often seem to be more of a political weapon than an economic tool these days. They’re used as bargaining chips in international relations, often provoking retaliation from other nations. A trade war can quickly spiral out of control, impacting economies worldwide.

If tariffs are to be implemented, they need to be done gradually and strategically—not thrown into action overnight. Sudden, sweeping tariffs leave companies scrambling, unable to adapt in time, creating more economic chaos than stability.

So, while tariffs might sound good in theory, in today’s global economy, they often cause more harm than good. The question isn’t just "Do tariffs work?"—it’s "At what cost?". As always, there isn't just one straight answer, but rather a trade-off that has to be considered.

A Good Tariff Sheriff

So, if tariffs aren’t always the economic villain, how should they be used? Or better yet, how does a good tariff sheriff wield them wisely? The key is precision. A well-placed tariff should target industries with high domestic output—think raw materials or strategically important sectors where dependence on foreign supply could be risky. And if governments really want to soften the blow on consumers, they could offset the extra costs by lowering other taxes, like income tax, to balance the redistribution of wealth.

But let’s be clear—there’s no one-size-fits-all approach. Every tariff should be investigated on a case-by-case basis. Studies have shown that in the short run, negative effects (higher prices, ripple effects on complementary goods) tend to outweigh the positives. But in the long run, if implemented wisely, tariffs could boost domestic production and strengthen the labor market. That’s a big if, though—it all depends on understanding the globalized nature of today’s economy.

Used correctly, tariffs can be a powerful tool. But as a certain web-slinging superhero’s uncle once said: With great power comes great responsibility. A reckless tariff policy can backfire, hurting consumers and industries alike. A strategic one? Well, that’s a different story.

That’s it for today, but hopefully we’ll see you back this Sunday as we continue our top-down analysis, narrowing down the final sector for our deep-dive. Stay tuned!

📌 Stay tuned for Sunday’s top-down analysis! We’ll be wrapping up our recent deep dives and selecting the final sector for a deep dive. Which industry stands out in today’s economic landscape? Find out soon!

🔔 Want sharper economic insights? Subscribe for updates and get exclusive analysis on trade policies, market trends, and the real impact of government interventions on your wallet.

💬 What’s your take on tariffs? Smart economic strategy or outdated policy tool? Drop a comment below—let’s debate! 🚀