Happy Friday! We’re back with another bite-sized article to kickstart your weekend. Today, we’re diving into a topic that doesn’t always grab headlines but deserves a second look: bonds. Sure, the spotlight often shines on flashy investments like AI stocks or the latest crypto rocket aiming for the moon. While chasing the hype can be exhilarating, it’s a double-edged sword—it moves fast, and sometimes in the wrong direction. Enter bonds: the steady, “boring” alternative that often gets overlooked because they lack the glitz of fast-moving markets. But don’t dismiss them just yet. Bonds have their own charm, and we’re here to break it down for you, starting with the basics.

Think of bonds like a mini-bank deal. As an investor, you lend money to a government or company for a set period. In return, you earn regular “coupon payments” (fancy talk for interest) either annually or biannually. At the end of the term, your initial investment (the principal) is paid back. Pretty straightforward, right? Like bank loans, the interest rate on these payments is fixed upfront and tied to short-term rates set by the central bank. As rates fluctuate, so do bond prices. That’s your crash course in bonds, but if you want the full scoop, check out our article on the basics of bonds.

Today, we’re getting a little more technical—and a lot more exciting. We’ll answer a key question: “How do changes in interest rates affect bond prices?” If rates shift by X%, how does your bond’s value react? Just like equities, bonds come with varying levels of risk and reward. Some investors even speculate on these rate changes, hoping falling rates will drive up their bond’s price—or cashing in when they’re short. Whether you’re a seasoned speculator or just curious about how bonds work, grab a coffee, settle in, and let’s dive in before the weekend officially begins.

Before we go further, a quick shoutout to our collaboration today with

, another stellar Substack writer. After this, don’t miss their articles on macroeconomic trends paired with stunning visuals—speaking of which, today’s visuals are courtesy of . Trust us, they’re worth a look!Ready? Let’s get into it. And if you’re new to bonds, we recommend checking out these reads for a solid foundation:

Duration

Let’s talk duration, the easiest (and most practical) bond concept to grasp in this article. At its core, duration measures how sensitive a bond’s price is to changes in interest rates. Think of it as the weighted-average time it takes for you to recover your investment, adjusted for the present value of all those future cash flows.

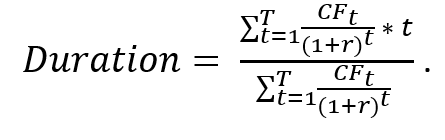

Here’s the math formula—don’t worry, it’s just for context (and maybe a chuckle if math isn’t your thing):

Looks scary? Don’t panic—we’ll simplify it with an example:

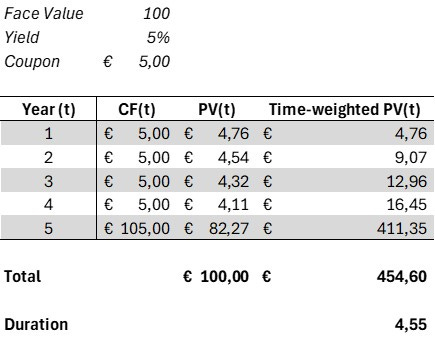

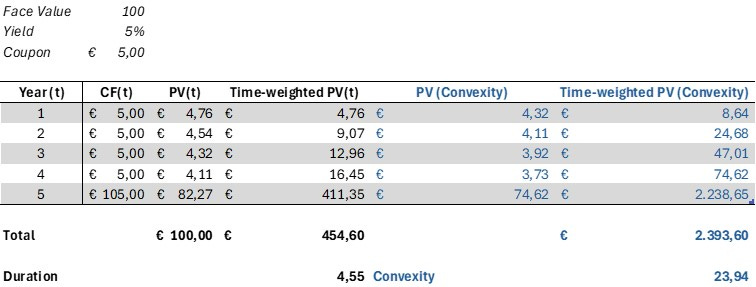

Imagine you’ve invested in a 5-year bond that pays a 5 EUR annual coupon, with a 5% yield to maturity (YTM). Since the coupon rate equals the YTM, the bond price is 100 EUR (its face value). Now, let’s calculate how sensitive this bond is to interest rate changes.

The formula for how bond prices change based on duration is:

Where:

D = Duration

Δy = Change in interest rate

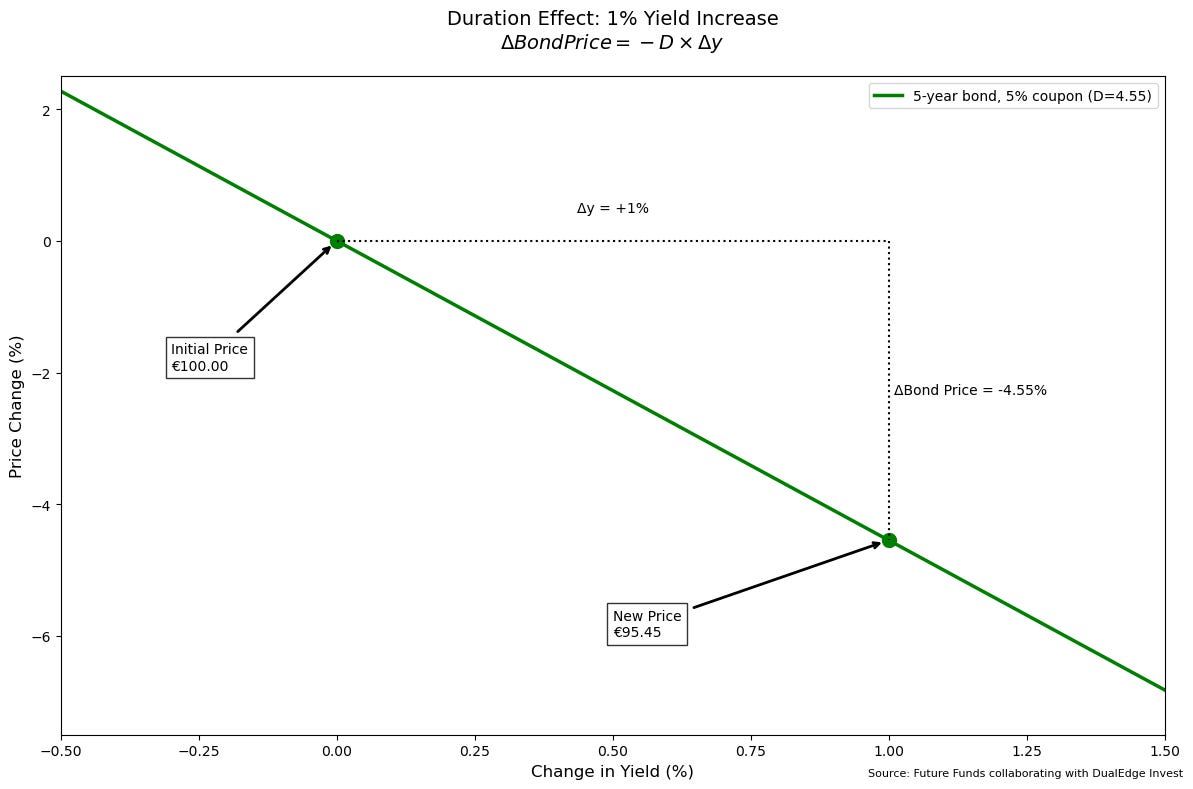

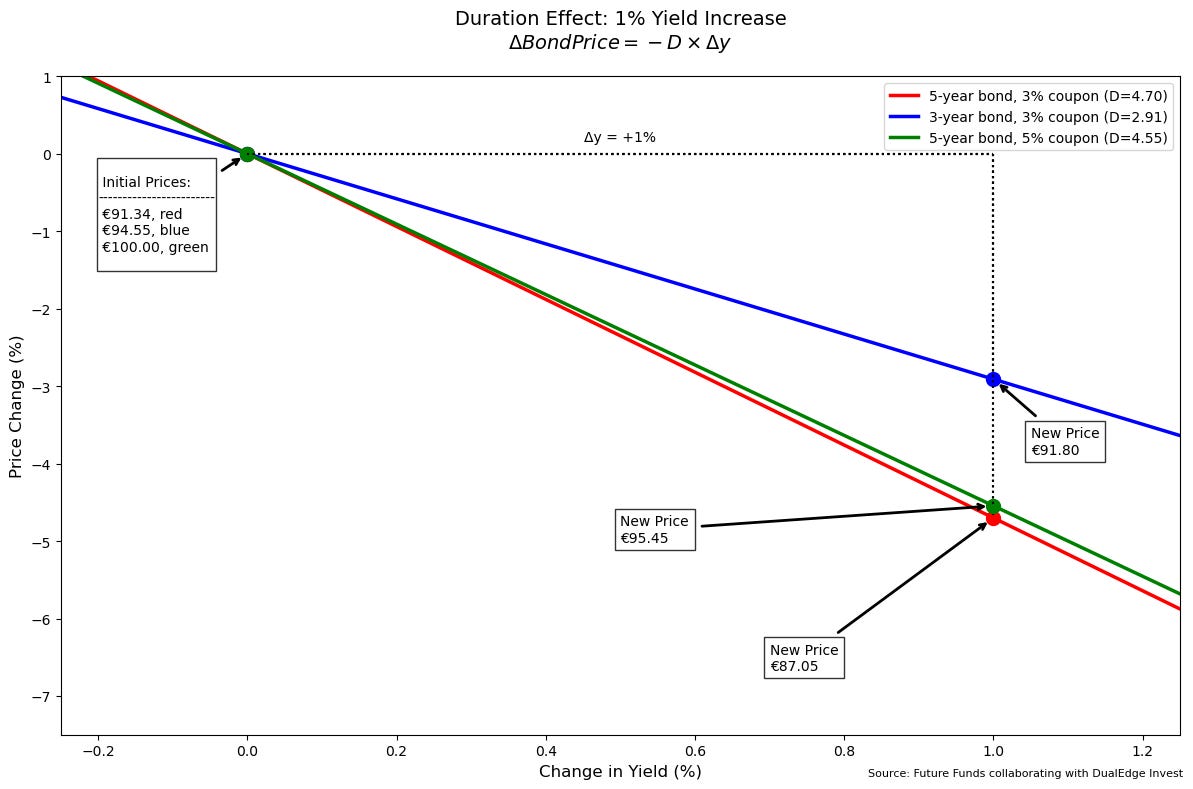

If a bond has a duration of 4.55 years and interest rates increase by 1%, the bond's price will decrease by 4.55%. For instance, a bond valued at 100 EUR would lose 4.55 EUR, reducing its price to 95.45 EUR. This price change can be visualized as follows:

Duration depends on two key factors:

Maturity: Longer-term bonds are more sensitive because their biggest cash flow—the principal repayment—happens far in the future, making it more affected by interest rate changes.

Coupons: Bonds with low coupon rates (or zero-coupon bonds) are more sensitive because a larger portion of their value is tied to the distant principal payment.

For example:

Switching the bond to 4 years reduces its duration to 3.72, making it less sensitive to rate changes.

Lowering the YTM to 3% for the original 5-year bond increases its duration to 4.72, making it more sensitive.

Comparing the effect of different changes looks like this:

Understanding duration is crucial for building a bond portfolio. Longer-duration bonds carry more interest rate risk, while shorter-duration and higher-coupon bonds are more stable. If your portfolio is heavily invested in bonds, you can even calculate its overall duration, giving you a clear idea of your sensitivity to rate changes—and helping you plan for opportunities or risks ahead.

Convexity

Let’s dig into convexity, the slightly more sophisticated sibling of duration. Earlier, I might have oversold duration’s ability to explain bond price changes. You see, duration assumes a linear relationship between interest rates and bond prices: for example, a 10% rise in interest rates would cause a price drop 10 times greater than a 1% rise. Sounds simple, right? But the reality is a bit more nuanced.

Here’s why: bond prices are tied to future cash flows discounted back to today. And the discounting process isn’t linear—it’s exponential. This means the real-world price change for a bond is always a little off from what duration predicts. For a rate increase, the actual price drop will be slightly smaller than expected. This difference is called the “convexity adjustment.”

In essence, convexity measures the rate of change in duration, or to put it more playfully, it tracks the change of the change in bond prices. (Yes, you read that right—this isn’t a typo!) While duration helps us understand how much bond prices move with interest rate changes, convexity adds a layer of precision by accounting for the curve in that movement.

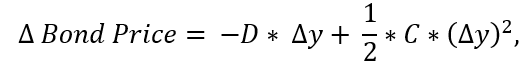

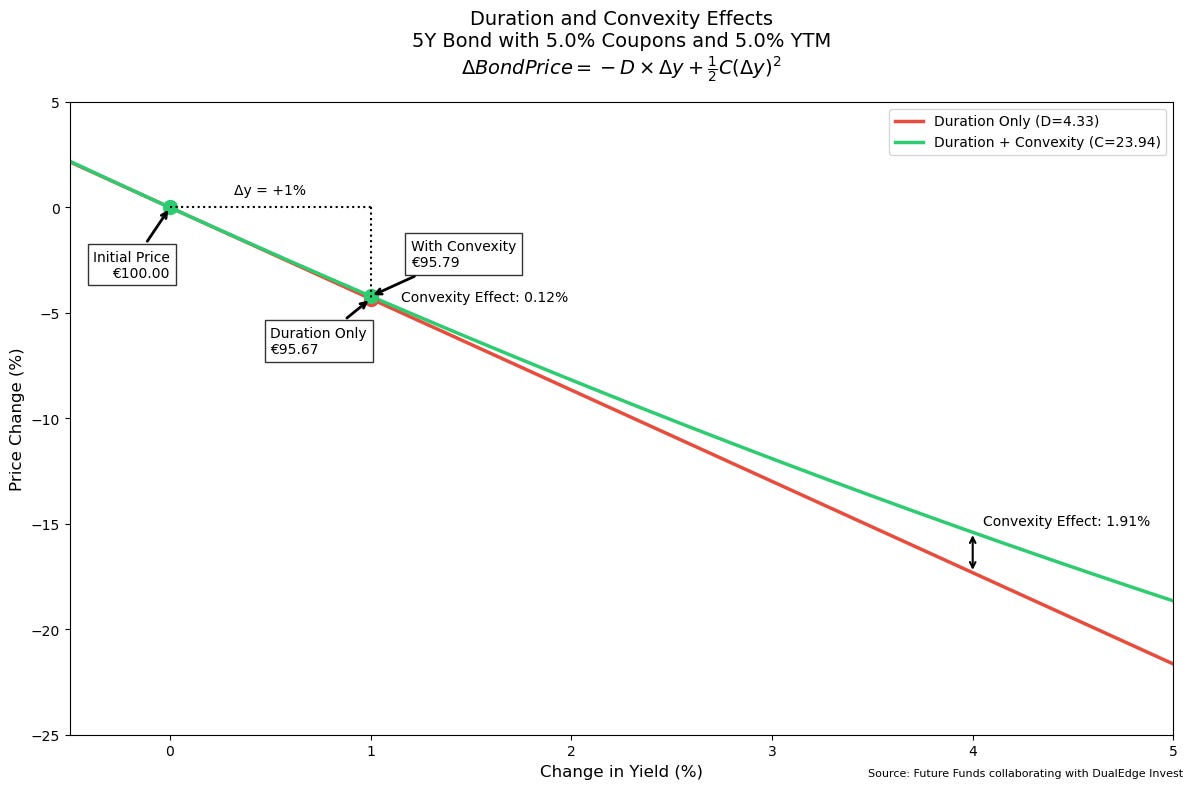

Let’s skip the scary-looking convexity formula and focus on the outcome instead. The price change of a bond is calculated as:

Where:

D: Duration

C: Convexity

Δy: Change in interest rate

Let’s use the example from before to show what convexity looks like:

Using the number for duration :

Duration: 4.55

Convexity (C): 23.94

Interest Rate Change (Δy): +1% (0.01)

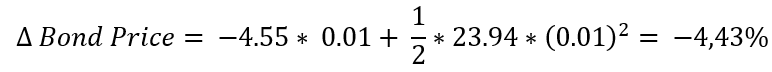

The change in bond price becomes:

The duration effect estimates a price drop of -4.72%.

The convexity adjustment adds back +0.29%.

Net price change: -4.43% (a slight correction from the original estimate of -4.55%).

For small changes in interest rates, the convexity adjustment is minor, almost negligible. But when rates shift significantly—say, by 5%—the difference becomes substantial.

Duration-only estimate: -4.55 * 0.05 = -22.73%

Convexity adjustment: 0.5 * 26.15 * (0.05)2 = 3%

Actual price change: -19.73%

The effects of this correction can be seen here:

Convexity tempers the drop, reducing the severity of the price decline. Importantly, convexity has a positive relationship with bond prices, meaning more convexity is better—it softens the blow of rising rates and amplifies gains when rates fall.

Bonds with longer maturities and lower yields naturally exhibit higher convexity. Why? It’s the same logic as with duration: cash flows further in the future are more sensitive to interest rate changes, creating a stronger curve in the price-yield relationship.

Final Remarks

What’s the point of all this math, you ask? Convexity is the fine-tuning tool that gives us a sharper understanding of bond price movements—especially during dramatic shifts in interest rates. While duration provides a solid estimate, convexity steps in to refine it, helping you better grasp the risks and opportunities hiding in your bond portfolio. Think of it as upgrading from a map to GPS—it’s not just about knowing where you’re going, but how to navigate the twists and turns.

The beauty of understanding duration and convexity is that it allows you to play with the variables. By applying these tools effectively, you can tailor portfolios to suit your risk tolerance, return expectations, or timing needs. Whether you’re looking for stability or aiming to capitalize on interest rate trends, these concepts let you craft a bond strategy that works for you.

And here’s the best part: these aren’t just bond-specific insights. Grasping these mechanisms helps you understand the broader principles of finance—from risk management to cash flow optimization—making you a sharper investor overall.

I hope this article has shown you that there’s so much more to bonds than YTM and coupon payments. Bonds are often seen as a simple asset class, and that’s both their strength and weakness. On one hand, their predictability and lower returns compared to stocks can make them seem “boring.” But on the other hand, that same predictability opens the door to sleek financial engineering. Done right, bonds allow investors to fine-tune cash flow timing and risk, giving you tools to play around with your portfolio like a pro.

That’s it for today—a slightly more technical dive, I know. But don’t worry! Milan will be back on Sunday with something lighter (I believe) and less technical.

Before you go, a HUGE shoutout to

for providing the amazing visuals that brought this article to life. His work makes even the most technical concepts feel clear and approachable. If you haven’t already, make sure to check out Future Funds for more brilliant articles and graphics on macroeconomics and investing. Seriously, his content is top-notch and worth a follow!Thanks for reading—see you soon!

Please note: This article includes a disclaimer regarding investment advice.

Some recent posts you might have missed:

How to Value REIT's

If you’re reading this, chances are you’ve already dipped your toes into the fascinating world of Real Estate Investment Trusts (REIT’s). (If not, check out our first article explaining how REIT’s work—it’s worth your time.) Today, we’re tackling a big follow-up question:

Why Altcoins Matter: Beyond Bitcoin in the Crypto Space

Remember we said in our post "Shaping the Future in 2025" that we’d occasionally share some side projects? Well, today is the day we deliver on that promise for the very first time.

Thoughtful article.

Properly selected corporate bonds can generate lucrative yields and attractive capital gains at maturity.