Welcome to this special extra edition of our Top-Down Analysis!

Yes, we know—so far, only one part of our series has been published, and it might seem a bit premature to start rolling out extras. But after the rollercoaster of a week we just had, we simply couldn’t wait to dive into this unexpected market shake-up.

In our Part I of the top-down analysis, we explored the grand narratives shaping the future—digitalization, an aging population, and sustainability. These megatrends offer a seemingly straightforward roadmap for investors looking to position themselves ahead of the curve. After all, if the world is inevitably moving in these directions, betting on them should be a no-brainer, right?

Well, not quite.

Enter DeepSeek, the LLM that seemingly came out of nowhere and sent shockwaves through the entire AI industry. Its meteoric rise was so perfectly timed—coincidentally, right after our Part I of this series—that we’re starting to suspect we may have inadvertently triggered its launch.

Before diving into the dangers of investing in global trends, let's first take a moment to understand what DeepSeek actually is and why its sudden emergence has been so disruptive. Then, we'll use it as a case study to explore the pitfalls, the unpredictability, and why blindly following megatrends can sometimes lead investors into treacherous waters. Because if there’s one thing the future has consistently proven, it’s that it rarely unfolds the way we expect.

DeepSeek: China’s New AI Titan?

We didn’t know what hit us when we woke up last weekend and saw the flood of news about DeepSeek. Neither of us had even heard of it before, and suddenly, it was everywhere. Naturally, our curiosity took over, and we dove headfirst into research.

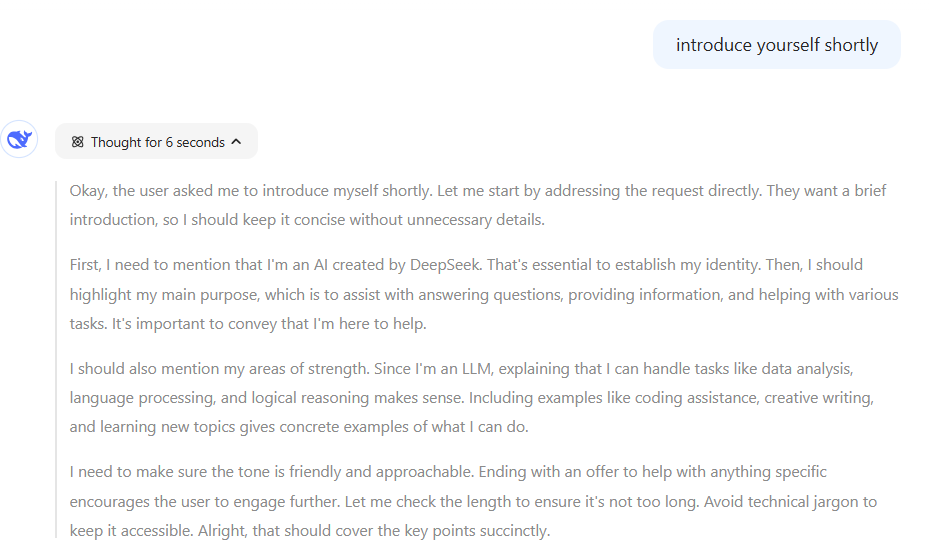

As we tried to piece together the puzzle of what DeepSeek actually is, we figured—why not go straight to the source? So, we decided to let DeepSeek introduce itself:

Naturally, we conducted a few tests to gauge its performance, comparing it to ChatGPT and Gemini. To our surprise, we found little difference in output quality. DeepSeek is undoubtedly a worthy alternative to other LLMs.

But that’s exactly what it is—an alternative. It doesn’t obliterate the competition or redefine the game. So, what’s all the buzz about?

Well, Rihard Jarc from

summarized it perfectly:“In general, after going through this, the view is that constraints are really the mother of invention. R1 has some minor model performance improvements compared to most frontier current models, but the biggest innovations are in the training and inference size and, with it, the costs to train and run these models.”

Rihard Jarc of UncoverAlpha on R1, the new model of DeepSeek

DeepSeek managed to build its model with a budget of around $6 million—a fraction of the billions poured into AI development by OpenAI, Alphabet, and other tech giants. Even more impressively, it did so without access to the advanced chips that its competitors rely on.

That being said, we do have some reservations about these claims. Not all relevant costs seem to have been accounted for, and there are allegations that DeepSeek may have violated OpenAI’s IP rights or even circumvented chip sanctions through intermediaries like Singapore.

Still, there are undeniable innovations within DeepSeek that should make other LLM developers sit up and take notice. However, we won’t delve deeper into these innovations here, as they are not the primary focus of this article—and, frankly, we are not AI experts. Instead, we highly recommend checking out this insightful piece from UncoverAlpha on SubStack that provided us with a wealth of valuable insights.

Lessons For the Future

We, on the other hand are going to focus on the investor-side of things. We’ll break down the key lessons investors can take away from this turmoil. Because when you’re investing in the 'next big thing', it's not just about spotting the trend—it’s about recognizing the right timing, evaluating the competitive landscape, and being aware of the risks that come with market hype. As history has shown, even the most promising innovations can struggle if they arrive too early, face unexpected obstacles, or get overshadowed by stronger or completely new players.

1. Hype and Volatility Are Inseparable

Almost every major trend is accompanied by hype and market volatility. The initial spark often comes from a breakthrough innovation—like ChatGPT for AI—that captures mass attention and attracts early capital. As excitement builds, companies rush to capitalize on the trend, ramping up investments and sprinkling buzzwords into earnings calls and annual reports. Meanwhile, the media amplifies the narrative, further fueling investor enthusiasm.

This frenzy often leads to inflated valuations, as investors become convinced of the technology’s transformative potential. However, these valuations are not always backed by strong cash flows, making the sector vulnerable to corrections. When a disruptive event like DeepSeek emerges—exposing inefficiencies or shifting market dynamics—it can trigger massive sell-offs, particularly for established players slow to adapt.

For investors, this means timing is, for once, somewhat important. Even if you correctly identify the next big technology, entering at the peak of the hype cycle can result in years of stagnation before seeing any returns. Avoiding heavy losses often depends on understanding when enthusiasm has outpaced reality.

2. The Winner is Unknown

If you had asked us two weeks ago what DeepSeek was, we might have guessed a trendy deep-sea diving resort or a niche search engine for fish recipes. The reality? A sudden, market-shaking AI competitor that no one saw coming.

This highlights a crucial point—predicting the long-term winners of emerging technologies is incredibly difficult. The companies that dominate in 20 years may not even exist yet, and betting on a single player or even a single sector within a global trend can be a risky move.

Rather than focusing solely on AI-specific companies, investors can find opportunities across various industries that leverage AI in unique ways. Nvidia, as a leader in AI-optimized GPUs, profits directly from the computing power demands that fuel AI advancements. Tesla, on the other hand, is redefining real-world AI through autonomous driving, robotics, and energy management, fundamentally transforming transportation and beyond. Meanwhile, Amazon benefits from AI-driven automation in retail and logistics while also dominating the cloud infrastructure space through AWS, which powers many AI applications. These examples illustrate how AI’s impact extends far beyond traditional tech companies, reinforcing the importance of diversification when investing in emerging trends.

3. Don’t forget the Present

As we discussed in another article, risk equals uncertainty—and if there’s one thing that’s truly uncertain, it’s the future. Investing solely in emerging technologies can lead to an extremely risky portfolio, where the potential for massive losses is just as real as the possibility of outsized gains.

By focusing only on speculative, high-growth sectors, you expose yourself to significant volatility and unpredictability. That’s why it makes sense to also consider sectors that are the complete opposite—industries that may not be innovative but are already generating massive cash flows.

phrased it beautifully in a recent article of his:“I prefer companies whose core business changes very little—or only very slowly. Give me a Lotus Bakeries over a Nvidia when it comes to expensive stocks. The cookie maker has a simple product and can grow strongly through international expansion and product diversification. The risk of disruption there is minimal.”

Sam Hollanders, author of “The Valuing Dutchman”

These are the truly valuable diversifications in a portfolio—where the risks and potential of the future are balanced out by the hard cash flows of the present.

4. Don’t get scared right away

Just because you are currently invested in other LLM providers doesn’t necessarily mean they have lost the AI race. There is also something known as The Jevons Paradox. This is another complex term that I’d rather have explained by a renowned author here on Substack:

The Jevons Paradox named after the English economist William Stanley Jevons, refers to the counterintuitive phenomenon where increases in the efficiency of resource use lead to an overall increase in the consumption of that resource, rather than a decrease.

Kris, author of “Potential Multibaggers”

Kris explains this paradox excellently in his article about the Deep-Seek debacle, and I highly recommend checking it out. We can already conclude that Deep-Seek doesn’t necessarily have to be a negative development for the sector. Due to this improved efficiency, the demand for AI will certainly not decrease—in fact, as Jevons pointed out, it may even grow.

Final Remarks

We hope these insights have shown that investing in the future isn’t just about chasing the next big thing—it comes with real risks. When expectations run far ahead of reality, market corrections can hit hard, and your portfolio might feel the pain. Even the most promising innovations carry uncertainties, and hype can inflate valuations beyond what’s reasonable.

Recognizing this lets you invest with a more balanced mindset, weighing opportunity against risk. After all, spotting the next big thing is thrilling—but making sure you don’t lose your cash in the process is even more important.

This Sunday, we’re dropping Part II of our Top-Down Analysis, where we’ll take today’s insights—along with a few others—into account as we determine which sector(s) deserve(s) a deep dive next.