“We have the same problem as everyone else: It’s very hard to predict the future.”

Charlie Munger

Since the dawn of time, people have been obsessed with predicting the future—especially when it comes to life-changing decisions. Ancient Greek mythology is full of stories about seers and prophets, but none were more famous than the Oracle of Delphi. Kings and conquerors traveled from distant lands, desperate for a glimpse into what lay ahead. The most legendary tale? King Croesus of Lydia, who asked whether he should wage war against the Persian Empire. The oracle, as always, gave a cryptic answer—one that led to a massive, and somewhat ironic, downfall.

Fast forward to today, and while we no longer rely on cryptic priestesses whispering riddles from smoke-filled temples, we’re still obsessed with forecasting the unknown. Just think about the stock market—if you had perfectly predicted the rise of Bitcoin a decade ago, you’d probably be reading this from your yacht.

Of course, absolute certainty in prediction remains a fantasy (for now?). The best we can do is make calculated guesses, often based on historical trends, statistical models, and gut feelings. But here’s the problem: the future is messy. It's shaped by unseen factors, wild variables, and chaotic surprises no one saw coming. That’s why investors turn to “experts”—market analysts, financial advisors, and economic gurus—who claim to see what others don’t. Entire industries are built on this promise: stock market analysts scrutinizing every fluctuation, fund managers selling you their "next big thing," and financial advisors charging hefty fees for their insights.

But here’s a thought: what if you didn’t need a high-paid guru or a hedge fund wizard? What if you had access to your own Oracle of Delphi? A system, a method, or a collective intelligence that could rival even the best minds on Wall Street?

Sounds impossible? Maybe not. That’s exactly what we’ll explore today. So, grab a coffee, settle in, and let’s dive into the wizardry of predictions…

A Crowd’s Opinion

Relying on just one person’s opinion is like trying to drive through a foggy mountain pass with only one dim headlight. No matter how rational you think you are, bias is hardwired into the human brain. Even the sharpest minds take mental shortcuts, influenced by personal history, cognitive quirks, and, let’s be honest, a bit of that ancient reptilian survival instinct. That’s why self-awareness is key. But here’s a thought—what if the best way to overcome bias isn’t just to be more self-critical, but to listen to others? (Yes, really. At least this time.)

Enter Francis Galton1, a statistician who stumbled upon something remarkable in 1907. In a livestock competition, 787 people—ranging from skilled butchers and farmers to total novices—were asked to guess the weight of an ox. The median estimate was only 0.8% off from the actual weight. That’s shockingly accurate, especially considering many participants had zero experience with cattle. (And no, we don’t know who won the competition—sorry!)

But there was a catch: each participant had to pay a small fee to enter, ensuring they took the task seriously. There was probably also little collaboration, as the participants could win a prize. This eliminated wild guesses and the risk of herd mentality. In short, independent thinking combined with collective aggregation led to near-perfect accuracy.

In a modern twist, Davis-Stober and colleagues2 (2014) put this phenomenon to the test: Can a crowd actually outsmart a single expert? And if so, under what conditions?

First, let’s define “wise” in this context. The study considers a crowd "wiser" if its average guess is closer to the correct answer than the guess of a randomly selected individual (“expert”) from that same crowd. And after some heavy mathematical lifting (which we’ll happily skip—you're welcome), the researchers came to a striking conclusion:

"Unless an expert can be deterministically selected as the best, an aggregated crowd judgment is almost always superior."

Translation? Unless you know in advance who the absolute best expert is (which you probably don’t), betting on the crowd is the smarter move.

Now, you might think, Okay, so let’s just fill a room with experts and get the best predictions possible. Makes sense, right? Wrong. Surprisingly, the study suggests that a homogeneous group of experts isn’t as effective as a diverse crowd.

Why? The study uses an investing analogy:

"Sometimes it is better to diversify performance by ‘hedging’ and including an asset that performs well when other assets perform poorly."

In other words, if you surround yourself with only like-minded experts, you risk creating an echo chamber where everyone thinks the same way, reinforcing blind spots instead of canceling them out. A more diverse group—including some contrarian perspectives—actually improves overall accuracy. Just like a well-balanced investment portfolio benefits from assets that move differently in various market conditions, a wise crowd benefits from intellectual diversity.

So, what can we take away from this?

The crowd is (almost always) wiser than a single expert.

A diverse crowd is even better than a group of just experts.

Armed with these insights, let’s dive deeper into how we can apply the power of collective intelligence to investing and decision-making in the next section.

Modern Day Oracle

Alright, let’s take these insights and make them work in the real world. Now, before you ask—no, this Modern-Day Oracle isn’t Warren Buffett (though solid guess). The real answer is right in front of you. Literally. The internet. A place overflowing with opinions—some insightful, some... well, less so—but still a goldmine for collective wisdom. Of course, we need to narrow it down a bit. The internet is kind of a big place, last I checked.

Let’s set some conditions. Remember the little side note from earlier—where participants had to pay a small fee to play? That’s key. So, we’re looking for:

A crowd (check).

A bunch of diverse opinions (certainly check).

A system where participants have skin in the game (check—because money talks).

Enter Polymarket, the world’s largest prediction market. And no, this isn’t a paid promotion (but hey, Polymarket, call me). The idea is simple: it’s a blockchain-powered platform where people trade shares in future events using crypto. Prices reflect probabilities—if you buy a share at $0.25, meaning a 25% probability, and that probability later rises, your share’s value increases too. If the event happens, your share jumps to $1 (jackpot); if not, it crashes to $0 (ouch). Think of it as literally buying probabilities.

[Disclaimer: At the time of writing, Polymarket has been banned in Belgium by the Gaming Commission. This article is purely illustrative and not an endorsement of betting. I’m just here to explain, not to recommend—got it? Cool.]

Now, let’s put this to the test with a juicy example: the 2024 U.S. Presidential Election. Normally, I’d just trust The Simpsons to predict the outcome, but for the sake of argument, let’s roll with Polymarket.

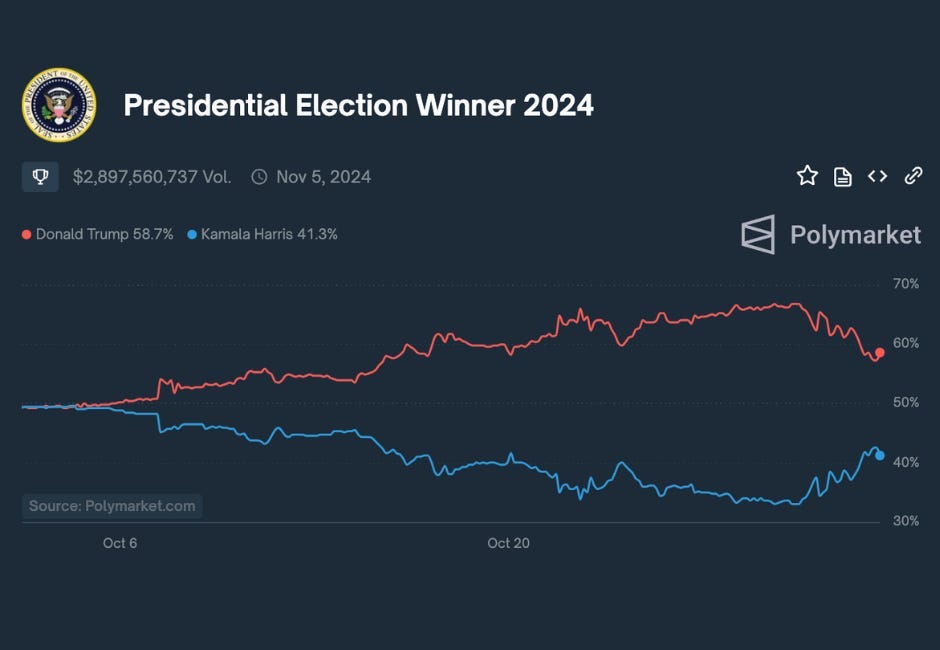

This election was a mess to predict—polls were hovering around 50-50, and no one knew for sure until results really started rolling in. But here’s the twist: Polymarket traders had already sniffed out the winner a month earlier.

By early October, Polymarket odds tilted toward Trump, and by election night, they settled at 60-40 in his favor. Compare that to mainstream media polls, which stayed stubbornly at 50-50. Why the difference? Wisdom of the crowd. A large group of traders—each with money on the line and access to their own unique insights—simply outperformed a handful of “experts” playing it safe.

And it’s not just politics—Polymarket has prediction markets on everything from stock movements to economic trends.

A word of caution, though. Polymarket is a tool, not a crystal ball. It should be one of many data points in your investing puzzle—not the whole picture. If you’re lost, it might offer useful insights, but don’t treat it as gospel. Also, like any market, it can be manipulated. Large bets from a single participant could skew the odds, making it seem like an outcome is more likely than it actually is. Stay sharp. And when in doubt? Sit it out. If you’re unsure about how these platforms work, it’s always safer to observe rather than dive in blindly.

Now, let’s wrap things up with a few final thoughts in the next section...

Final Remarks

If history has taught us anything, it’s that predicting the future is both an obsession and a gamble. From the mysterious oracles of the past, who claimed divine insight, to modern prediction markets, where probabilities are shaped by financial incentives, our quest for certainty remains unchanged. But while collective intelligence can often outperform individual experts, it is not infallible—markets can be manipulated, biases still exist, and even the best predictions sometimes miss the mark.

So, let’s repeat one more time: Polymarket is a tool, not a guarantee. It should complement, not replace, your research. Always exercise caution, diversify your sources, and never invest money you can’t afford to lose. Stay sharp, question the odds, and when in doubt—sit it out.

Want to dive deeper into market dynamics? Stay tuned for our next article on Friday, where we’ll explore the real-world impact of tariffs and how they shape global trade.

📌 Stay tuned for Friday’s deep dive on tariffs! We’ll break down how they impact global trade, markets, and your investments—don’t miss it.

🔔 Want smarter investing insights? Subscribe for updates and get exclusive analysis on prediction markets, economic trends, and decision-making strategies.

💬 What’s your take? Do you trust the wisdom of the crowd, or do you prefer expert forecasts? Drop a comment below and let’s discuss!

Footnotes

GALTON, F. Vox Populi. Nature 75, 450–451 (1907). https://doi.org/10.1038/075450a0

Davis-Stober, C. P., Budescu, D. V., Dana, J., & Broomell, S. B. (2014). When is a crowd wise? Decision, 1(2), 79–101. https://doi.org/10.1037/dec0000004

Nice post! I just posted about this. Then came over to check out your page, and your latest post covers the same topic. DMed you about recommending each other as we have lots of overlap from different angles.