Normally, today would have been the grand finale of our Amazon deep dive series — the piece we’ve been itching to deliver because, frankly, it’s a juicy one. To everyone eagerly waiting — sorry, you’ll have to hang tight until next Sunday.

No, I wasn’t lazy this weekend (well, no lazier than usual). But something happened this week that hijacked my attention.

Back in March, I did a deep-dive analysis on Aris Water Solutions. Aris manages the salty wastewater produced by oil and gas operations in the Permian, recycling and disposing of it to reduce environmental impact. In short, Aris is a small but essential cog in the U.S. energy machine.

We really went deep: we looked at the macroeconomic forces shaping Aris, their strengths and weaknesses, the investor risks, and we even ran a forensic-level check on their financials — the kind of audit that would make the Big Four accountants spit out their coffee. (Okay, okay, we’re exaggerating, but you get the point.)

So, what was the conclusion of all that work?

Aris is a high-quality company actively addressing its weaknesses, and those efforts seem to be paying off.

But we didn’t buy.

Now, before you start roasting us as fools, let me explain.

The reason we didn’t pull the trigger on Aris mostly came down to the final chapter of our deep dive: the valuation.

That’s where we hit some sticking points. First, valuing Aris is a pain in the ass because it’s nearly impossible to estimate their reinvestment rate with any confidence.

Second, we found the stock richly priced, which meant the risks we identified weren’t compensated by an attractive entry point. The risk-return profile just wasn’t optimal for us.

And then — something happened:

Aris stock plummeted 20% after their Q1 release. You can imagine how relieved we were that we hadn’t recommended Aris to our readers (and, of course, that we hadn’t loaded up on the stock ourselves).

That’s why today, instead of an Amazon deep dive, we’re bringing you an update on Aris. Because maybe this is an overreaction — or worse, maybe it’s an underreaction, and even uglier things are coming.

So, we’re diving into what’s going on with those Q1 numbers and whether this is just panic over noise or a sign of a fundamental shift in the business.

So, what’s going on?

Aris actually posted solid Q1 numbers — revenue hit $120.5 million, up 16% year-on-year, and adjusted EBITDA climbed 6% to $56.5 million. Sure, net income slipped 5%, but on the surface, these are the kinds of results that normally keep investors smiling. So why the sell-off?

The real trigger wasn’t past performance, but the outlook: management warned that Q2 EBITDA will likely dip due to postponed maintenance and weaker skim oil prices — something we had flagged cautiously as a risk back in our original research. CEO Amanda Brock pointed to record volumes in both the segments Produced Water Handling and Water Solutions, with strong operational margins at $0.44 per barrel. But she acknowledged part of that margin strength came from deferred costs, giving Q1 a temporary $2 million lift.

Looking ahead, Brock highlighted that Aris’s long-term contracts and top-tier customers like Chevron and ConocoPhillips provide resilience, even if the oil market gets choppy. CFO Steven Thompson chimed in with reassurance that the company can scale back capex by 25–30% if needed, showing they have levers to pull when the market shifts.

In short: operationally, Aris is flexing, but the market isn’t reacting to today’s muscle — it’s worrying about tomorrow’s bruises.

Which brings us to the next big question: what kind of growth is the market now pricing into Aris? After this sharp sell-off, we need to unpack what expectations are baked into the current valuation — because as every investor knows, it’s not the past that matters, but the future the market sees (or fears). Let’s roll up our sleeves and look at what assumptions the stock price is quietly whispering.

What Does Mr. Market Expect?

To get a grip on the market’s current expectations, we ran a Free Cash Flow to Firm (FCFF) valuation in reverse — essentially asking:

How fast does Aris need to grow over the next decade to justify today’s price?

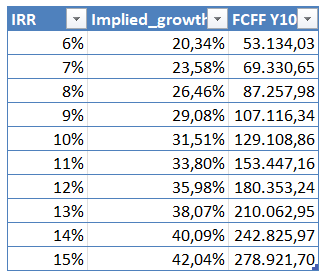

This gives us the so-called implied growth rate for the next 10 years. We anchored our assumptions with a conservative terminal value — a perpetual growth of just 2%. Then, we varied the required return from 6% up to 15%, to reflect different investor risk appetites and opportunity costs.

Here’s what the market seems to be pricing in at each of those thresholds:

At first glance, those growth expectations seem steep. But let’s not forget: Aris ran a very high reinvestment rate last year. Management has already hinted at a pivot — shifting focus from pure growth to shareholder value. Translation? Lower capex, more free cash flow, without needing the business to operate any better.

Let’s put some numbers behind that:

In 2024, Aris generated $8.5 million in free cash flow — not exactly thrilling. But that number came after a whopping $154 million in capex. For 2025, capex is expected to drop to around $100 million. If Aris simply repeats its 2024 operating performance — even with slightly lower margins (which should be more than offset by revenue growth) — FCFF could jump to roughly $54 million. That’s already more than what’s required in year 10 to justify a 6% return.

Which brings us to the million-dollar question:

Is this new share price warranted — or has the market overreacted (again)?

To answer that, we’ll wrap it all up: what we think, where we still have doubts, and what we’re watching next.

Closing Remarks

Let’s start with that dip in skim oil prices — something we had flagged as a potential risk, though it may have shown up earlier (and sharper) than expected. Still, we’re not shaken. Our overall view on Aris hasn’t changed.

What has become even clearer is just how strong 2024 was for Aris — especially on margins. Now that the macro winds are blowing a bit colder, we’re seeing some pressure there. High maintenance costs will always eat up a good chunk of revenue, and that’s unlikely to change. So yes, near-term margin expansion feels like a stretch. But hey, we’re not here to play fortune teller — just to point out that our original macro concerns weren’t misplaced.

On revenue, though? We’re more optimistic. Our initial research showed that lower oil prices don’t necessarily mean lower volumes in the Permian Basin. And ConocoPhillips — Aris’s largest customer — just gave us more reason to believe that trend holds up.

Now, about valuation — let’s keep it simple. The implied growth rates the market’s pricing in look steep, but that’s largely because of Aris’s sky-high reinvestment rate in 2024. So the smarter question is:

👉 What return do you want — and can Aris deliver the FCFF needed to get there within 10 years?

For me? Still not a buy. But I’m also the guy who wants equity returns that make private equity blush. So, you know… grain of salt.

Oh — and one more thing: we’re working on something big. In a couple of days, we’ll be dropping a full Aris report. Not a quick update, not a blog-length opinion piece — the whole thing. All our research, analysis, models, and behavioral takes wrapped into one beast of a breakdown. If you’ve been following our Aris journey, or even just trying to figure out whether this stock deserves a spot on your radar — you’ll want to read it. Trust us, it’s going to be worth your time (and your coffee).

📢 Is Aris a buy for you?? Drop a comment — we’d love to hear your take.

🔔 Subscribe so you don’t miss next week’s deep dive into Amazon. It’s coming, we promise.

Our Recent Posts:

Oh, Deere — Are Investors Facing a Bumpy Ride?

Welcome back to — yes, already — Part III of our Deere & Co deep-dive.

The Way Forward For Amazon

Today, we’ve arrived at the final part of our Qualitative research on Amazon. Normally, this is the point where I’d dig back into the numbers—running a fresh check on the balance sheet and income statement before moving forward.

The Hidden Cost In Dollar-Cost Averaging

Last week, we (and by “we,” I mostly mean my sharp co-author Milan) published a piece on why “buying the dip” isn’t always the sacred mantra it’s made out to be. There are, after all, different flavors of being contrarian — that is, going against the crowd — and each flavor has its own unique implications for how you behave in the market.

Great breakdown. A good reminder that even strong fundamentals can get overshadowed by uncertainty about the outlook. Looking forward to your full report!