Welcome to our new Sunday special series—your new favorite way to mix weekend vibes with a dash of financial wisdom. Over the coming weeks, we’ll introduce you to a top-down approach.

First, what’s all this talk about a top-down analysis? Imagine starting with a bird’s-eye view of the investment landscape—spotting the global trends and macro shifts that are changing the world as we know it. From there, we’ll zoom in closer and closer, hopping from sectors to industries, and finally landing on a company that ticks all the right boxes. It’s a bit like treasure hunting, but with spreadsheets and strategy.

By the end of it, we’ll zero in on one fascinating company that’s begging for a deep dive. Or, who knows, we might just end up discovering that among the thousands of publicly traded stocks, there isn’t a single one worth a second glance. Wouldn’t that be something? All this effort, and not even a crumb of opportunity. Let’s hope it doesn’t come to that!

In this first chapter, we’re starting as high up as it gets—the stratosphere of global trends. What are the big, bold changes reshaping our planet? And more importantly, which sectors are perfectly positioned to ride these waves? By the end of this part, we’ll have a shortlist of sectors that demand a closer look, setting the stage for the next episode.

So, grab your coffee (or something stronger), and let’s dive into the big picture. Today, we’ll focus on three major trends shaping the future: digitalization, demographic shifts, and sustainability. These aren’t just buzzwords; they’re the tectonic plates of change, moving industries and economies in profound ways.

Clouds, Codes, and Connections

Let’s kick things off with our first trend: digitalization. This is the most obvious trend on our list—so much so that ignoring it would be borderline criminal. However, it’s important to approach this trend with the widest possible lens. While some specific sectors and innovations within digitalization are grabbing all the headlines, others are quietly flying under the radar, and these underappreciated areas might hold significant potential.

At its core, digitalization is the process of taking analog processes and information, and turning them into digital forms. Sounds simple, right? But it’s so much more than just automating a few tasks. It’s about completely reimagining how businesses, consumers, and even governments operate and interact with one another. From how we shop and work to how cities are run, digitalization is reshaping the world at lightning speed.

Now that we’ve set the stage with an overview of digitalization, let’s dive deeper into its key components:

Big Data: Handles enormous amounts of information to uncover patterns and insights. This helps businesses make better decisions, improve customer experiences, and optimize operations in areas like marketing, healthcare, and beyond.

Artificial Intelligence (AI): Enables machines to learn and adapt, revolutionizing industries. From chatbots that improve customer service to algorithms powering self-driving cars, AI is making processes smarter, faster, and more efficient.

Telecom: Ensures global connectivity, with 5G leading the charge. This new generation of telecom technology supports faster internet speeds, reduced lag, and innovations like the Internet of Things (IoT) and smart cities.

Cybersecurity: Protects sensitive information and digital systems from cyber threats. As the digital world grows, cybersecurity ensures trust and safety for both individuals and organizations, combating issues like data breaches and hacking.

Cloud Computing: Replaces traditional physical servers with remote, scalable solutions. Businesses can store and access data easily, enabling flexibility, cost savings, and the ability to power complex applications and services.

Digital Business Processes: Transforms manual workflows into streamlined, automated systems. Companies like SAP lead in helping organizations adapt, making operations like inventory management and financial reporting more efficient and resilient.

Computation power: Digitalization is driving an insatiable demand for computational power, transforming how we live, work, and innovate. At the heart of this shift lies the need for advanced technologies capable of handling the increasing complexity of modern systems. Semiconductors, for example, serve as the backbone of this transformation, powering everything from smartphones and computers to AI systems and electric vehicles. As our reliance on digital tools grows, advancements in computational technologies are becoming critical to sustain and accelerate the pace of digitalization and global connectivity.

By breaking down these specific trends within digitalization, we can start to see the immense opportunities—and challenges—that lie ahead. But as we marvel at this digital revolution, it’s worth noting that not all trends revolve around code and clouds. Some are rooted in the very fabric of society itself. This brings us to our next topic.

The Business of Growing Older

One of the most significant demographic changes globally is aging populations, or as it’s commonly known, the silver tsunami. This trend isn’t just about gray hair and retirement parties—it’s reshaping economies, healthcare systems, and industries in profound ways.

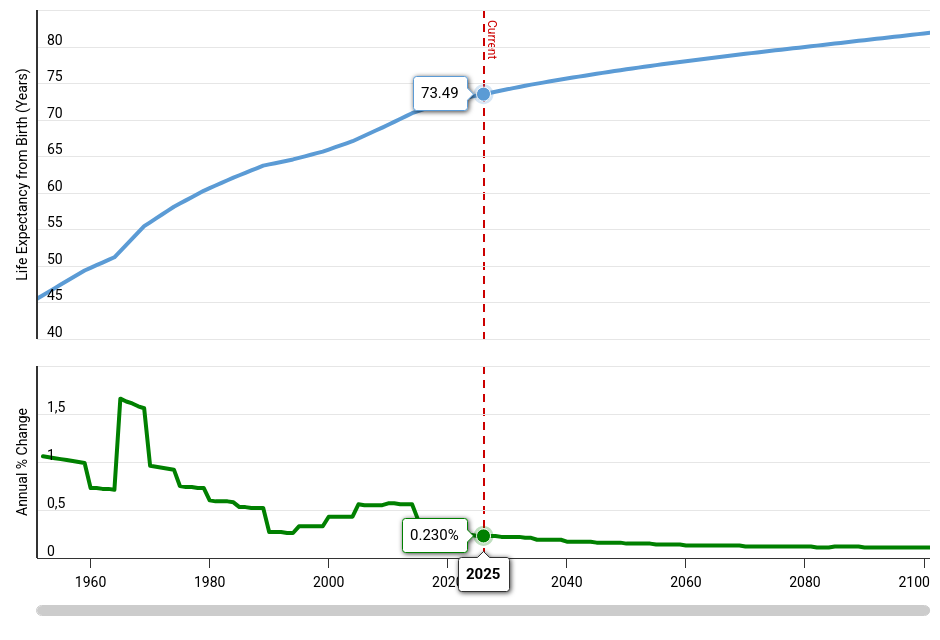

People are living longer than ever before. In 1960, the global average life expectancy was just 52 years, whereas today it has risen to over 73 years. And as you can see on Graph I, it is only going to keep rising.

In developed countries, this increase means retirees are spending significantly more years in retirement compared to previous generations. For example, the average length of retirement in many Western nations has grown by nearly a decade over the past 50 years.

At the same time, societal shifts towards individualism have led to a decline in multigenerational living arrangements. Older adults are increasingly being cared for in retirement homes or assisted living facilities rather than living with family. This growing trend has created a booming demand for specialized housing, eldercare services, and healthcare technologies tailored to seniors.

These shifts present significant opportunities for certain sectors:

Healthcare and Pharmaceuticals: With longer lifespans, there is a surge in demand for medical treatments, long-term care, and age-related healthcare solutions.

Senior Living and Housing: The rise in retirement communities and assisted living facilities is reshaping real estate and construction industries.

Technology for Aging: Innovations like wearable health monitors, telemedicine, and smart home systems are increasingly geared towards improving the quality of life for seniors.

Financial Services: Longer retirements mean greater demand for pension planning, wealth management, and estate planning services.

Green Gold Rush

The word sustainability often sparks debate. On one side, it’s seen as a necessary shift to combat climate change and protect future generations. On the other, critics argue it imposes costly regulations and disrupts traditional industries. Regardless of these perspectives, there is no denying that a significant trend is underway to make key sectors more sustainable.

One major driver is the need to address climate change. The global temperature has already risen by 1.1°C since pre-industrial times, with dire warnings from scientists about keeping this rise under 1.5°C to avoid catastrophic consequences. This urgency has led to significant investments in renewable energy, infrastructure to manage extreme weather, and innovations to reduce emissions.

Another factor reinforcing sustainability is resource efficiency. With finite resources like water and minerals under pressure, sectors are focusing on reducing waste and optimizing usage.

Finally, shifting consumer and investor expectations are pushing businesses to act. In addition to these pressures, regulatory frameworks and government subsidies are accelerating the shift towards sustainability. Policies aimed at reducing carbon emissions and providing financial incentives for greener technologies are creating new opportunities. Companies are increasingly evaluated on their environmental and social governance (ESG) performance, influencing investment flows and market opportunities, as Cas already explored previously.

These interconnected forces make sustainability more than a passing trend—it’s a lasting shift with wide-reaching implications across industries.

Key areas impacted by sustainability trends:

Energy: While solar, wind, and hydro power are becoming essential alternatives to fossil fuels, it is equally important to consider the role of oil and gas in the current energy landscape. Renewable energy sources address environmental concerns and drive innovation, but oil and gas remain critical for meeting global energy demands in the near term. Balancing the transition to renewables with the existing infrastructure for fossil fuels is a complex challenge that requires careful planning and investment.

Electrification of Machines and Vehicles: Electrification is transforming industries by reducing emissions and improving energy efficiency. Advances in battery technology are enabling electric options for vehicles, machinery, and even aviation. Building charging infrastructure and scaling these technologies make electrification increasingly viable across diverse sectors.

Utilities: Utilities are adopting more sustainable practices by reducing resource waste, such as minimizing water consumption and utilizing advanced filtration technologies to improve water quality. Beyond water, they are addressing broader energy challenges by upgrading infrastructure, integrating renewable energy into grids, and enhancing overall efficiency to manage energy resources more responsibly.

Commodities: The shift to sustainability is impacting commodity markets, with increased demand for materials like lithium and cobalt, which are essential for batteries and renewable energy technologies.

What’s Next

As we wrap up this first part of our journey, we’ve delved into three powerful trends reshaping the world: digitalization, aging populations, and sustainability. These forces are not only changing industries but creating fresh opportunities for those ready to adapt.

In the next chapter, we’ll unveil which industries we believe are best equipped (and not overvalued) to thrive in this evolving landscape, taking a closer look at sector valuations, growth potential, and their alignment with these key trends. From there, we’ll dig deeper into the most exciting sectors and spotlight where the real opportunities lie. Don’t miss what’s next as we take our top-down analysis further!

Please note: This article includes a disclaimer regarding investment advice.

Other Articles You Might Like:

Why Nice Companies Finish Last

“Asking companies to bear the burden of being society’s conscience is not only unfair, but it tilts the playing field in favor of the least socially conscious investors and companies.”

Increasing The Odds Of Finding Winning Investments

"We look for a horse with one chance in two of winning and which pays you three to one."

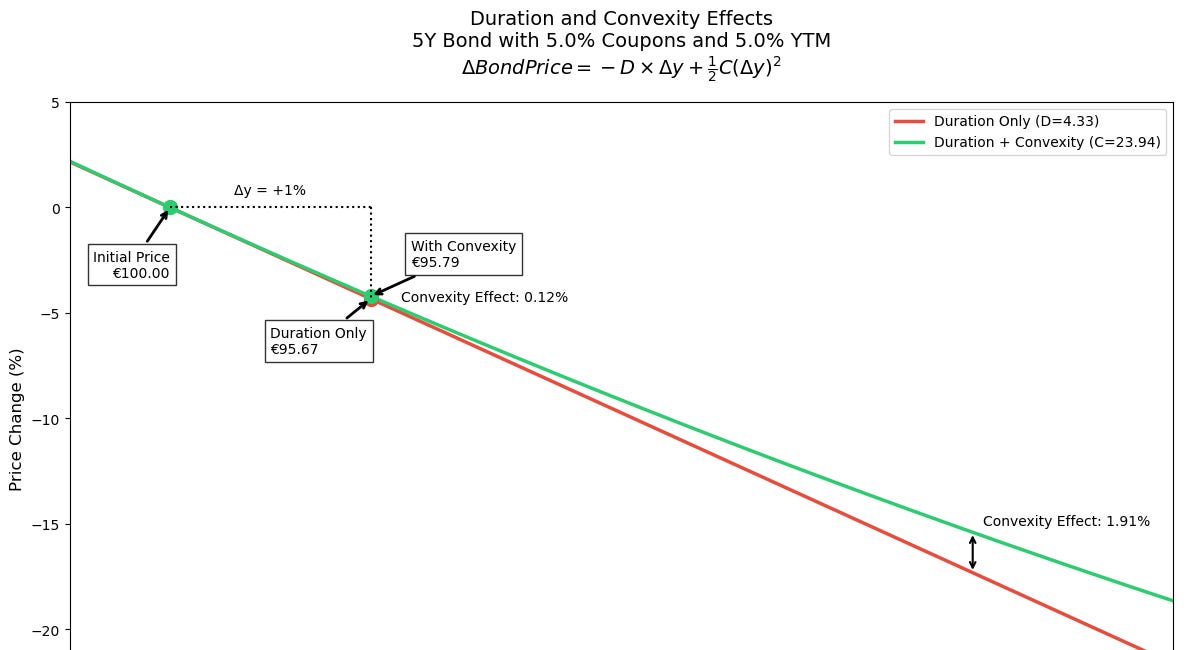

Bonds - Advanced Concepts

Happy Friday! We’re back with another bite-sized article to kickstart your weekend. Today, we’re diving into a topic that doesn’t always grab headlines but deserves a second look: bonds. Sure, the spotlight often shines on flashy investments like AI stocks or the latest crypto rocket aiming for the moon. While chasing the hype can be exhilarating, it’s …