Not too long ago, my co-author shared a fantastic piece on how bonds can be a powerful tool for reaching short-term financial goals. Inspired by his girlfriend, he mapped out the different types of bonds available and highlighted which ones might appeal to various kinds of investors. I was impressed by how clearly he laid out the information, making a topic like bonds feel approachable and easy to digest. It even sparked the idea for me to dive a bit deeper and tackle a more technical angle.

As the "numbers person" here at DualEdge Invest, I’m naturally drawn to the quantitative side of things, which is exactly what this article is all about! I’ll be exploring how bonds are priced and what factors play into this pricing. By getting a grasp on this, you'll gain a better understanding of one of the core aspects of bonds: the yield. Plus, this knowledge lays a great foundation for more advanced valuation topics, which we’re excited to cover in future articles.

Writing about technical topics while keeping it engaging can be tricky, especially as I’m still honing my style as a writer. So, I’d really appreciate any feedback! Let me know your thoughts in the comments—your input helps us create better content for you. Thanks for being part of this journey!

The Basic Components

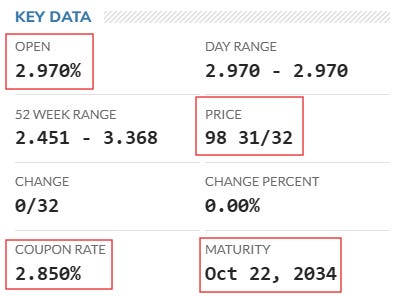

To bring this theory to life, let’s dive into a practical example. Here’s a look at a real bond quote for a Belgian 10-Year bond1 (and since we’re based in Belgium, it’s right at home for us!):

Here’s what you need to know about this bond:

Current Yield (= Open) = 2,97%

Price = 98,97 EUR

Coupon = 2,85 EUR

Maturity = 10 years (use the Excel function YEARFRAC)

So, what does all this mean? Let’s break it down:

The price of the bond—€98.97 here—is what you’d pay to buy it today. Typically, bond prices are shown as a percentage of the bond’s face value, which in this case is 100.

The coupon represents the annual payment you get for holding the bond, essentially your reward for taking on the risk that the issuer (a company or government) might default. Generally, the greater the risk of default, the higher the coupon as compensation.

Then there’s the maturity—the point when the bond “expires” and the face value is paid back. Maturity is crucial because it factors in the time value of money. As the bond gets closer to its maturity date, its price tends to move toward its face value.

Lastly, we have the current yield of 2.97%, which shows the annual return based on today’s price. However, when we talk about a bond’s “Yield,” we often mean the Yield to Maturity (YTM)—the return you’d get if you held the bond until its maturity. YTM includes all future coupon payments and the face value repayment on the maturity date.

Now that we have discussed the key aspects of the bond itself, it is time to dive into the valuation. Let’s find out how bonds are exactly priced!

Bond Yields

Our loyal readers know this by heart, but there's one line that truly captures the essence of valuation:

“The value of an asset is equal to the sum of the future cash flows, discounted back to today.”

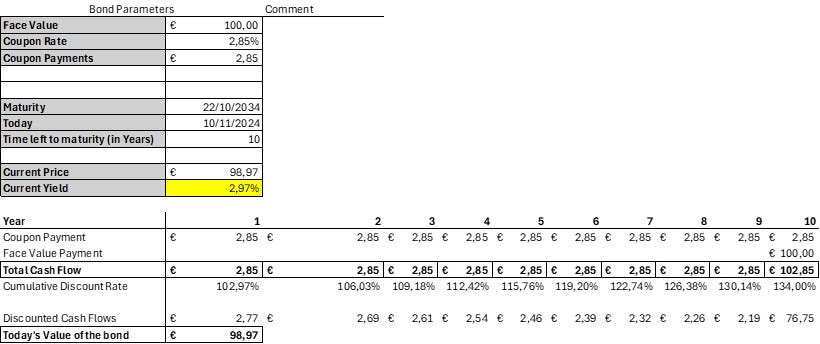

What this means is that to value any asset, we need to know two things: (1) the future cash flows and (2) the discount rate. For our bond example, we’ve got the future cash flows locked in: each year for the next 10 years, we’ll receive a coupon payment of €2.85, and at the end of that period, the bond matures, and we’ll get back the face value of €100.

The discount rate, or the required return for the investor, is based on the current yield to maturity (YTM). If we know the bond’s price, we can determine its YTM—and vice versa. This YTM isn’t random; it depends on a few key factors: the risk-free rate, the bond’s credit risk, the time to maturity, and other elements like the bond’s liquidity. The calculations below show in practice how this YTM determines the price of a bond:

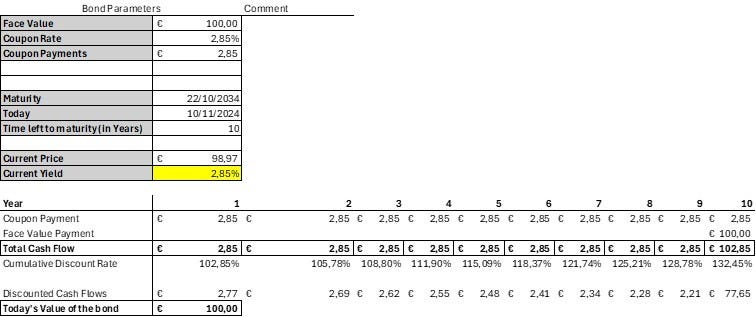

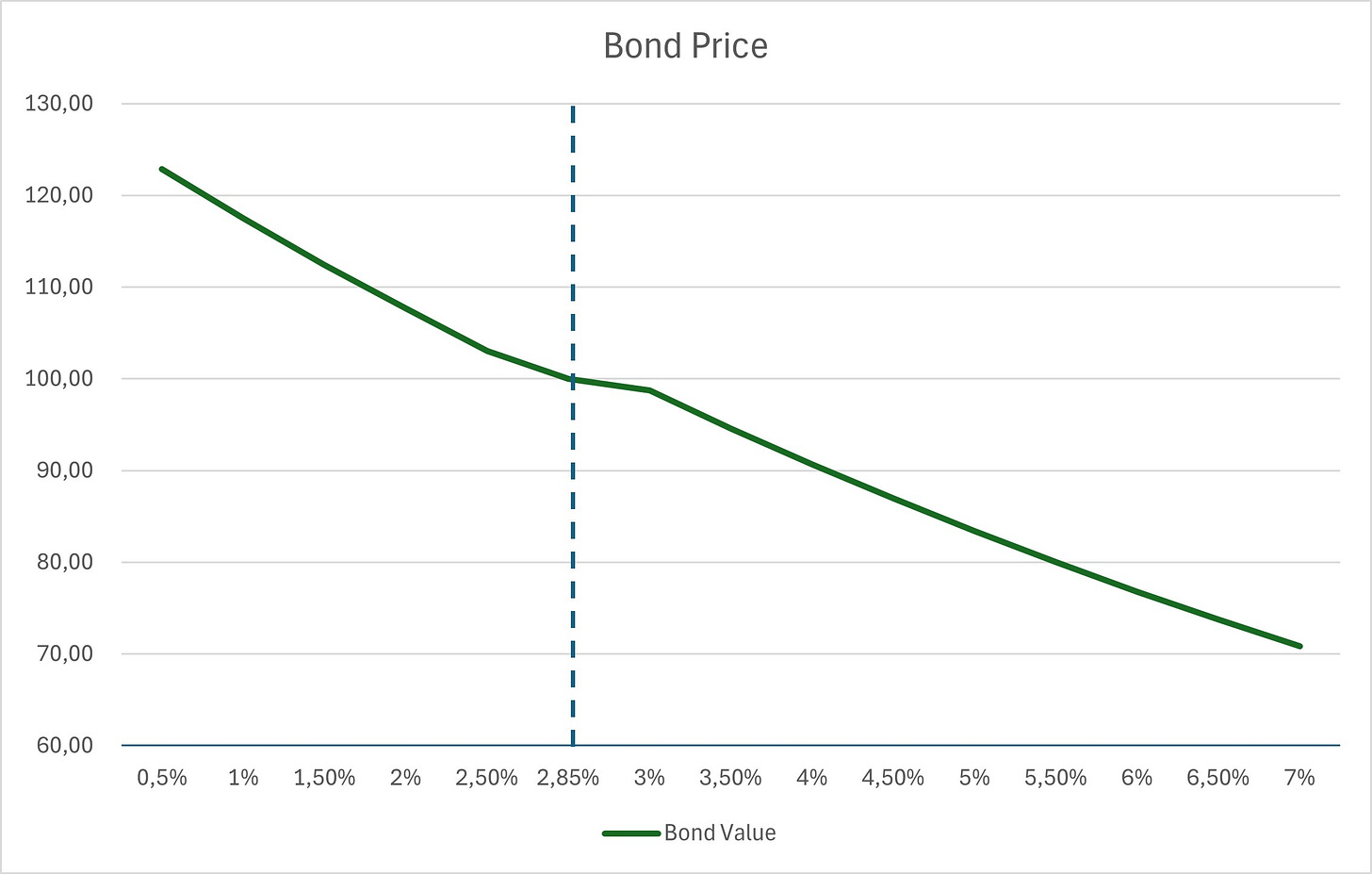

The connection between bond prices and Yield-to-Maturity (YTM) leads to some fascinating insights. When the YTM matches the bond's coupon rate, the bond’s value will equal its face value. In other words, the return investors are expecting aligns perfectly with the bond’s offered return. This can be seen in the calculations below:

Now, what happens if the YTM rises above the coupon rate? In that case, the bond’s price will fall below its face value. For example, if the risk-free interest rate rises, the YTM goes up too. This means that existing bonds, which now offer a lower return compared to new bonds, become less attractive. To compensate, their prices drop. This is a classic case of supply and demand in action: when a bond’s required return is higher than its current return, demand falls, driving prices down until they reach a new balance.

The reverse is also true. If the required return drops, maybe due to a decrease in the risk-free rate, bonds with higher returns become more appealing. Demand for these bonds increases, pushing their prices up.

This dynamic between YTM and bond price is illustrated in the graph below:

As you can see, valuing bonds is often simpler than valuing stocks because there’s no guesswork involved in the cash flows—they’re predetermined. This makes calculating bond prices a more straightforward process, with fewer assumptions and more certainty in the math.

Final Remarks

We’ve covered a lot of ground here! From the key variables of a bond to the relationship between Yield-to-Maturity (YTM) and bond prices, we’ve broken down some essential concepts. The goal of this article was to give you a solid foundation in how bond prices respond to shifts in interest rates—a crucial part of understanding bonds.

Bonds are a cornerstone of today’s financial world, built on a straightforward agreement between two parties. Personally, I believe that having a basic understanding of bonds is invaluable for anyone navigating today’s financial landscape. With this knowledge, you’re better equipped to interpret how bonds fit into the bigger picture of investing and finance.

References

https://www.marketwatch.com/investing/bond/tmbmkbe-10y?countrycode=bx

Please note: This article includes a disclaimer regarding investment advice.