“Asking companies to bear the burden of being society’s conscience is not only unfair, but it tilts the playing field in favor of the least socially conscious investors and companies.”

A. Damodaran

E-S-G.

Just three letters, but together, they carry a weight that’s shaking up boardrooms and sparking joy for activists. ESG stands for Environmental, Social, and Governance—a way of doing business ethically, with a positive impact on people and the planet. It’s an ideal that sounds simple, but putting it into practice? That’s a whole different story.

Over the past decade, ESG has soared in popularity, keeping pace with globalization and a growing awareness of environmental issues. According to Investopedia, ESG investing is about screening investments based on a company’s values and, even more, pushing those companies to act responsibly. Sounds straightforward, right? Good corporate behavior equals more value. But, as it turns out, it’s not quite that simple.

Here’s what makes ESG so interesting: it’s still a relatively new concept. So while we have insights from recent research, the full impact of these policies will take decades to unfold. Rather than try to sway you to one side or the other, I’m here to lay out what we know so far and the different perspectives emerging from the research.

In the end, you—the obviously brilliant reader—can decide where you stand. Sound fair? Perfect. Let’s dive in and take a closer look beneath the surface!

Setting The Scene

ESG sounds simple enough, right? Just look at a company’s Environmental, Social, and Governance aspects. But here’s the catch: with new concepts like this, everyone seems to have their own spin on what they actually mean. In fact, as Cornell and Damodaran point out, back in 2018, there were over 600 (!) different measures of ESG in use by various rating firms. And even if they used the same criteria, they rarely measured them in the same way. So, right off the bat, we hit a big challenge—how do we even define and measure ESG consistently?

For now, the most trusted ESG criteria come from the larger rating firms, which work similarly to credit rating agencies. These firms have dedicated teams who analyze the ESG risks of companies in detail. But let’s be real, they still have their own proprietary methods, which means there’s room for improvement. Take the MSCI ESG ratings, for example—they’re widely used and feature in research like that by Giese et al., yet they’re just one approach among many.

Now, onto value. Fortunately, this one’s been around a lot longer, and we have a solid framework to work with. As we covered in a previous article, value can be summed up in one (admittedly long) sentence: the value of an asset is the sum of its cash flows, discounted back to today. Say this at a finance gathering, and you’re bound to impress. Essentially, this means value has two core components: (1) the future cash flows it can generate, and (2) a discount rate, which reflects the asset’s risk.

Bridging the Gap: How ESG Connects to Value

Alright, we’ve nailed down what ESG and value mean. Now, let’s get into the connection between the two—how exactly does ESG impact value? This link comes from what are called transmission mechanisms. For ESG, there are three of these pathways, though two are the big players when it comes to directly influencing value.

First up, we have the one with an immediate impact on cash flow, fittingly named—the cash flow transmission channel. Imagine it like this:

Here’s how it works: people tend to like high ESG-rated companies (or as we’ll call them, nice companies). They trust and prefer these companies, so they’re more likely to buy from them. That bumps up revenue right away. On the cost side, it’s a bit of a mixed bag. Initially, these nice companies may see a temporary spike in expenses as they work to meet ESG standards. But down the line, they gain pricing power and see a drop in penalties, fees, and regulatory costs. All this means their profit margins tend to stay strong—or even improve—making them more profitable in the long run.

Now let’s talk about the other transmission channels that link ESG and value. Each one impacts a different piece of the value puzzle, starting with the second channel, which focuses on risk. This one’s called the Valuation Channel, and it works on the discount rate of an asset—the lower the risk, the lower the discount rate. Picture it like this:

Here’s the logic: investors feel confident investing in these “nice” companies (our ESG-friendly companies), which lowers the cost of equity. Lenders are also more comfortable lending to these companies, which drives down the cost of debt. Together, these effects reduce the company’s systematic risk, which ultimately decreases the cost of capital—essentially the discount rate.

I mentioned three transmission channels, right? We’ve covered the two that directly impact value, so let’s look at the third one. This one, called the Idiosyncratic - a fancy word for company-specific - Risk Channel, has a more indirect link to value but is still crucial. At its core, it’s all about reputational risk. Companies involved in high-profile scandals—like major environmental accidents or fraud—face a “tail-risk.” This is a low-probability event, but if it happens, the fallout can seriously hurt stock prices.

Visualize it like this:

The idea here is that nice companies, with strong governance (that “G” in ESG), manage risk better, which lowers their chances of encountering these catastrophic tail events. In the end, this makes them safer and more reliable investments.

Do Nice Companies Finish Last?

When it comes to whether nice companies are actually more valuable, we’re looking at three possible scenarios:

Nice Companies Win: Good behavior pays off, and ESG creates value.

Bad Companies Lose: Poor behavior gets punished, meaning a lack of ESG destroys value.

Nice Companies Finish Last: Bad companies come out on top, showing that a lack of ESG actually creates value.

In the first two scenarios, ESG compliance works as you’d hope: companies with high ESG scores are rewarded, while those without it face consequences. But in the third scenario, things get interesting. Here, nice companies work to meet ESG standards but get no market reward. Instead, consumers gravitate toward bad companies' products because they’re cheaper or more convenient, driving up their sales and profit margins. Bad companies sidestep the costs of ESG, giving them an advantage. Investors and lenders see those strong earnings and cash flows, which lowers their cost of capital and boosts their value relative to nice companies.

So what does the data say? Well, it’s mixed. According to Giese et al. (2019), who used MSCI ESG criteria in their research, nice companies do, in fact, benefit from higher value. They argue that ESG compliance positively impacts all three transmission channels: higher profitability, lower risk, and fewer severe incidents. That’s a pretty compelling case for the first scenario if you ask me.

On the other hand, Cornell and Damodaran (2020) suggest that the second scenario, which they call the “punitive scenario,” is more realistic. They found that companies facing severe incidents see a significant drop in value, mostly through the idiosyncratic risk channel. Interestingly, the market drop in value closely matches the cost of fines, which implies the market may only penalize actual costs, not reputational damage.

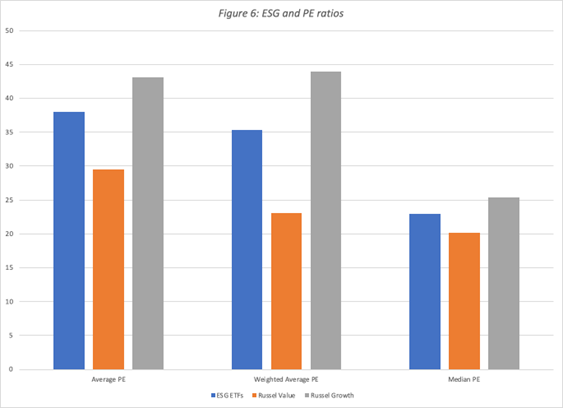

Cornell and Damodaran also explored how ESG influences stock pricing, not just intrinsic value. If ESG really added value, you’d expect to see it reflected in stock prices for these nice companies, right? Well, it doesn’t quite work out that way, as shown in the graph below:

From this, it’s clear that nice companies’ P/E ratios fall somewhere between those of growth and value companies, both on average and in terms of median.

Cornell and Damodaran make one final point: nice companies could produce excess returns in a certain transitional period before settling into lower returns. The idea is that as investors recognize their higher value, they buy in, driving up prices. Eventually, as prices stabilize at a higher level, expected returns dip—but so does risk. Yet, as things stand, these companies’ prices are still sitting between those of growth and value stocks. This leaves us with two possible interpretations:

Investors are rational and believe nice companies don’t offer extra value.

The most probable scenario: investors are short-sighted, overlooking the long-term gains of ESG. Note that this discourages managers from prioritizing ESG since their incentives are tied to short-term performance.

In the end, we can’t be certain which scenario will take the lead. With so many factors in the mix, predicting the outcome is a challenge. But for now, I’ll let the next section offer some final thoughts, leaving you to form your own conclusions.

Final Remarks

In this article, we’ve covered a lot of ground—defining ESG, exploring its connection to value, and debating whether it actually creates value. And while we’d all love a clear-cut answer, it’s just not that simple. One thing I hope stands out is that companies don’t operate in isolation. They exist within a web of other stakeholders—customers, legal systems, and other businesses—all influencing and being influenced by each other. In the end, the direction society takes plays a huge role.

For companies to "be nice" and still survive, they have to pass some of these costs onto consumers. If customers aren’t willing to bear that cost, preferring cheap and convenient options, then companies might not be able to keep up with ESG standards—they simply won’t make it. That brings us closer to the scenario where “nice companies finish last.”

And let’s not forget the role of policymakers. It’s not solely up to companies to be the moral compass of society, especially when doing so could harm their viability. Instead, it’s up to elected officials to guide society in this direction, creating a landscape where responsible business practices aren’t just admirable—they’re achievable and sustainable.

So, to answer the big question—do nice companies really finish last? I decided to call in a bit of backup from my trusty friend, ChatGPT, and honestly, I couldn’t have said it better: “In the end, markets are evolving, and as ESG continues to gain traction, we may see nice companies not just catching up, but setting the standard for what it means to finish first.”

References

Cornell, B., & Damodaran, A. (2020). Valuing ESG: Doing good or sounding good? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3557432

Gawęda, A. (2022). ESG rating and market valuation of the firm: Sector approach. European Journal of Sustainable Development, 11(4), 91–104. https://doi.org/10.14207/ejsd.2022.v11n4p91

Giese, G., Lee, L., Melas, D., Nagy, Z., & Nishikawa, L. (2019). Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. The Journal of Portfolio Management, 45(5), 69–83. https://doi.org/10.3905/jpm.2019.45.5.069

Investopedia. (2024, July 30). What Is ESG Investing? https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp

KPMG Limited. (2022). ESG in business valuations. ESG in Valuations Newsletter, KPMG Cyprus.

Please note: This article includes a disclaimer regarding investment advice.