“The time to buy is when there's blood in the streets.”

- Baron Rothschild -

There’s blood in the streets, folks. The markets have been bleeding red for weeks now. Sometimes it’s just a mild paper cut—light red, barely a scratch. Other times? Full-on financial carnage. And while this sort of thing tends to send both rookie and seasoned investors into a mild (or not-so-mild) panic spiral, I have to admit… I kind of love it. Seriously.

Why? Because this is when the real fun begins. I get to roll up my sleeves and dive into company analysis like a kid in a candy store. Digging into how businesses tick, what gives them their edge, their moat. Playing around with numbers, testing scenarios, crunching data like it’s a puzzle waiting to be solved. And best of all? That magical moment when I spot an undervalued stock. When the math says, “Hey, this thing is a steal.” It’s like finding a hidden treasure buried in Wall Street noise.

But let’s be honest—over the last few years, the market’s been riding high, soaring to the point where deals were few and far between. It’s been slim pickings for value hunters like me. That’s why these red-tinged days? Chef’s kiss. Prices are dropping, and every morning feels like Christmas: new opportunities just waiting to be unwrapped.

Now, I’m not just waxing poetic here for fun. I’ve actually been doing some work behind the scenes. Dusted off my trusty stock screener, gave the metrics a facelift, plugged in fresh data, and started treasure hunting. And since I (and my co-author) are now basically full-blown Substack stock nerds, I felt it was only right to let you in on the action.

Fair warning: this article’s going to be a bit number-heavy—it is me, after all. But make it to the end, and you’ll walk away with five shiny new investment candidates.

So grab your coffee, strap on those number-goggles, and let’s dive in!

A (Quick) Screening

The idea from the get-go was pretty straightforward: look for value stocks that are tanking not because the fundamentals are falling apart, but simply because the market's having a panic attack. Those are the ones worth diving into with a full-blown deep-dive. So, step one: find value stocks. And what better starting point than the good ol’ S&P 500? It’s big, it’s broad, and it gives us a nice playground of companies to work with. So that’s exactly what I did—I took the entire S&P 500 and made it my “investment universe” (a fancy way of saying “this is the pile I’m digging through”).

Now, a quick nerdy sidenote: the average market cap in the S&P 500 hovers around $100 billion, but the median is only $34 billion. Why the big gap? Outliers, of course. Or, more specifically, the usual suspects—the MAG7 giants skewing the numbers. Not a dealbreaker, but something to be aware of. So I made a simple rule: anything under $34B market cap gets tagged as “small,” everything else is “big.” Easy.

Next up, I trimmed some fat. Certain sectors just aren’t my jam—namely financials (think banks, insurance, lending) and pharma/biotech. Not because they’re bad investments or boring—just because I don’t fully understand them, and I’d rather not pretend I do. Better to focus on what I can analyze with confidence.

Then came the fun part: picking variables for the screener. I focused on two broad categories—how well a company runs its core business (fundamentals), and how the market is currently pricing that company (valuation). Here’s the shortlist of metrics I used, along with the median values for each (so we know what “average” looks like):

If a company scores better than these medians, that’s a good sign:

EBIT Margin: 18.88%

Net Margin: 12.65%

Free Cash Flow Yield: 3.75%

If it scores lower than these, even better:

CapEx % of Revenue: 3.95%

Price Ratios (P/S; P/B; P/E): 2.91; 1.27; 7.37

EV/EBIT: 20.14

Now, I know most of you already get this stuff, but just to be super clear: this isn’t some magic formula. These are just my early filters—my pre-screening checklist. If a stock ticks the right boxes here, maybe it’s worth digging deeper. If it doesn’t? I’m not wasting my time. Simple as that.

Let’s meet our contestants…

Our Contestants

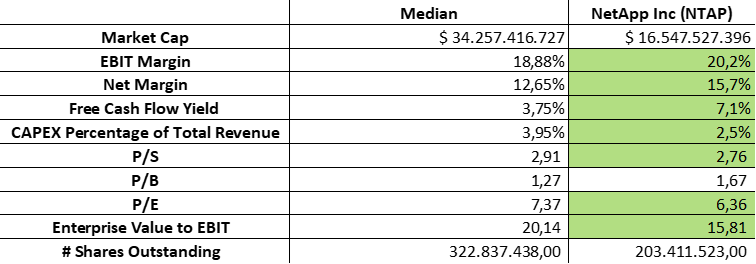

NetApp Inc - NTAP (16,55B)

Current Share Price: $82,71

NetApp Inc. is a U.S.-based technology company specializing in data storage and management solutions for enterprises. Founded in 1992 and headquartered in San Jose, California, NetApp offers a range of products and services that help businesses store, manage, and protect their data across on-premises and cloud environments.

The summary shows that they have great margins compared to the market, while having to invest little. In addition, they seem to be lower priced in terms of P/S, P/E and EV/EBIT. Only in terms of P/B, NetApp is in a higher range. A potential reason for this could be the tech-nature of the company, which is characterised by a relatively low book value, and therefore higher P/B ratios. A strong first contestant, if you ask me.

A O Smith Corp - AOS (7,40B)

Current Share Price: $63,09

A. O. Smith Corporation is a leading American manufacturer specializing in residential and commercial water heating equipment, boilers, and water treatment products. Established in 1874 and headquartered in Milwaukee, Wisconsin, the company has evolved into a global water technology enterprise. Its product portfolio includes gas and electric water heaters, tankless systems, boilers, water softeners, and filtration solutions. A. O. Smith operates manufacturing facilities across North America, China, India, and Europe, serving customers worldwide.

The summary shows that they have great margins as well, especially for not being a tech-company. The CapEx rate is also quite low for not being a tech-company. Again, the P/B is on the higher side, the EV/EBIT is quite low, showing mixed signs in the valuation. This could be an interesting non-tech option to dig deeper into.

Match Group Inc - MTCH (7,18B)

Current Share Price: $29,01

Match Group, Inc. is a leading American technology company specializing in online dating services. Headquartered in Dallas, Texas, and founded in 2009, Match Group operates a diverse portfolio of popular dating platforms, including Tinder, Match.com, Hinge, OkCupid, Plenty of Fish, Meetic, and OurTime. These platforms cater to various demographics and preferences, facilitating connections across a broad spectrum of users worldwide.

The summary is comparable to that of NetApp Inc, typically the profile of a tech-company. However, their margins are even slightly higher, and they seem to be priced even lower. Could this contestant be the Match we’re looking for (yes, pun intented)?

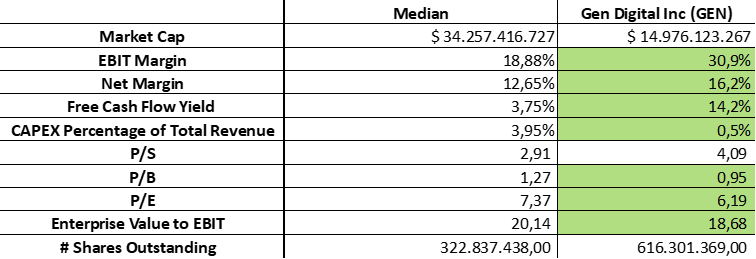

Gen Digital Inc - GEN (14,98B)

Current Share Price: $24,45

Gen Digital Inc. is a global cybersecurity company that provides consumer-focused security, identity protection, and privacy solutions. Headquartered in Tempe, Arizona, with a co-headquarters in Prague, Czech Republic, the company was formerly known as Symantec Corporation and NortonLifeLock Inc.

Gen Digital's portfolio includes well-known brands such as Norton, LifeLock, Avast, AVG, Avira, CCleaner, and ReputationDefender. These products offer a range of services, including antivirus protection, identity theft prevention, device optimization, and online privacy tools.

The numbers here are intriguing. Gen boasts sky-high margins and reinvests almost nothing—just 0.5% of revenue. While their Free Cash Flow Yield is stellar, the high P/S might be a red flag, possibly hinting at declining revenue. But if that's just a temporary blip, we could be looking at a highly efficient cash machine. Definitely the wildcard of the group—and that’s what makes it fun.

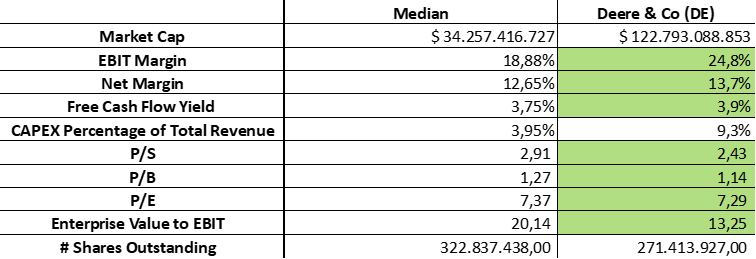

Deere & Co - DE (122,79B)

Current Share Price: $452,23

John Deere – for the Dutch-speaking among you, yes from the meme – is a legendary American manufacturer of agricultural, construction, and forestry machinery. Founded in 1837 by blacksmith John Deere, who revolutionized farming with the invention of the self-scouring steel plow, the company has grown into a global powerhouse headquartered in Moline, Illinois. Today, John Deere is renowned for its iconic green and yellow equipment, ranging from tractors and combine harvesters to excavators and lawn mowers. Beyond machinery, the company offers advanced technologies like precision agriculture tools and provides financial services through John Deere Financial. With a commitment to innovation and sustainability, John Deere continues to shape the future of farming and infrastructure worldwide.

As expected, they’re reinvesting heavily—but here’s the kicker: their margins are surprisingly strong, even standing tall next to the tech crowd. And valuation-wise? Very compelling. This could be a rare chance to own a piece of one of the purest, most tangible businesses out there. A classic, but make it golden.

Closing Remarks

Five contenders. Two rock-solid, “you-can-touch-this” kind of businesses. Three tech-heavy hitters, living in the digital clouds. Four relatively small fish, and one absolute unit of a mastodont. Different vibes, different strengths—but all worthy of a closer look.

Sadly, there can only be one winner. The good news? You’re in charge.

At DualEdge Invest, we’re not here to tell you what to think—we’re here to lay out the case and let you make the call. That’s why we’re handing the mic over to you.

We’ve got a poll waiting for you just below. The question: who’s got the most potential? Who’s the undervalued gem that deserves a coveted spot on our radar—and maybe, just maybe, a full deep-dive feature?

Already voted? You’re the best. If not—get in there, we’d love to hear what you think.

That’s it from me for now. Thanks for tuning in, enjoy your weekend, and as always: see you in the next one!

📢 No comment needed today—unless you really want to, of course!

What we’d really love is for you to take a moment and cast your vote in the poll (if you haven’t already). It only takes a second, and it helps us a ton. Thanks for being part of the journey!

🔔 Don’t want to miss the deep-dive on the winning stock?

Make sure to subscribe so you’re the first to know when we reveal which of these five contenders gets the spotlight. You’ll get the full breakdown, numbers, narrative, and our take—delivered straight to your inbox.