This is it. The final chapter of Part III. After rigorous analysis, comparisons, and more than a few surprises, we're down to the ultimate decision: which sector has triumphed and earned the right to deliver a company worthy of a deep dive?

Today, we’re diving into a sector that touches every single one of us. A sector that not only rides the megatrend of aging populations but also taps into powerful forces like AI, genetics, and so much more. This isn’t just another niche play—this is the intersection of multiple groundbreaking trends, and it’s shaping the future in ways most haven’t even begun to grasp.

Recap: How We Got Here

If you’re new to this series—first of all, welcome. Second, let’s get you up to speed.

We’re conducting a top-down analysis, a structured approach where we start with the big picture—identifying major global trends—before narrowing it down to specific sectors and, ultimately, one investment-worthy company.

In Part I, we identified three megatrends shaping the future: Digitalization, Aging Demographics, and Sustainability. These aren’t just buzzwords; they represent fundamental shifts that will drive economic growth for decades.

In Part II, we used a structured, data-driven approach to determine which sectors within these megatrends offer the best investment potential. We landed on three finalists:

Semiconductor Equipment (Digitalization)

Environmental & Waste Services (Sustainability)

Healthcare Support Services (Aging Demographics)

Also don’t miss out on our extra part of this series!

In Part III, we’ve been diving deep into these three finalist sectors—one at a time. First, we examined Semiconductor Equipment, a high-margin, high-barrier industry at the core of modern technology. While its potential is undeniable, the combination of geopolitical risks, customer concentration, and cyclicality led us to eliminate it from contention.

Next, we took a close look at Environmental & Waste Services, a sector often overlooked but undergoing major innovation as the world shifts toward sustainability. A formidable competitor that continues to make a compelling case.

And that brings us to our final sector and today’s focus: Healthcare Support Services—a sector that could very well take the crown. After today’s deep dive, we’ll take a short break, and next Sunday, we’ll reveal the ultimate winning sector and the company that deserves our full attention.

More than Needles and Nurses

Just like Environmental & Waste Services, Healthcare Support Services is an incredibly broad sector encompassing a wide array of services. However, not all of these directly tie into the aging demographic trend we’re focusing on.

For example, several categories fall under this sector but do not (directly) relate to aging demographics:

Distribution & Pharmaceutical Wholesalers – These companies supply medicines and medical products to pharmacies, hospitals, and healthcare providers, ensuring a steady flow of essential drugs and equipment.

Workforce Management & Staffing Agencies – They help healthcare facilities find and manage qualified professionals, from nurses to administrative staff, filling critical workforce gaps.

Dental & Orthodontic Care – This sector includes services related to oral health, such as routine dental checkups, braces, and other orthodontic treatments.

Mental Health & Addiction Services – Organizations that provide therapy, counseling, and treatment programs for mental health conditions and substance abuse disorders.

Fertility Care & Reproductive Health – Clinics and services that assist individuals and couples with fertility treatments, IVF, and other reproductive health-related procedures.

But don’t worry—this sector still has plenty of services that directly cater to the aging population. Let’s take a closer look at some key subsectors driving innovation and meeting the increasing healthcare demands of an aging world.

The Power of Early Detection

One of the most critical areas within healthcare support services is diagnostics and laboratory testing. These companies specialize in analyzing biological samples—such as blood, urine, saliva, and tissue—to detect diseases and medical conditions. As the elderly are more susceptible to cancer, cardiovascular diseases, diabetes, and neurodegenerative disorders, the demand for early detection and routine health monitoring is soaring.

Innovation is also playing a major role in this field. AI is already being used to enhance diagnostic accuracy and speed. A great example is Google’s DeepMind, which has developed an AI model capable of detecting over 50 eye diseases from retinal scans with an accuracy comparable to world-class ophthalmologists (with 94% accuracy).

Beyond AI, other exciting developments in medical testing include CRISPR-based diagnostics and liquid biopsies. CRISPR is a powerful tool that allows scientists to edit DNA, like a precise pair of scissors that can cut and change genetic material. Companies like Mammoth Biosciences are using CRISPR to detect diseases faster and more accurately, which means doctors can find health problems earlier and treat them better. Another breakthrough is liquid biopsy, developed by firms like Guardant Health. Instead of taking a painful tissue sample, this method finds tiny bits of tumor DNA in a patient’s blood. This makes cancer detection much easier, especially for older people, because it’s less invasive and more comfortable than traditional biopsies.

The Shift Towards Aging in Place

More and more seniors prefer to stay in their own homes for as long as possible—after all, who really wants to move into a nursing home? This has led to explosive growth in the Home Care & Long-Term Care sector. While traditional home care—such as nurses delivering medication and assisting with daily activities—remains the backbone of this industry, digital transformation is pushing the boundaries further.

For example, telemedicine is making it easier for elderly individuals to consult with doctors without leaving their homes. Amwell, a leading telehealth company, provides user-friendly video consultation platforms that allow seniors to speak with healthcare professionals remotely. This minimizes the need for in-person visits, reduces healthcare costs, and significantly improves quality of life.

AI is Changing the Game (Again)

This brings us to the broader field of Healthcare IT & Digital Health, where companies focus on leveraging technology to make healthcare more efficient and effective. AI-powered healthcare solutions are already demonstrating incredible potential. One real-world example is Tempus, which uses AI to help doctors analyze vast amounts of medical literature and patient data to recommend personalized treatment plans.

Another critical innovation linked to this space is electronic health records (EHRs). AI-driven EHRs can revolutionize patient care by predicting health risks, enhancing personalized medicine, and reducing medical errors. AI can analyze EHRs to identify patients at high risk for conditions like heart disease, allowing for early interventions. By integrating genetic information with patient history, AI can recommend customized treatment plans tailored to an individual’s unique needs. Additionally, automated AI systems can flag potential prescription conflicts or missed diagnoses, improving patient safety.

The convergence of AI and digital health isn’t just about efficiency—it has the potential to transform healthcare as we know it, ensuring better outcomes, lower costs, and a higher quality of life for aging populations.

With all these advancements, it’s clear that healthcare support services remain at the forefront of innovation, driven by the pressing needs of an aging society.

A Healthy Sector (or not?)

For investors seeking stable, long-term opportunities, few sectors offer as many advantages as healthcare support services. This industry benefits from multiple structural growth drivers.

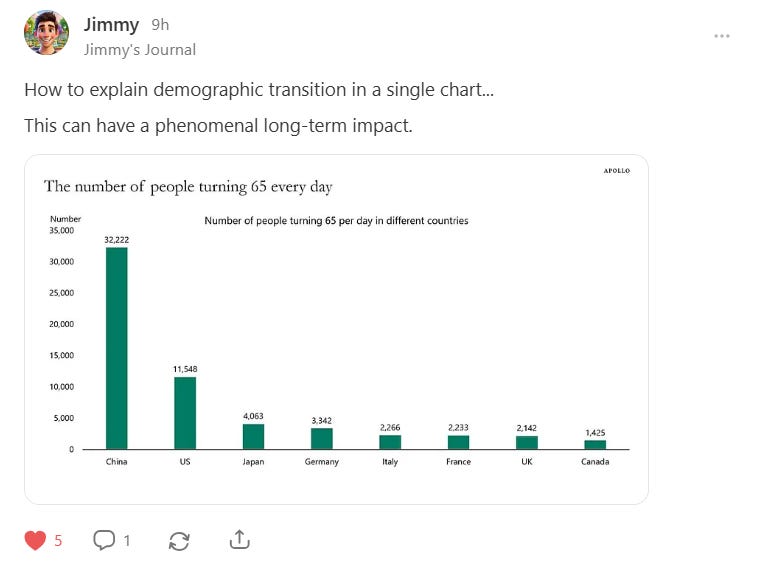

One of those drivers are the aging populations in the Western world. This is an undeniable demographic trend that will shape economies and industries for decades to come. As birth rates decline and life expectancy increases, the proportion of elderly individuals in society continues to rise. This trend is particularly pronounced in regions like Europe, North America, and parts of Asia, where the percentage of people over 65 is expected to double by 2050. This shift creates a structural demand for healthcare support services, ensuring long-term growth and stability for the sector. If you are interested in this topic, you can find our full breakdown in Part I.

Our friend Jimmy from Jimmy’s Journal recently posted a Note that clearly illustrates this trend:

Another key reason that this sector is so attractive to long-term investors is its anti-cyclical nature. Unlike industries that suffer during economic downturns, healthcare remains a necessity regardless of financial conditions. People will always require medical assistance, diagnostic testing, and long-term care, making this industry resilient even during recessions. Governments also tend to prioritize healthcare spending, ensuring a continuous flow of funding to support critical services—at least in most developed nations. This makes the sector a reliable choice for investors looking to hedge against economic volatility.

Adding to its appeal is the rapid advancement of AI and digital solutions within healthcare. As we explored in the previous part, AI-driven diagnostics, telemedicine, and electronic health records are transforming the industry by increasing efficiency and improving patient outcomes.

But not everything in this sector is all sunshine and roses. As always, there are downsides to consider.

While CRISPR-based diagnostics, AI-driven healthcare solutions, and liquid biopsies hold immense promise, they still require extensive research and development before becoming widely adopted. CRISPR's potential for rapid and precise disease detection is groundbreaking, but clinical validation and scalability remain challenges. AI in healthcare has demonstrated strong capabilities in medical analytics and personalized treatment, yet integration into existing healthcare systems is complex and ongoing. Liquid biopsies are revolutionizing cancer detection by offering a less invasive alternative to traditional biopsies, but they must reach higher accuracy and broader applicability to replace established methods. These technologies represent exciting frontiers in healthcare, but continued innovation, investment, and regulatory adaptation will be key to unlocking their full potential.

Government influence on healthcare support services, while providing stability, also presents challenges. Strict regulations increase bureaucracy and compliance costs, slowing innovation. Price controls and reimbursement policies can strain finances, limiting investment in new technologies. Political shifts create uncertainty, as changing healthcare policies impact funding and profitability. While necessary for public health, government intervention can complicate business operations in this sector.

Regulations on AI in healthcare differ across regions. The United States lacks specific federal laws, with HIPAA covering data protection but not AI. Efforts to introduce regulations have stalled. Canada also has no established framework, though discussions continue. In contrast, the European Union leads with GDPR, enforcing strict rules on AI and health data use, requiring transparency and security. The proposed AI Act further categorizes AI risks, ensuring human oversight.

As AI integration into healthcare advances, these regulatory hurdles will shape how and where companies can leverage Big Data for medical innovation. While regulation is essential for ethical AI use, overly restrictive policies could stifle progress, making it a crucial factor for investors to monitor in the healthcare support services sector.

Finally, we want to repeat the same warning we gave for the Semiconductor Equipment sector. AI is on the verge of entering a massive growth phase. This means that many new players will enter the market, and in this sector, the barriers to entry are significantly lower than in the semiconductor industry. Predicting the future winners is, therefore, much more difficult—some of them may not even exist yet!

What’s Next?

Now, let's discuss how this series will continue and conclude.

These sector analyses have been incredibly interesting to conduct, and I must admit that I have gained a deeper appreciation for all three industries. I am someone who enjoys shaping my investment decisions based on a broader vision of the world, and being able to express that vision through investing is something I find truly rewarding. The three sectors we explored over the past few days align well with this perspective, and I am convinced that each of them holds promising investment opportunities—even our eliminated contender, the semiconductor equipment sector.

As you may have noticed, I have not yet made a final decision between Environmental & Waste Services and Healthcare Support Services. And I won’t be making that choice today either. I need some time to let everything sink in, and I will also consult with Cas to hear his thoughts on the matter. Once we reach a decision, we will share a brief email explaining our choice and the reasoning behind it.

📌 Stay tuned for Tomorrow’s post! To ease the anticipation surrounding our decision, you won’t have to wait long for new content. Tomorrow, Cas will take over and teach you how to effectively save money. I’ll definitely be paying attention, as looking at my spending this month, I could use some financial discipline!

🔔 Want more insights? Subscribe for updates and get exclusive analysis on Top-Down Analysis, Qualitative research and deep dives on companies!

💬 What’s your take on this sector? Smart economic strategy or outdated policy tool? Drop a comment below—let’s debate! 🚀

Previous Posts in this Series:

Why Waste is NOT a Waste of Time

Remember when waste management was just about collecting garbage and dumping it in a landfill? Well, those days are long gone. Today, the Environmental & Waste Services sector is buzzing with innovation, transforming how we handle waste.

What No One Is Telling You About the Semiconductor Market

The first time I ever did "qualitative research" into specific sectors, I landed on AI and Big Data. Sounds impressive, right? Like I had some grand vision of the future? Yeah, not so much. This was early 2021, and my "research" consisted of skimming a few Seeking Alpha articles about the "Top 5 Sectors for 2021 and Beyond." Armed with my vast five minu…

What We Can Learn From the DeepSeek-Saga

Welcome to this special extra edition of our Top-Down Analysis!