Last week, together with

, we dove into the world of ingredient companies. Yes, I know — that sounds painfully boring. But hear me out.When Ozeco pitched the idea, I’ll admit it — I yawned. This isn’t a sector that screams disruption or Silicon Valley-style reinvention.

But if you know Ozeco, you know he doesn’t suggest things lightly. And the deeper we dug, the clearer it became: this corner of the market hides real treasure.

Because as investors, we’re after businesses that are essential, hard to replace, and quietly compounding value in the background.

Ingredient companies are exactly that. They’re the hidden architects behind the taste of your soda, the scent of your shampoo, and the shelf life of your medicine — invisible, but indispensable.

With high margins, low capital needs, sticky customer relationships, and strong tailwinds (think clean label, health, biotech), they combine defensive durability with steady growth. And the best part? They do it without ever needing to be the brand.

It’s a corner of the market that operates under the radar — which might be exactly why it deserves our attention.

So this week, we’re picking one of these ingredient giants for a deep dive. But before we get there, let’s size up the contenders — and figure out which one deserves the spotlight.

The shortlist:

IFF

Givaudan

DSM-Firmenich

Symrise

Novonesis

Together, they dominate the industry. In traditional flavours & fragrances, scale and creative R&D are major competitive advantages. Givaudan is the historic market leader, with Firmenich, IFF, and Symrise rounding out the “Big Four” — who together control ~80% of the global market. Novonesis is more specialized, but equally dominant in its niches: industrial enzymes and food cultures.

So how do you pick a winner from a list of giants? You start by asking the right questions — about moat, growth, resilience, and valuation. Over the next pages, we’ll do just that — by digging into operational performance, valuation, balance sheet strength, exposure to markets and risk, and much more to uncover our ultimate winner.

But before we crown anyone, let’s flip the lens. What could go wrong?

🧨 First, a health check: where can things go wrong?

Before we dive into strengths, let’s look for cracks. No matter how attractive a company might seem, if there’s hidden fragility — we want to find it early. And this sector, while attractive, isn’t without risks.

We’ll stress-test our shortlist on a few common fault lines:

Integration headaches from past M&A

Overleveraged balance sheets that reduce flexibility

Low or deteriorating ROICs — where growth might destroy rather than create value

Quick sidenote: M&A plays a central role in this industry. Why? Because scale matters. Whether it’s sourcing rare naturals, developing proprietary biotech strains, or expanding reach across regional markets, acquisitions are often the fastest (or only) route to growth.

But it’s also where things tend to go wrong.

On paper, all five companies bring global reach and brand equity. But not all of them carry the same level of execution risk.

One name in particular stands out — and not in a good way.

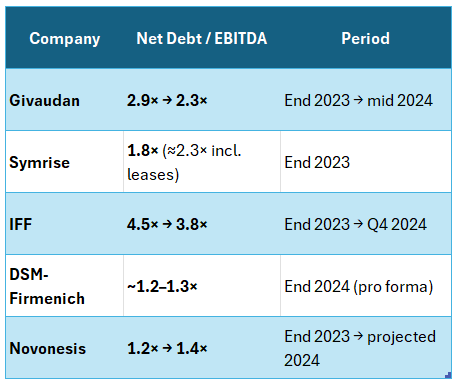

IFF made two bold acquisitions in recent years: Frutarom (2018) and DuPont’s Nutrition & Biosciences unit (2021). But integration has been bumpy, debt ballooned, and ROIC has lagged. It’s not a broken business — but it does look far more vulnerable than the others.

We’re not in the business of betting on turnarounds. Especially when others are offering quality without the drama.

So with respect to its legacy, we’re letting IFF go.

And just like that, we’re down to four.

🧭 A quick strategic snapshot

Now that we’ve filtered out the weakest link, let’s take a moment to step back and compare the remaining four contenders side by side. While each has its own history, culture, and niche, they’re all competing in roughly the same arenas — and their strategic DNA tells us a lot about how they play the game.

Here’s the 10,000-foot view:

If I had to call it as an investor — DSM-Firmenich leaves me the coldest.

A focus on "synergies" always rings a bit hollow, especially when the deal is fresh and the benefits are still theoretical. Add to that a sprawling portfolio, and it becomes hard to be truly dominant in any single niche. Not impossible — but with limited industry knowledge, I’d rather assume focus wins over scope.

Givaudan? It’s the heavyweight champion of the past decade. No one questions its market position. But it feels more like the safe pick than the exciting one. A giant, yes — but one that’s more about maintaining the status quo than shaping the future.

That leaves us with Symrise and Novonesis.

Symrise looks like a solid operator, but lacks a distinctive edge or bold vision. A bit too... middle-of-the-road.

Novonesis, on the other hand, stands out. The biotech focus, high R&D intensity, and sustainability angle suggest it wants to be the innovator of the pack. That’s compelling — but not without risk. High R&D comes with high burn, and the biotech angle edges out of my circle of competence.

Still, no one stands out head and shoulders above the rest based purely on strategic profile — each has its pros and cons. But if I had to make a call based solely on this lens, Novonesis would be my pick. It’s the only one that really seems to be leaning into innovation with intent, not inertia.

What’s Under The Hood?

A bold strategy means nothing without execution. So let’s pop the hood and look at how these companies actually run — how they convert ideas into margins, how efficiently they scale, and how resilient they are when things get messy.

We’ll use four lenses:

Margins

CapEx and Scalability

Operational resilience

customer stickiness

Let’s start with margins — the simplest signal of pricing power and defensibility. Novonesis clearly leads the pack here. Their enzymatic niches command premium prices and face limited competition, meaning high-value, low-erosion cash flow. Givaudan and Symrise don’t do badly either. In 2023, both raised prices fast enough to offset raw material inflation. Volumes dipped, but margins held — a classic sign of embedded value.

DSM-Firmenich? Trickier. While the fragrance and taste units resemble Givaudan, the vitamin segment is a problem child — cyclical, commoditized, and margin-dilutive. They’ve already started cleaning house (think: cutting vitamin production and carving out the animal nutrition division), but the structural baggage is real.

Then there’s capex and scale. Novonesis and DSM-Firmenich both rely on fermentation — a capital-heavy business that requires big stainless-steel reactors, complex filtration, and a lot of energy. But Novonesis seems to manage this complexity better. Their specialty focus means the upfront investment pays off more directly, while DSM is stuck balancing premium perfume with commodity vitamins.

Givaudan and Symrise are much lighter on their feet. Blending flavors and fragrances requires less capital than biotech fermentation — which makes scaling cleaner, and returns on capital higher over time.

Operational resilience? Givaudan scores high. With 69 factories and an ultra-localized setup, it’s designed for disruption. Symrise stumbled in 2023 when a U.S. facility went offline — a reminder that even diversified setups can hinge on single points of failure. DSM faces volatility from China’s vitamin dumping; Novonesis has some exposure to agri inputs but seems less vulnerable overall.

Finally, customer stickiness. Here, everyone wins. These companies co-create with consumer giants — Unilever, Nestlé, L’Oréal — earning preferred-supplier status baked into product lifecycles. Even when volumes dip (like in 2023’s destocking wave), relationships remain strong, and no customer holds too much power.

Verdict? DSM-Firmenich once again finds itself at the bottom of the pile. Operationally, they’re the clear laggard — dragged down by a complex portfolio, cyclical vitamin exposure, and a strategy that still feels more theoretical than proven.

The other three show much stronger execution. Novonesis and Givaudan lead in margin quality and resilience, while Symrise, though less visionary, holds its own as a reliable operator.

So, with three rounds in, we’re calling it: DSM-Firmenich is out. Three left standing.

Next up, The grand finale

Financial Firepower & Relative Valuation

Let’s talk money. Because a beautiful strategy and slick operations only go so far if they don’t turn into hard financials — growth, returns, cash, and valuation.

Over the past decade, Givaudan, Symrise and Novonesis have grown both organically and through bolt-ons. Givaudan does ~4% organic annually and keeps M&A modest — surgical tuck-ins to plug portfolio gaps. Symrise is a touch bolder, combining solid organic growth with regular small acquisitions (petfood, beverage flavors). Novonesis is the new kid on the block — a €12B fusion of Novozymes and Chr. Hansen — and expects 6–8% organic growth as it ramps up cross-selling.

Capital returns paint a similar picture. Givaudan delivers a strong ~20% cash ROIC (ex-goodwill), backed by pricing power and embedded client relationships. Novozymes (pre-merger) sat at 20–25% ROIC for years — biotech done right is a cash machine. Novonesis, if integration goes well, could return to those elite levels.Symrise is slightly lower, around 8–12% depending on the year, but steadily improving.

And then there’s free cash flow. Here, Givaudan and Symrise lead. Givaudan converts ~15% of sales into FCF. Symrise is similar — 11–15% in recent years. Novozymes and Chr. Hansen were historically very cash generative, and the new Novonesis should follow suit, though integration will weigh in the short term.

On valuation, it’s a quality premium world. Givaudan trades ~20× EV/EBITDA, Symrise ~16×, Novonesis likely high teens too. Are they cheap? No. But PEG ratios are mostly >1, so the market clearly believes in durable, compounding quality.

Verdict? All three score well — but the cash crown goes to Givaudan. It’s expensive, but for good reason. Novonesis is the up-and-comer with massive potential, and Symrise is the pragmatic middle-ground pick.

That leaves us with one last decision.

Who gets the full deep dive treatment?

Closing remarks

So, where do we stand?

Givaudan is the reigning monarch — dominant, dependable, and cash-rich. If you want stability and global reach, this is your pick. But don’t expect it to surprise you.

Symrise is the quietly competent operator. Solid execution, smart bolt-on growth, and improving cash flows. Not flashy, but increasingly impressive.

Novonesis is the wild card with the sharpest edge. High innovation, strong margins, and biotech flair — but still early in its integration story.

All three are world-class — but only one gets the full deep dive next week.

And that’s where you come in.

We’ve set up a quick poll for our readers: Which company would you like us to dissect next?

Let the battle of the ingredients begin.

📢 We'd love to hear from you — Drop a comment below if you have thoughts, questions, or your own take on the finalists.

🔔 Don’t miss next week’s deep dive — Subscribe now so you’re the first to know who wins (and why).

Please note: This article includes a disclaimer regarding investment advice.

Our Recent Posts:

Value At A High Cost

Last week, we unpacked the backstories of Equinix and Digital Realty Trust: our two data center REITs caught in the analytical spotlight. But every good story needs a strong ending, and in finance, that means valuation. We’ve got the narrative, but does the math back it up?