Last week, we unpacked the backstories of Equinix and Digital Realty Trust: our two data center REITs caught in the analytical spotlight. But every good story needs a strong ending, and in finance, that means valuation. We’ve got the narrative, but does the math back it up?

These two giants may operate in the same space, but they come with very different vibes when it comes to risk and stability. So, naturally, we’re curious: do those differences show up when we run the numbers?

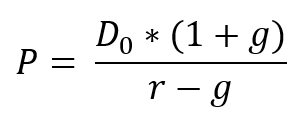

After wrestling with various methods - and the accompying frustration, I finally landed on the trusty Dividend Discount Model (DDM) - credit to my co-author for the advice. Makes sense, right? If you’re eyeing REITs for their sweet, sweet dividends, then a dividend-focused valuation model is the way to go.

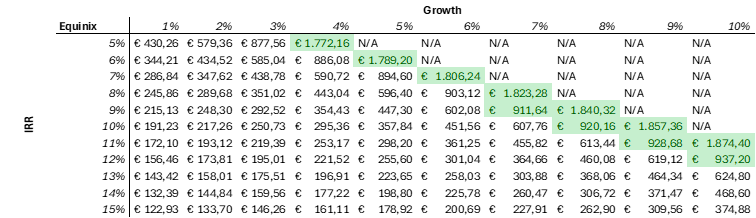

Now, DDM isn’t rocket science. In fact, it only asks you to guess two things: the internal rate of return (IRR) and the perpetual growth rate of the dividend. Easy enough... in theory. Instead of locking in on one “best guess,” I built a whole matrix of possibilities. Sounds fancy, but it’s basically plugging in a bunch of growth and return combos to see what values pop out. Throw in a bit of color coding, and boom - you can easily spot when those dividends start looking juicy compared to the stock price.

To avoid too much assumptions, I also reverse-engineered what the market might be pricing in. In one scenario, I assumed a 10% IRR to figure out the implied growth. In the other, I locked in a modest 2.5% growth rate—roughly matching inflation—and solved for the IRR. Nerdy? Maybe. Useful? Definitely.

But enough theory. Let’s roll up our sleeves and dig into the valuations. The goal here isn’t for you to just nod along—we want you to challenge the assumptions, play with the numbers, and make your own call.

So grab a steaming hot coffee , and let’s get into it!

Equinix

When looking at the DDM Matrix of Equinix, it’s clear that the IRR and the growth only differ with 1 percentage point to be worthwile, up until the growth reaches 7%. From that point on, the difference can be 2 percentage points as well, although the margin becomes very small in those cases. At an IRR of 10% - my go-to IRR when looking at investments - the perpetual growth has to be at least 8% to be worthwile. Achievable? I don’t think so. 8% perpetually is about 4 times expected long-term inflation, implying that this dividend will grow bigger than the US GDP at one point… Not exactly realistic.

This also comes back in the market-implied rates. For an IRR of 10%, the market-implied growth is a whopping 7,97% - very close to the 8% previously mentioned. On the other hand, when the growth is only 2,5% - closer to inflation - the implied expected return for investors is about 4,53%. For comparison, the US 10-year yield at moment of writing is 4,47%. This comparison shows that an investment in this REIT at the current price would yield more or less as much as a risk-free - or at least that’s what it’s supposed to be - investment in US bonds. Personally, I’m looking for assets with a little more potential, even if it means taking on more risk.

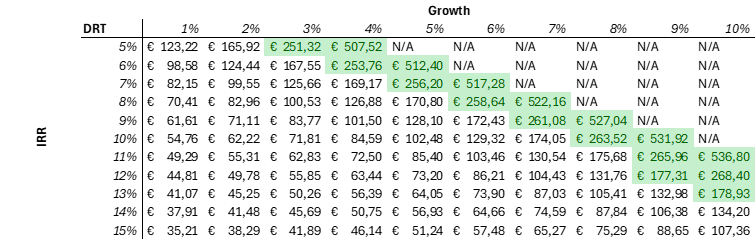

Digital Realty Trust

When looking at the DDM Matrix for Digital Realty Trust (DRT), a different picture emerges compared to Equinix. Here, the relationship between IRR and growth seems a bit more forgiving. For most of the matrix, a 2 percentage point spread between growth and IRR still results in attractive valuations. For example, with a 6% growth rate, valuations remain interesting even up to an IRR of 8%, with the estimated value hovering around €258,64. For a growth of 10%, the implied IRR is even 13%. A much more reasonable expectation than what we saw with Equinix.

However, the dynamics for more realistic numbers remains more or less the same. At a 10% IRR—the same benchmark we used before—the implied perpetual growth rate also needs to be around 8% to justify the current market price. Still pretty aggressive.

Looking at the market-implied numbers tells a similar story. If we assume a 10% return requirement, the market seems to be pricing in a growth rate of about 7,05% - slight lower than for Equinix. Alternatively, if we anchor growth at 2.5%, the implied IRR is roughly 5,46% - slightly higher than Equinix and therfore also the US 10-year yield. Once again, we’re facing the dilemma: do you want to take on REIT risk for a return slightly over that of bonds?

It’s clear that DRT is the more palatable of the two from a valuation standpoint—still not screaming cheap, but at least the market expectations are a little more realistic. Would I personally invest in either one at current market prices? Probably not. However, as said before, the choice should be yours. If you’re looking for a lower-risk, but lower-return investment, one of these REITs could offer exactly that. Do your own due diligence, form your own opinion on whether the risk justifies the return, and make an informed decision.

These valuations, however, do not mean that these REITs are completely written off. As mentioned, these are dependend upon the current market price. A drop of 10% - 20% in a volatile market, and it’s a completely different story. For now, these implied rates seem a bit overinflated to me, but I’ll keep an eye on how price evolves, and maybe who knows?

Closing Remarks

So, what’s the final verdict after diving deep into both Equinix and Digital Realty Trust?

The data center sector remains incredibly compelling—its long-term growth potential is hard to deny. With cloud services, AI, and data consumption only accelerating, the structural tailwinds are firmly in place. But promising narratives don’t always make for great investments, especially when the market has already priced in a rosy future.

Take Equinix, for example. At a 10% required return, the market-implied perpetual dividend growth is an eye-popping 7.97%. Flip that around and use a more conservative 2.5% growth rate, and the market-implied IRR shrinks to 4.53%—barely above the current US 10-year Treasury yield of 4.47%. That’s not exactly a screaming bargain for something carrying real estate and business model risk.

Digital Realty Trust looks slightly better. With the same 10% return target, the market is implying a 7.05% growth rate—still lofty, but more grounded than Equinix. And if we hold growth at 2.5%, the implied IRR clocks in at 5.46%. That’s at least a bit of a premium over government bonds, though not by much. The valuations suggest DRT is more reasonable—but still not quite in bargain territory.

In short: now isn’t the time. The market has priced in much of the sector’s potential—too much, in fact. That doesn’t mean these REITs aren’t worth watching. A meaningful correction of 10–20% in market prices could completely change the picture and open the door to attractive, risk-adjusted opportunities. But at current levels, the risk-reward just isn’t there—at least, not for investors seeking compelling upside.

So for now, I’m staying on the sidelines—but keeping them on the watchlist. Because in investing, getting a lot of value at a low price is everything.

Appendix

DDM Formula

DDM Valuation

📢 What’s your take on these valuations? Agree, disagree, or see something we missed? Drop your thoughts in the comments!

🔔 Like deep dives like this? Hit subscribe so you don’t miss the next - and probably last free - one!

Please note: This article includes a disclaimer regarding investment advice.

Our Recent Posts

In DRT We Trust

Last week, we had to shift our plans a little bit. Instead of screening for viable companies and picking one to fully analyze, I opted for two deep-dives. One on Equinix and one on Digital Realty Trust (DRT), two giants in the world of data centers.