Why Aris Might Be the Oil Industry’s Best-Kept Secret

Deep Dive on Aris Water Solutions Part I

This March, we're diving deep into Aris Water Solutions, a company that made it onto our radar through a top-down analysis.

The Journey So Far

Our top-down analysis began by identifying three transformative megatrends—Digitalization, Aging Demographics, and Sustainability—that shape long-term market opportunities. Using these themes, we analyzed various sectors through a rigorous quantitative screening process, focusing on profitability, growth, and valuation metrics. This narrowed our search to three final sectors: Semiconductor Equipment (Digitalization), Healthcare Support Services (Aging Demographics), and Environmental & Waste Services (Sustainability). In the final qualitative stage, we assessed real-world risks, industry stability, and technological advancements, leading to a tough showdown between Healthcare Support Services and Environmental & Waste Services. While healthcare showed strong potential, regulatory risks and complexity tilted the balance in favor of Environmental & Waste Services, an industry offering stability, technological growth, and lower disruption risks—ultimately leading us to Aris Water Solutions as our top deep-dive candidate.

But before we get into our research, let's be clear: this is not financial advice. We’re not here to tell you to buy or sell anything. Our goal is to map out the situation, highlight where we see value, identify risks, and—most importantly—show you what we focus on when analyzing a company.

The goal of this Part I is to provide a clear understanding of the needs and challenges Aris Water Solutions addresses, who they are as a company, how they respond to these needs, and how they plan to grow in the future. As is often the case here at DualEdge, in the coming weeks, we will publish additional parts that take a deeper dive into the financial aspects of the company, the impact of external factors such as environmental concerns, competition, and macroeconomic trends, the risks involved, and how Aris seeks to mitigate them. Finally, we will also explore the company's valuation.

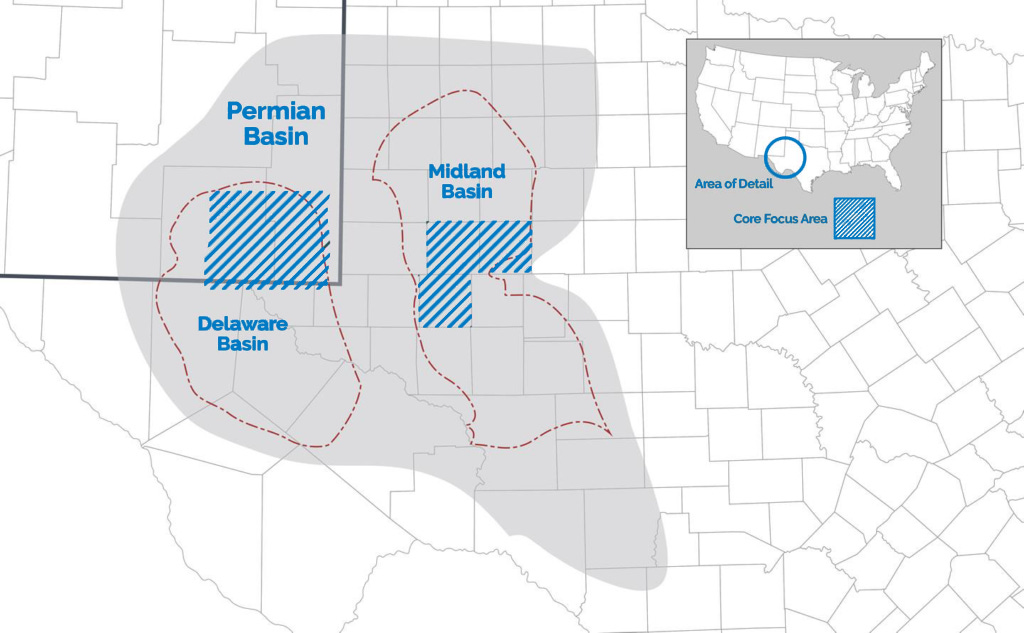

Setting the Stage: The Permian Basin

To understand Aris Water Solutions, we first need to look at the Permian Basin, the only region that Aris currently operates in. The Permian is one of the world's most prolific oil-producing regions. Located in West Texas and Southeast New Mexico, this "super basin"—a geological depression where sediment, organic material, and hydrocarbons have accumulated over millions of years—accounts for about 41% of total U.S. crude oil production and 15% of natural gas output in 2022, and it only has risen since then. If it were a country, it would rank among the world's largest oil producers.

Despite decades of extraction, the Permian isn’t running dry anytime soon. Thanks to technologies like hydraulic fracturing (fracking) and horizontal drilling, even previously inaccessible reserves are now being tapped. In 2023, the region still held an estimated 20 billion barrels of proven oil reserves—around 40% of all U.S. reserves.

The Water Challenge

Oil production in the Permian isn’t just about oil—it’s also about water. And a lot of it.

Fracking a single well requires 14–16 million gallons of water—roughly the amount needed to fill 25 Olympic-sized swimming pools. The reason fracking is so water-intensive is that it involves injecting a high-pressure mix of water, sand, and chemicals deep underground to fracture rock formations and release trapped oil and gas.

For every barrel of oil pumped, 3–4 barrels of contaminated "produced water" come up with it. This wastewater is a toxic cocktail of salt, heavy metals, and hydrocarbons that can be several times saltier than seawater—making disposal and treatment a major challenge.

The region produces nearly 19 million barrels of wastewater per day—that’s enough to fill more than 1,200 Olympic-sized swimming pools daily. Managing this massive water influx is one of the biggest logistical and environmental hurdles in the Permian.

Managing this water is a huge challenge. The Permian is an arid region with limited fresh water, and groundwater sources are depleting fast. It has very few natural water sources and an annual average precipitation of only ~13 inches (~330 mm)—far below the national average. Meanwhile, companies have historically disposed of wastewater by injecting it deep underground—but that’s been triggering earthquakes, prompting regulators to crack down.

The problem has been growing rapidly. The number of earthquakes with a magnitude of 3.0 or higher has more than quadrupled in some key oil-producing areas like Midland, Odessa, and Lea County, New Mexico, between 2018 and 2023. In response, regulators in Texas and New Mexico have started imposing severe restrictions on wastewater injection, forcing operators to either reduce volumes, shut down disposal wells, or find alternative solutions.

The result? Rising costs, stricter regulations, and increasing pressure to find sustainable solutions. And that is where Aris comes into play.

Enter Aris Water Solutions

Aris Water Solutions is a leading player in the water midstream sector, specializing in managing water resources for oil and gas producers. Originally founded in 2015 as Solaris Water Midstream by William “Bill” Zartler, the company built an extensive water pipeline and infrastructure network in the Permian Basin.

In October 2021, the company rebranded as Aris Water Solutions and went public on the New York Stock Exchange (NYSE: ARIS), raising approximately $214 million in its IPO. This move provided capital for further expansion and allowed early investors to partially exit.

Aris is led by industry veterans with deep expertise in energy and water management. Founder Bill Zartler, who has over 30 years of experience in private equity and energy infrastructure, serves as Executive Chairman. Before founding Aris, he was the Founder and Managing Partner at Denham Capital Management, a global energy and commodities private equity firm, where he led investments in the midstream and oilfield services sectors. He later founded Solaris Oilfield Infrastructure, a company focused on providing mobile proppant management systems for hydraulic fracturing.

CEO Amanda M. Brock, who joined Aris in 2017, brings extensive international experience in water treatment, sustainability, and energy infrastructure. She previously served as CEO of Water Standard, a water treatment technology company. Under her leadership, Aris has formed key partnerships with major oil companies to advance sustainable water solutions in the Permian Basin, solidifying its role as a critical player in water management for the energy sector.

How Do They Operate?

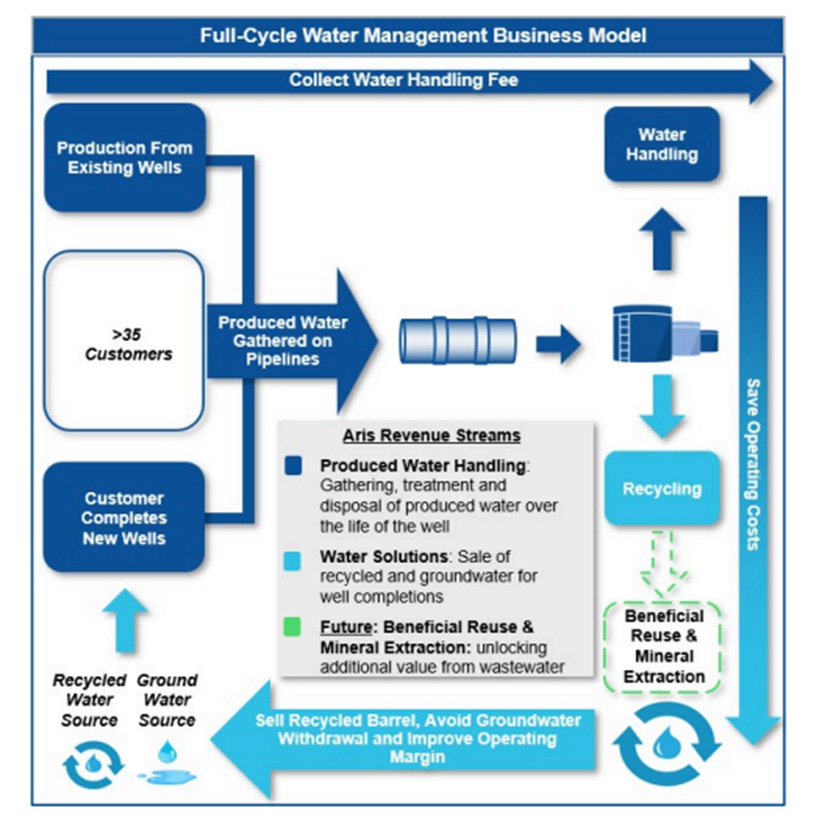

Aris operates a full-cycle water management system, ensuring that oil and gas companies can handle, recycle, and reuse wastewater more efficiently. The process begins with the collection of produced water, which is the byproduct of oil extraction; It is gathered from both existing and newly completed wells through an extensive pipeline network. With around 35 customers, primarily oil and gas producers, Aris manages this water throughout the well’s lifecycle. In return for this service, the company charges a water handling fee for collecting, treating, and disposing of the produced water.

Rather than solely relying on deep-well injection for disposal, which has been linked to environmental concerns such as induced seismicity, Aris recently prioritized wastewater recycling. By treating and repurposing this water, they create a sustainable solution that significantly reduces the industry’s dependence on fresh groundwater. The recycled water is then resold for use in new fracking operations, helping to close the loop on water consumption in the Permian Basin.

Aris generates revenue through multiple streams. The primary source comes from produced water handling, which involves the gathering, treatment, and disposal of wastewater throughout the life of a well. Additionally, the company profits from selling both recycled water and groundwater for well completions, offering a practical alternative to traditional freshwater sources. Looking ahead, Aris is also exploring opportunities in beneficial reuse and mineral extraction. By unlocking additional value from wastewater, they aim to tap into new revenue streams while simultaneously reducing waste.

Now, let’s take a closer look at how Aris Water Solutions aims to position itself for the future. The company defines itself as a growth-oriented environmental infrastructure company, which makes it particularly interesting to examine its growth trajectory.

The Path Going Forward

One of Aris’ primary strategies is organic expansion, which involves continuous investments in infrastructure. Each year, the company commits substantial capital to the development of new pipelines, pump stations, evaporation facilities, and recycling plants. A prime example of this is the recent $45 million acquisition of the 45,000-acre McNeill Ranch, located on the Texas-New Mexico border. Strategically located in the rapidly expanding Northern Delaware Basin, this ranch allows Aris to develop new injection wells and infrastructure to handle future water flows.

Aris also strengthens its position through mergers and acquisitions (M&A). In 2022, the company acquired Delaware Energy Services, which immediately expanded its disposal and recycling facilities while adding new customers in its core region. This acquisition solidified Aris’ presence in the Northern Delaware Basin and brought in a skilled local team.

Beyond acquiring companies, Aris has also invested in intellectual property (IP) to enhance its technological capabilities. In 2022, Aris acquired advanced water treatment technologies from Water Standard, including key intellectual property for sophisticated purification processes. This move directly supports Aris’ expansion into water recycling. Keen-eyed readers may also note that Water Standard was the previous employer of CEO Amanda Brock—a clear sign that she is leveraging her network and expertise to drive Aris forward.

The company’s heavy investments indicate a strong commitment to its future, but the key question is: Will these investments pay off?

From a market demand perspective, the outlook is promising. The Permian Basin remains the most productive oil region in the U.S., and forecasts indicate that thousands of new wells will be drilled in the coming years. Increased oil production leads to an exponential rise in produced water, driving demand for Aris’ services.

Additionally, regulatory pressures favor Aris' business model. Both Texas and New Mexico are pushing for limitations on deep-well injection due to seismic activity concerns, while simultaneously encouraging water recycling initiatives. New Mexico is even exploring the possibility of allowing treated produced water to be repurposed for industrial and agricultural use—an ongoing political discussion that could create a game-changing market for Aris. If regulations shift in favor of partially treated produced water being legally used for irrigation or industry, Aris would hold a first-mover advantage due to its existing pilot programs and technology.

On top of that, Aris has recently begun research into extracting valuable minerals from produced water. If successful, this could open up an entirely new revenue stream, further reinforcing its long-term growth potential.

Closing Remarks

In this first part of our deep dive into Aris Water Solutions, we’ve explored the company’s origins, the vital role it plays in managing water resources in the Permian Basin, and its strategy for growth. We examined why water management is a growing challenge in oil production, detailed Aris’ operations and revenue model, and assessed whether its growth strategy is well-positioned for the future.

One thing is clear—Aris is not the typical company we analyze. It operates in a niche market, providing specialized services to a single sector—one that is not without controversy and is more dependent on macroeconomic and political factors than most industries. This dependency can create moats through expertise and high barriers to entry—after all, replicating Aris’ extensive infrastructure would take years and could likely only be achieved through costly acquisitions. However, there are already some red flags. Customer concentration, regulatory risks, and global oil price volatility that came to mind when I researched this company.

Rest assured, we will delve deeper into these factors in the upcoming sections. Through a SWOT analysis, we will clearly outline Aris’ competitive advantages and risks, examining how the company leverages its strengths while mitigating potential threats.

Next week however, we’ll take a deep dive into these external influences—exploring the impact of regulatory policies, shifting market conditions, and industry competition on Aris Water Solutions. Can Aris maintain its competitive edge in an industry that is constantly evolving? Stay tuned!

📢 What’s your take? Is Aris your next investment or are you already convinced it is uninvestable? Let’s hear your perspective—drop a comment and let’s discuss! 👇

🔔 Don’t miss out! Next Sunday, we’re continuing our deep dive into Aris Water Solutions—breaking down the external factors influencing the company, and what it all means for investors. Stay tuned!

Love the series!

Well done!