Are Small Caps the Ultimate Contrarian Bet?

Index investors are ignoring them, but history says you shouldn’t.

For quite some time now, I've been hearing the same message here in Belgium: "Now is the time to invest in small caps." It’s a phrase that keeps coming up in investment circles, financial discussions, and even casual conversations among investors. But as any seasoned investor knows, hype alone isn’t a reason to jump in. So, I decided to dig deeper.

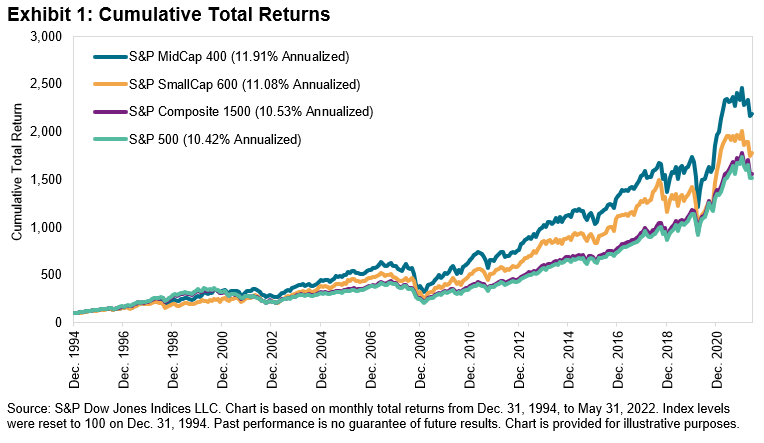

Quite some research shows that small-cap stocks tend to outperform their larger counterparts over the long term, delivering higher returns than large caps. (See Graph I for reference.) Of course, this claim needs nuance, and we’ll get into that further in this article. But seeing the data laid out so clearly was enough to pique my interest.

Given that we’ve just wrapped up our top-down analysis and are in the midst of our research into the standout from that process—Aris Water Solutions—it seemed like the perfect time to take a detour and investigate small caps in more detail.

In this article, we’ll first examine the strengths and weaknesses of small caps, identifying the key factors that influence their performance. We’ll then explore the crucial considerations for investing in them, before finally comparing their valuation and pricing relative to large caps.

Why you should invest

Okay, let’s dive into the thesis on why investing in small caps can be attractive beyond just valuation comparisons with large caps.

First, small caps offer strong diversification benefits, especially for investors who primarily allocate funds to ETFs. This is because small-cap stocks are often underrepresented—or even completely absent—in major indices like the Nasdaq and the S&P 500.

Investing in them also helps achieve a broader sectoral spread.

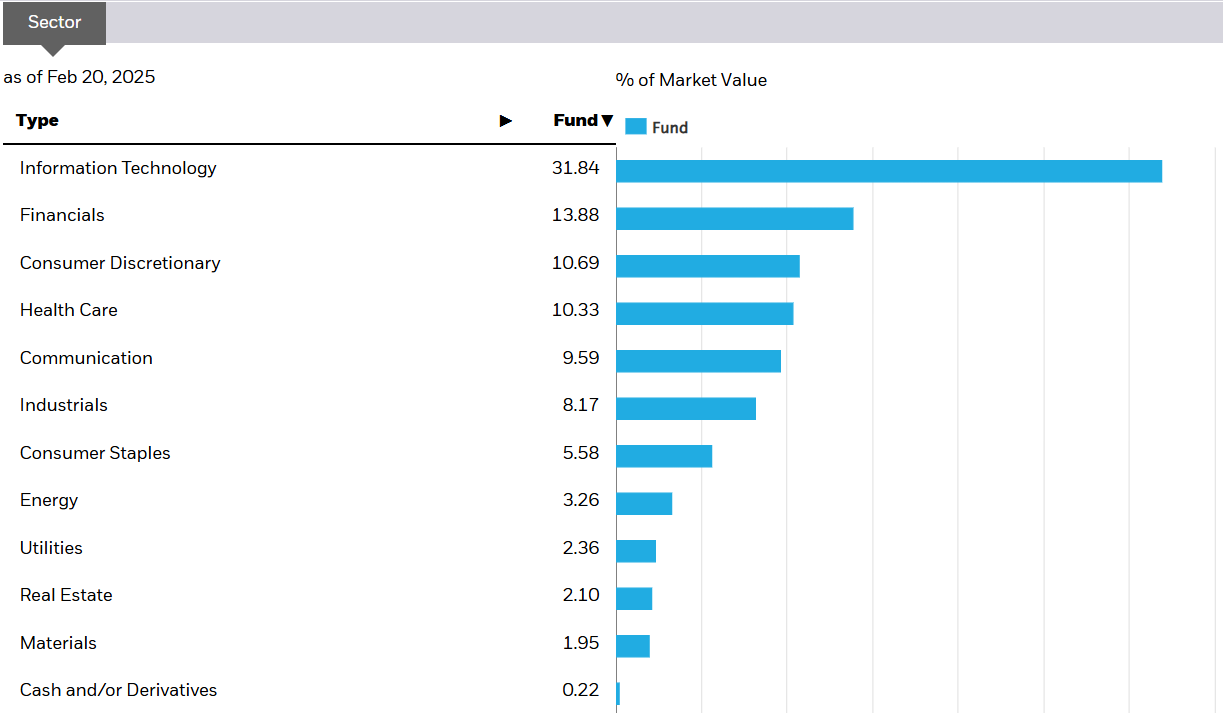

To illustrate this, let’s take the U.S. market and compare two popular ETFs: the S&P 500 ETF and the Russell 2000 ETF from iShares. The S&P 500 tracks the 500 largest publicly traded companies in the U.S., meaning it is heavily dominated by mega-cap and large-cap stocks, with major representation in sectors like Information Technology and Financials.

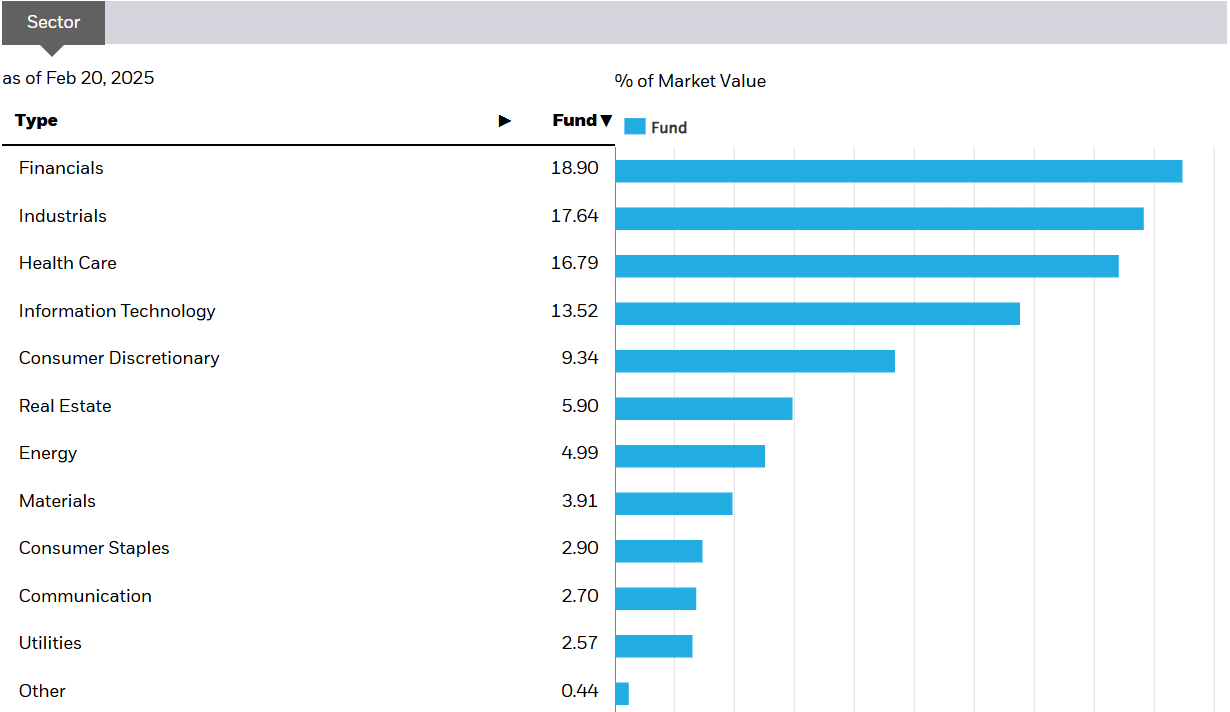

In contrast, the Russell 2000 tracks 2,000 smaller publicly traded companies in the US, offering more balanced exposure across a wider range of industries, including Healthcare, Industrials, and Consumer Discretionary.

For those who have read our piece on the healthcare sector, you’ll know there’s significant value to be found there as well. By incorporating small caps into your portfolio, you’re not only gaining diversification but also tapping into opportunities that large-cap-heavy indices might overlook.

One of the most overlooked advantages of small caps is their strong connection to local economies. Unlike multinational behemoths that generate revenue across dozens of countries, small-cap companies tend to make most of their money close to home. This means they react more directly to local economic conditions, policy shifts, and fiscal stimulus. If a region is poised for growth, small caps are often the best bet to benefit.

Take the Russell 2000, for example. This index outperformed other indices after Trump’s election in 2016. Why? Because investors saw these companies as the biggest winners from tax cuts and deregulation. But it’s not just politics—monetary policy plays a huge role as well.

Small caps are also particularly sensitive to interest rates. Unlike their large-cap counterparts, which can tap into bond markets with ease, smaller companies rely heavily on loans to fund growth. And with a significant chunk of these loans tied to variable interest rates, a rate cut can immediately lower their financing costs. In fact, data shows that roughly a third of Russell 2000 companies have variable-rate debt, compared to just 6% of S&P 500 companies.

This means that when interest rates decline, small caps tend to outperform significantly. Lower borrowing costs provide these companies with cheaper capital, allowing them to expand, invest, and increase profitability at a much faster rate than their large-cap counterparts. Historically, rate-cut cycles have fueled strong rallies in small-cap stocks, making them an attractive bet for those who position themselves early.

Why you shouldn’t invest

The reliance on debt with floating interest rates comes with its drawbacks. When interest rates rise, small caps are often among the hardest hit, as the cost of growth skyrockets. Additionally, these companies tend to be less profitable, their revenue streams are more volatile and less diversified, and they lack the financial cushions that giants like Microsoft and Apple enjoy, sitting on mountains of cash. Just like our blog, this investment class has two edges—one of opportunity, but also one of risk. The rising interest rates of the past few years have undoubtedly played a significant role in the recent underperformance of small caps.

In the U.S., another major factor behind this underperformance is the rise of private equity. This shift has provided fast-growing smaller companies with more financing options than ever before, allowing them to stay private for longer. Many of the best small-cap businesses no longer feel the pressure to go public, instead securing capital behind closed doors. The downside? Retail investors like us are left out of the game, unable to access some of the most promising compounders that might have otherwise been available in the public markets.

Under or Over-Valued?

Finally, we promised to take a closer look at the valuation differences between small and large caps. The prevailing consensus is that large caps are overvalued, while small caps have underperformed. But is this actually the case?

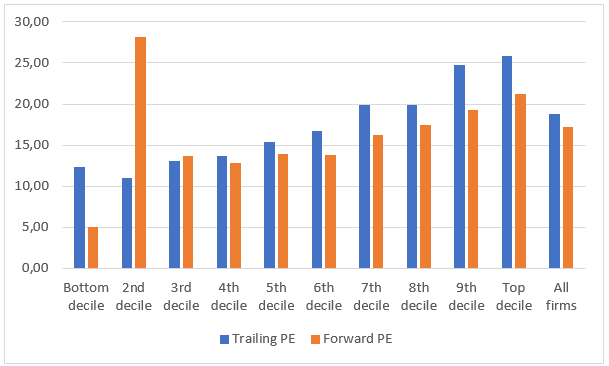

According to research by David Barr, CFA, this claim holds up. He demonstrates that as of May 31, the forward PE ratio of small caps relative to large caps stood at 73%, indicating that small caps are currently trading at a 27% valuation discount compared to large-cap stocks.

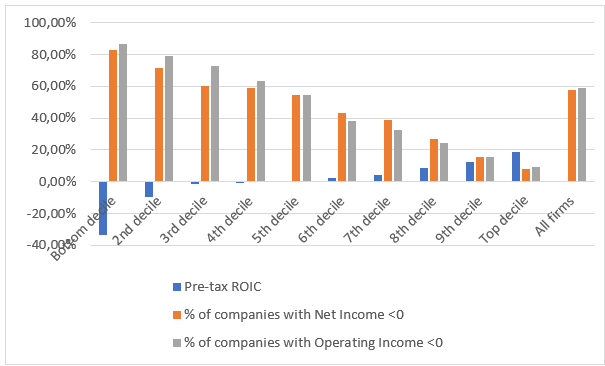

We also decided to dig into the data ourselves. As we often do, we turned to Damodaran’s website, where we found a database categorizing over 4,000 companies into deciles based on market capitalization. The first decile represents the smallest 10% of companies, with each subsequent decile increasing in size. From this, we were able to generate the following graphs.

As you can see, Graph II clearly illustrates that investors are paying a premium for the earnings of larger companies compared to small caps. However, it’s important to add some nuance. In Graph III below, you’ll notice a significantly higher proportion of unprofitable companies in the lower deciles. There’s a reason why larger companies command higher valuations—their earnings are more predictable and far less volatile than those of small caps.

Closing Remarks

We want to wrap up this analysis with the following conclusions. Yes, there is a clear undervaluation in the small-cap segment of the stock market. The rise of ETFs has led to these companies receiving less attention—and consequently, less capital.

With interest rates likely (but never certain) to decline, we also have a potential catalyst for a small-cap resurgence. Additionally, given the current geopolitical uncertainty, small caps could offer an interesting investment angle, as they are less exposed to trade wars due to their predominantly domestic revenue streams. When combined with effective diversification (read our article Decoding Diversification to understand what we mean), small caps present a compelling investment opportunity.

However, it’s not all sunshine and rainbows. Small caps often come with significant risks, including frequent lack of profitability, heavy reliance on external debt with floating rates, and undiversified revenue sources. Moreover, if Trump continues his trade wars, inflation could spike again, keeping interest rates high or even pushing them further up. The rise of private equity has also siphoned away many of the best small-cap investment opportunities from retail investors. With fewer high-quality picks available, one must ask: is the increased risk still worth it? That’s a question only you can answer, as the right choice varies from investor to investor.

What we can promise, though, is that we’ll be back on Wednesday with a fresh blog post on the impact of AI on different industries. And don’t forget—this Sunday, we’re dropping the first part of our deep dive on Aris Water Solutions. Plenty to look forward to!

📢 What do you think? Do you see Small Caps outpeform in today’s markets? Drop your thoughts in the comments—I’d love to hear your take! 👇

🔔 Don’t miss out! Next Sunday, we’re diving into the fundamentals of Aris Water Solutions—breaking down the numbers and what they really mean. Stay tuned!